Currency volatility remains the bane of investing in Emerging Markets. The UN reports in its 2019 Financing for Sustainable Development Report that ‘Financiers responding to an FSB consultation cited currency risks as the most relevant factor constraining availability of infrastructure finance in developing economies.’

Currency and commodity prices respond at the margin to the laws of supply and demand. That’s particularly true in those EM countries where local currency is seen as a source of consumption rather than wealth. In such jurisdictions-usually but not always low-income economies demand for currency is frequently impacted by terms of trade shocks often driven by commodity price change.

Somewhat ironically much of the ensuing macro volatility is tied to liberalisation policies prescribed by the IMF and others in stabilisation programs. The very cure-opening to foreign portfolio flows and banking presence-becomes a killer when flows hit a sudden stop. Long in the tooth EM investors hardly need reminding of how such reversals led to the various 1990’s crises.

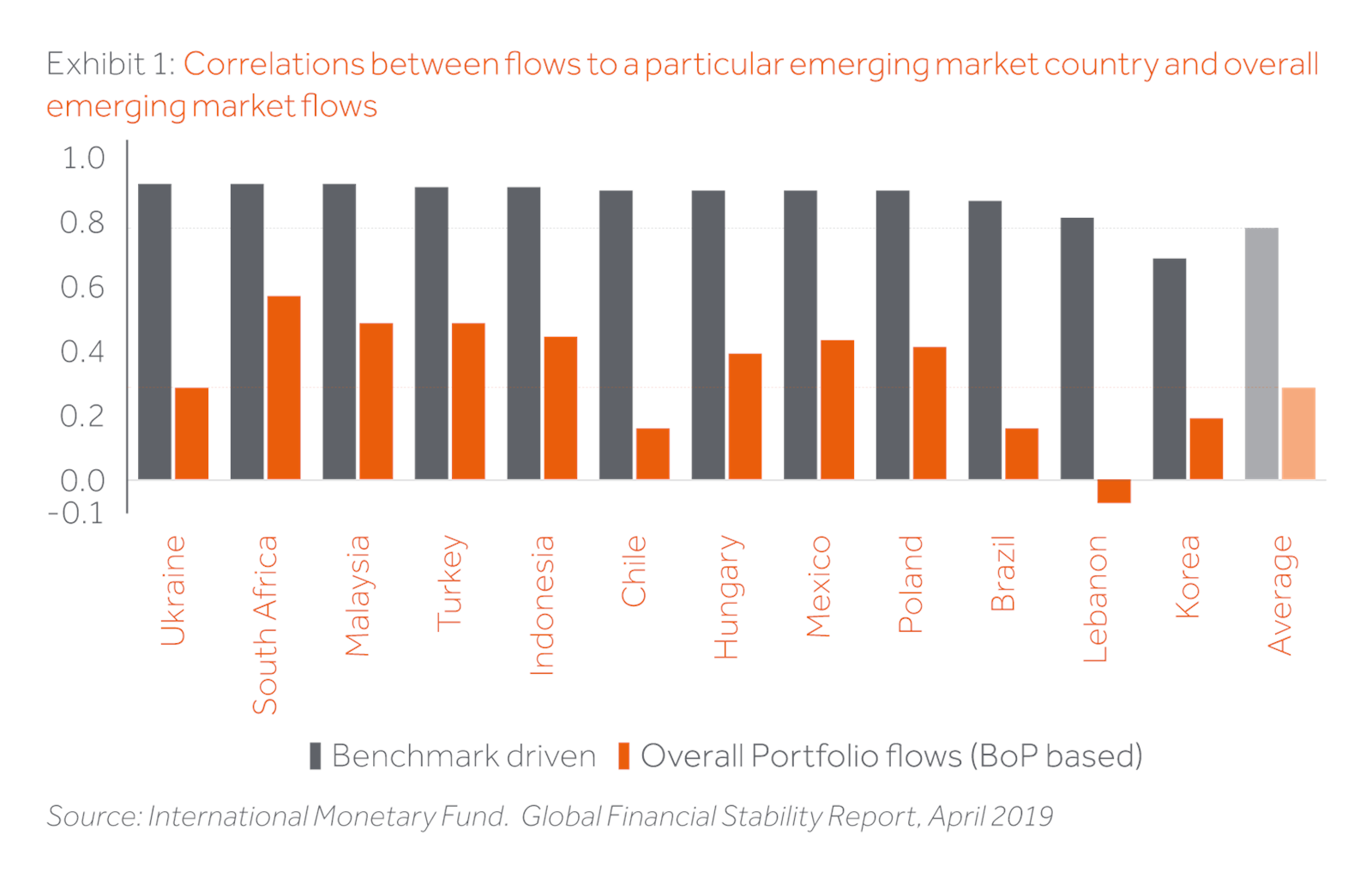

Portfolio flows have risen nearly fivefold in the last 4 years exceeding $250 billion in 2018. The IMF estimates that a material proportion of these flows are through index-based instruments such as ETF’s. This can be seen in the chart showing correlations between single country and overall EM equity inflows. Exhibit 1 suggests that foreign investor flows are dominated by passive investors. Such investors are more inclined to asset class views – ‘China trade wars mean we sell EM’ than country specifics. A terrible beauty is born.

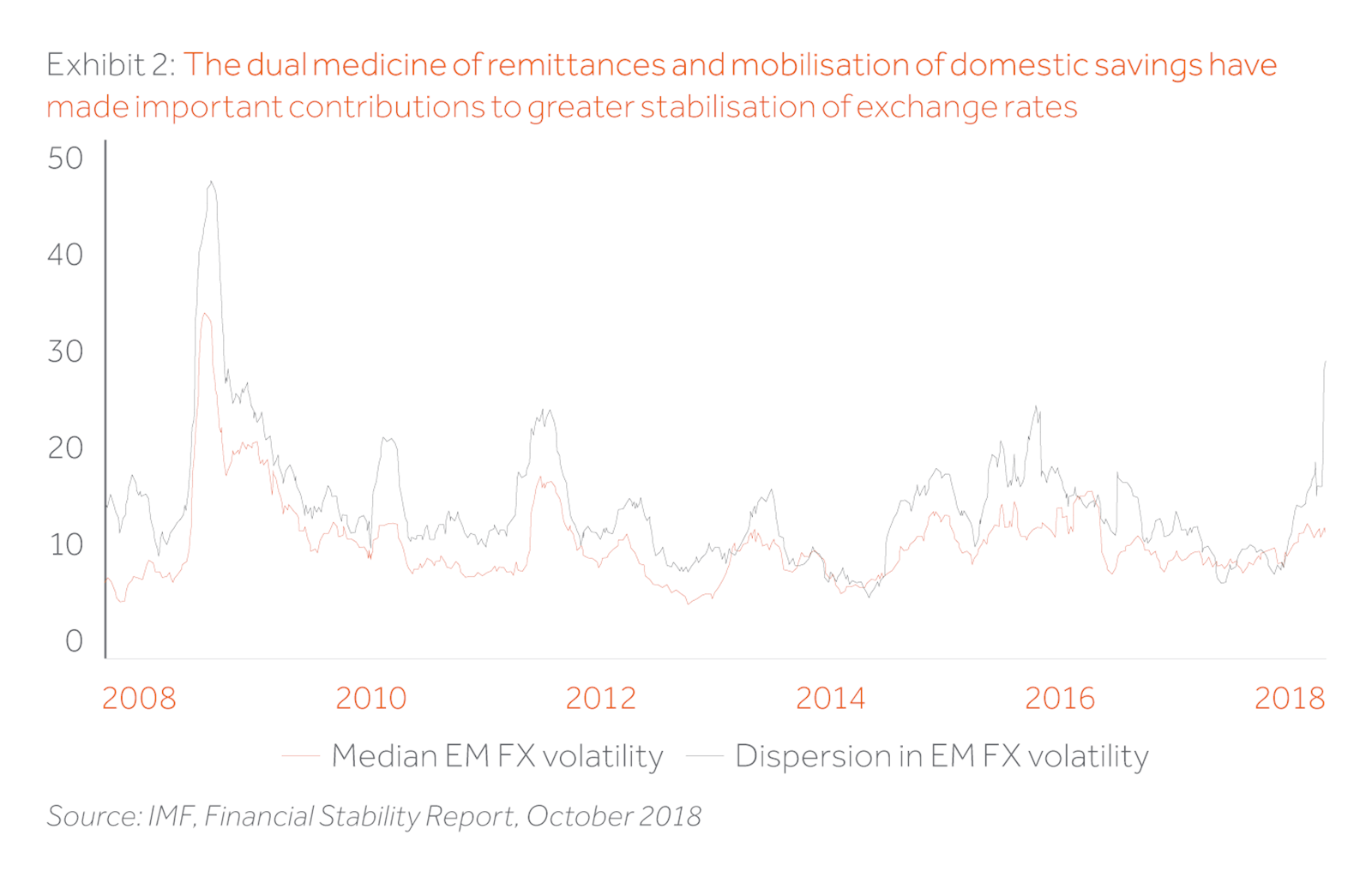

Happily, offsets exist. We wrote last year (March 2018, Bringing it home: Opportunities and trends in migrant remittances) about the growing importance of remittances sent home to poorer countries. Such flows provide a stable source of demand for local currency being spent by families back home on basic consumption, healthcare and education. From Nepal to Nigeria or the Philippines to Panama these remittances -way more stable than FDI or portfolio flows-play a role in stabilising currency markets. Such flows rose by 8% to over $520bn in 2018 and are forecast to rise further over the next few years aided in part by fin tech bringing down transaction costs.

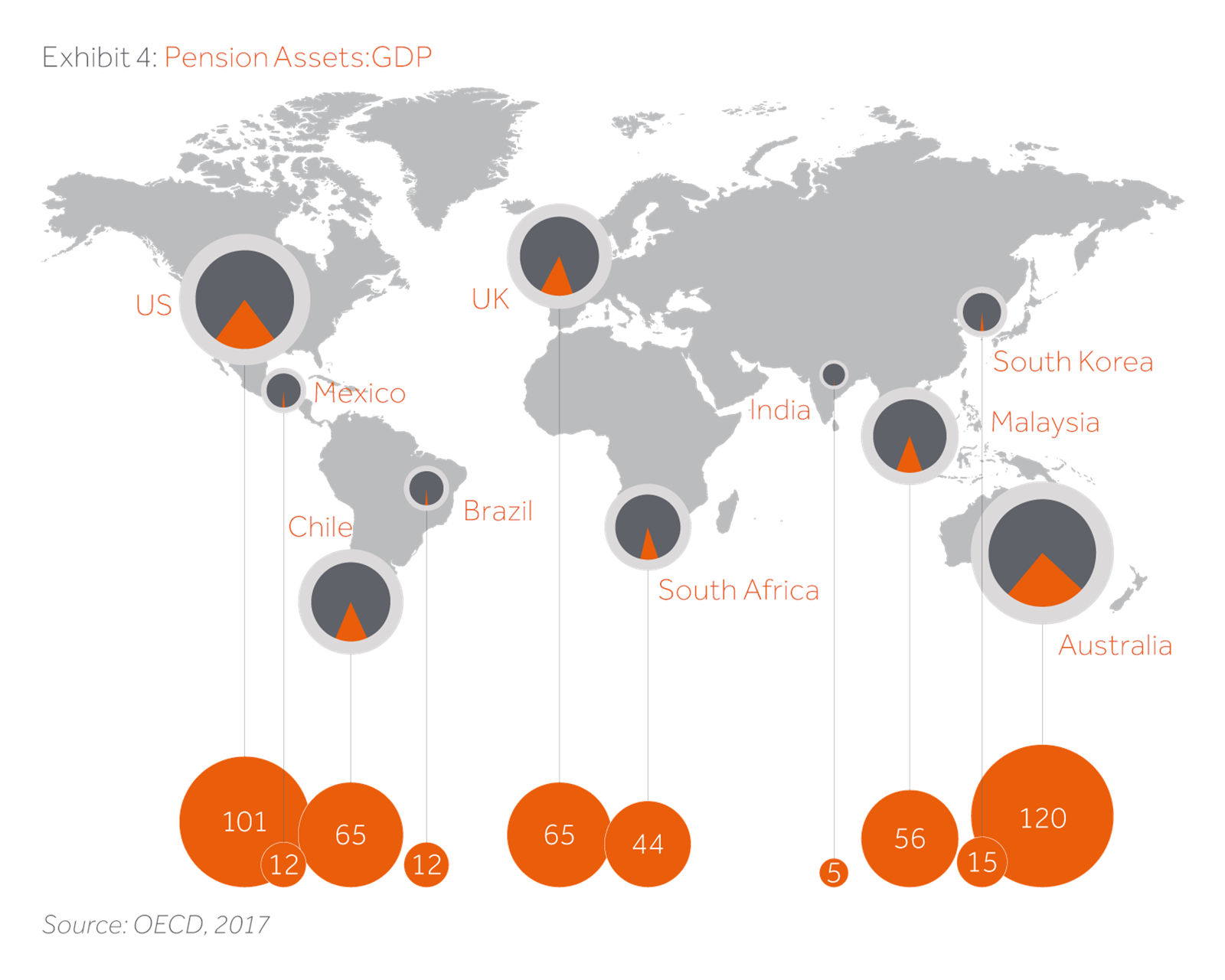

Wealthier countries have other sources of demand for domestic assets cast off by foreigners. Mandatory savings linked to retirement or insurance needs create demand for domestic assets to hedge liabilities. In developed markets pension savings, more than doubled their share of GDP in the period 1980-2010. Starting from a lower base the same is true in many low to middle income countries.

Many of the mandatory savings schemes were born of crisis. The poster child, Chile, introduced mandatory funded worker schemes in the aftermath of the 1980’s Latin American debt crisis. Mexico revamped her system in 1997 as a response to the near ruin of her financial system created by the 1994 Peso devaluation. Malaysia’s MPF and other cousins owe much of their growth to legislation introduced in the wake of the Asian crisis. In all 3 cases the crises themselves owed something to a sudden stop in short term banking flows. Today as foreigners sell, onshore savers buy the assets and help smooth currency, financial and macroeconomic volatility. For sure the South African Rand has seen its share of volatility, but this would have been far worse without onshore insurance and banking led demand for long duration assets.

Financial inclusion also plays a role. This is the extension of financial services to an ever-wider audience. Worldwide some 1.2 billion new bank accounts have been opened since 2011 but more than 1.7 bn adults are outside the financial system altogether. Governments are struggling to address this problem which is largely income related. Failure has enormous risks: -by 2050 over 1.3 bn elderly will live in developing economies of whom two thirds would lack any formal retirement income World Bank estimates. Programs in India such as Jan Dhan Yojana for banking and Atal Pension Yojana in pensions are designed to deepen financial inclusion.

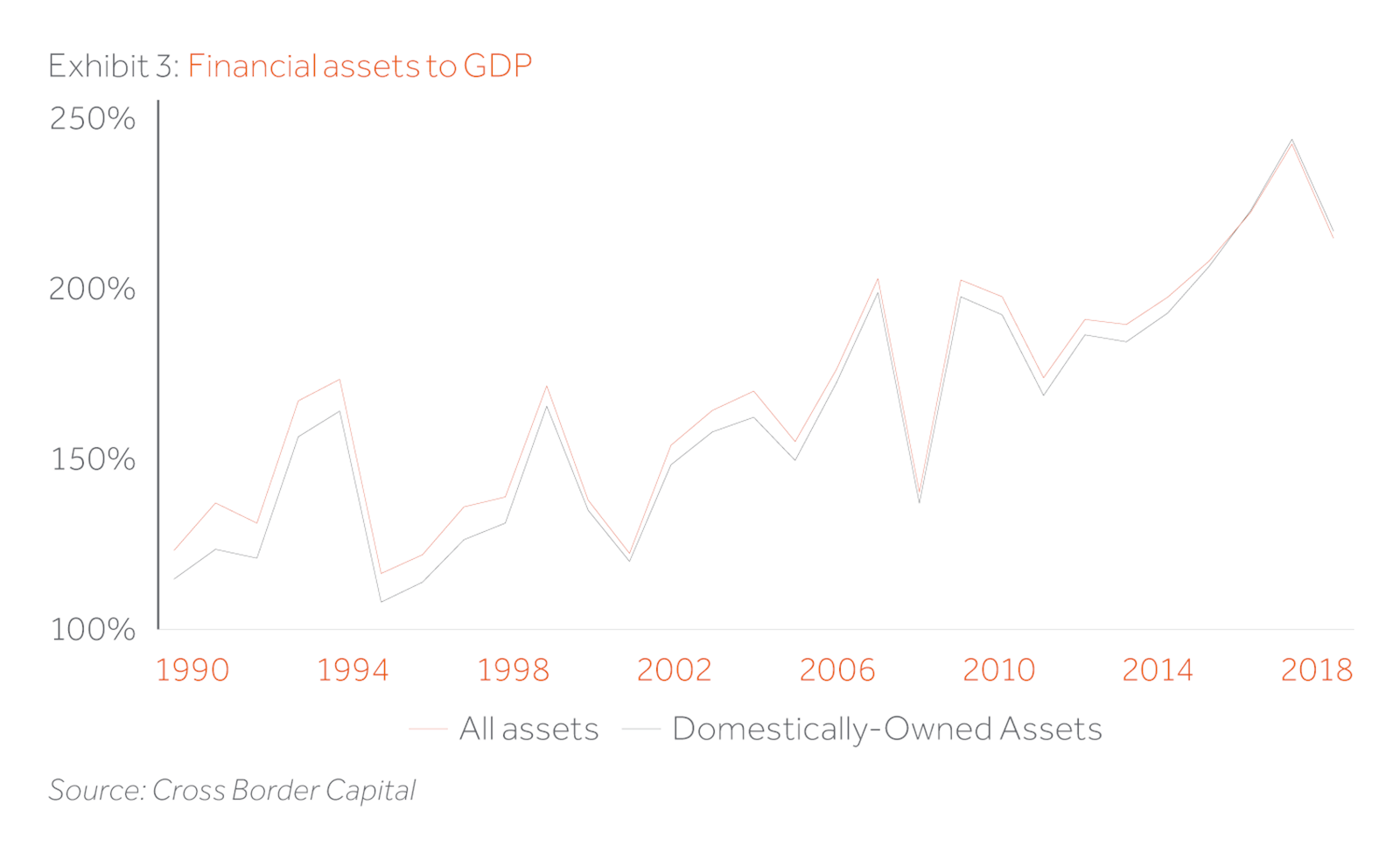

Clearly many emerging economies have come a long way from the 1990’s. The rise in domestic savings and the associated reduction in currency volatility has encouraged citizens to hold assets in their own base currency. Analysis from Cross Border Capital, a London based specialist in analysis of financial flows shows a picture of growing financialisation. Whilst citizens in Turkey and Argentina have preferred to hold foreign currency in general the clear trend is an increase in domestically held assets even after allowance for growing foreign interest in owning local currency debt

A considerable share of this growth is China which now represents over 28% of global credit. Even so in most countries we see a similar trend line.

Currency volatility does remain a threat. The IMF analysis suggests that whilst the occurrence of core currency fluctuation is declining single country risk is increasing-the dispersion line. Our suspicion is that this reflects deteriorating fiscal dynamics and debt service risks. The Bank of Canada tracks these countries in a database found at https://www.bankofcanada.ca/2018/07/staff-working-paper-2018-30/. Most of the casualties are smaller economies whose economies are neither large enough nor sufficiently diversified to have material stabilisers.

Terms of trade shock also remain a material source of currency volatility. Under diversified economies are particularly vulnerable to commodity price led shock. Onshore savings can go some way towards stabilisation, but the chicken and egg conundrum of low income and undiversified economies still exists. Such risks are a part of the risk premiums investors demand.