In opening this document, you have just created demand for data centre capacity.

Even if you close the digital tab now, your enquiry created and used data. When you realise how great this article is and share it on social media, you will have used even more data (you might also want a reality check, but we hope not!)

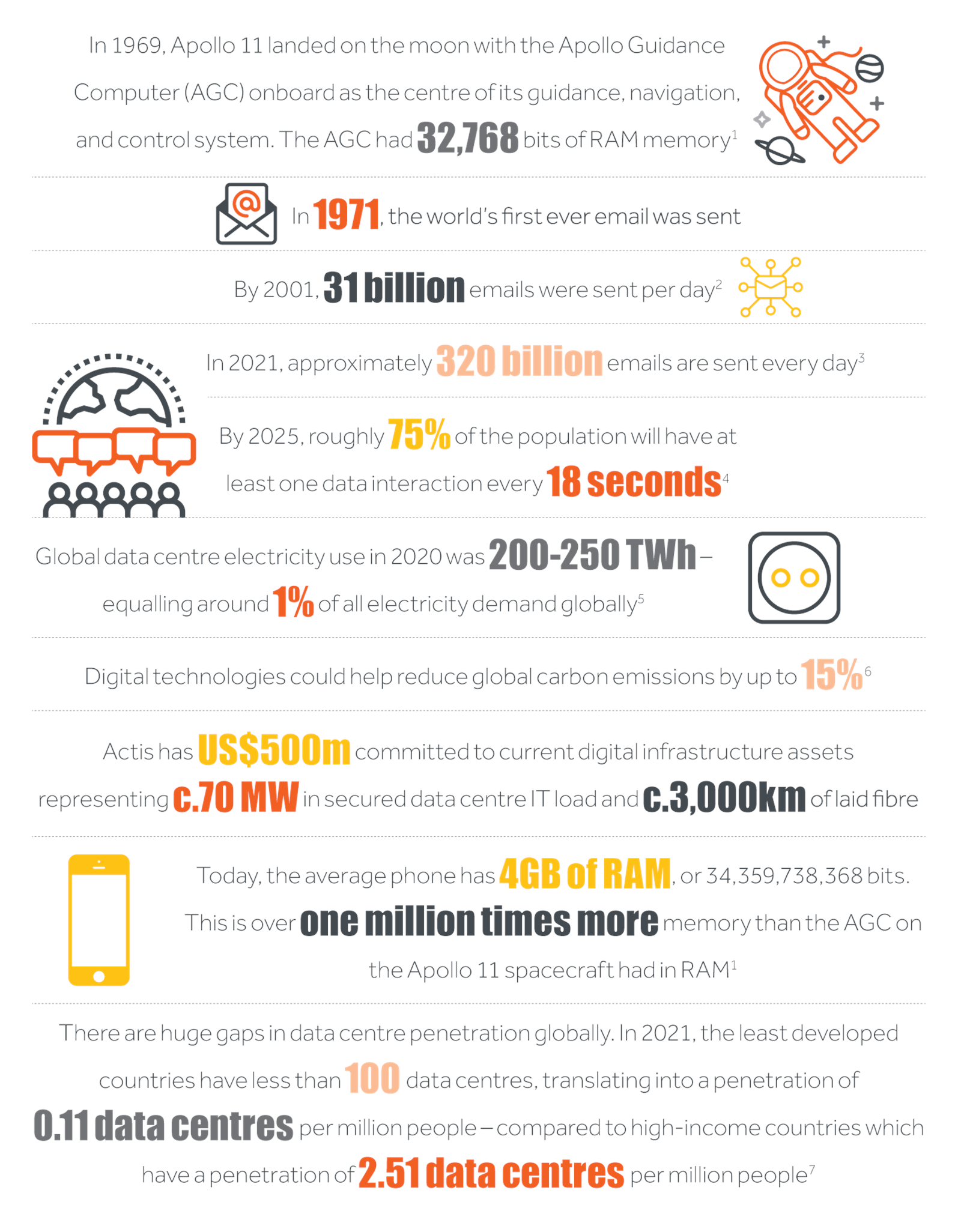

In 2020 – according to market research firm Statista – the total amount of data created, captured and consumed globally was 64.2 zettabytes. By 2025 forecasts are this will nearly treble. Surprisingly only 2% of this data was stored and retained into 2021. This too grows rapidly – 19.2% per annum to 2025 or nearly 150% over the period.

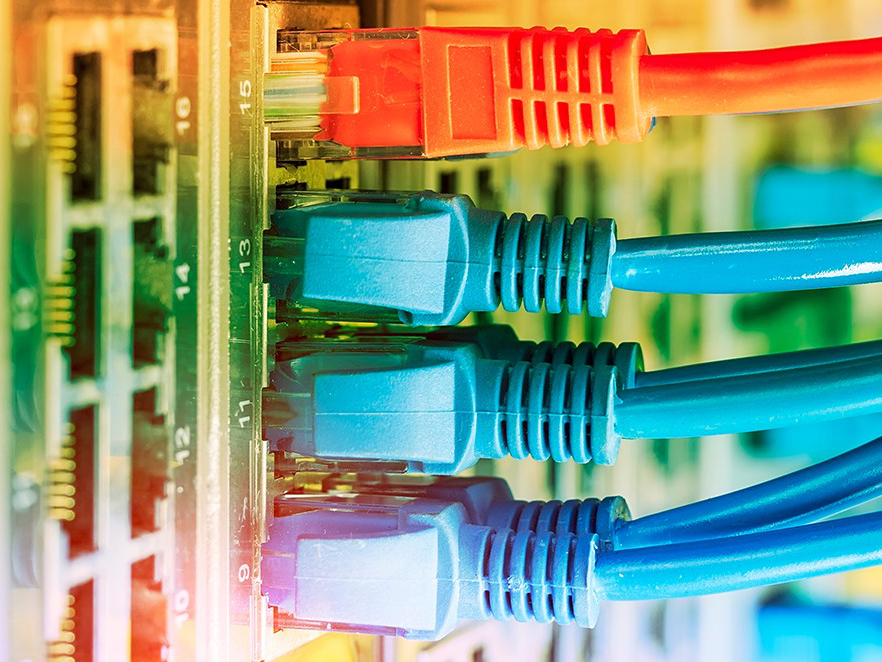

Creating, consuming, distributing, and storing this tsunami requires infrastructure. Which is where digital infrastructure in general and data centres come in.

We all know about infrastructure – the physical assets we see and need, but often take for granted. Together these assets form an asset class much in demand given a global shortage of long duration investments with cash flows uncorrelated to equity and bond markets.

Traditionally infrastructure carries, connects, stores or enables economic activity touching all of our lives. Digital infrastructure is the same but involves data. Data is now seen as ‘The Fourth Utility’, with the first three being electricity, gas and water.

Data centre operators facing rapid growth are pressing for truncated construction times

Skill and experience are at a premium in meeting these challenges. Technological progress in transmission drives this growth. 5G for instance, has multiples of capacity and capability relative to 4G. Technology adoption based on digitalisation is a powerful force for growth.

Emerging markets – the core geography where Actis operates – are rapid adopters. Low penetration of digital infrastructure and explosive growth rates are common factors. There is a long way to go with demand growth in these geographies. Best of all digital infrastructure creates jobs and enables social and economic progress.

So, this is a slam dunk asset where secular growth guarantees attractive returns

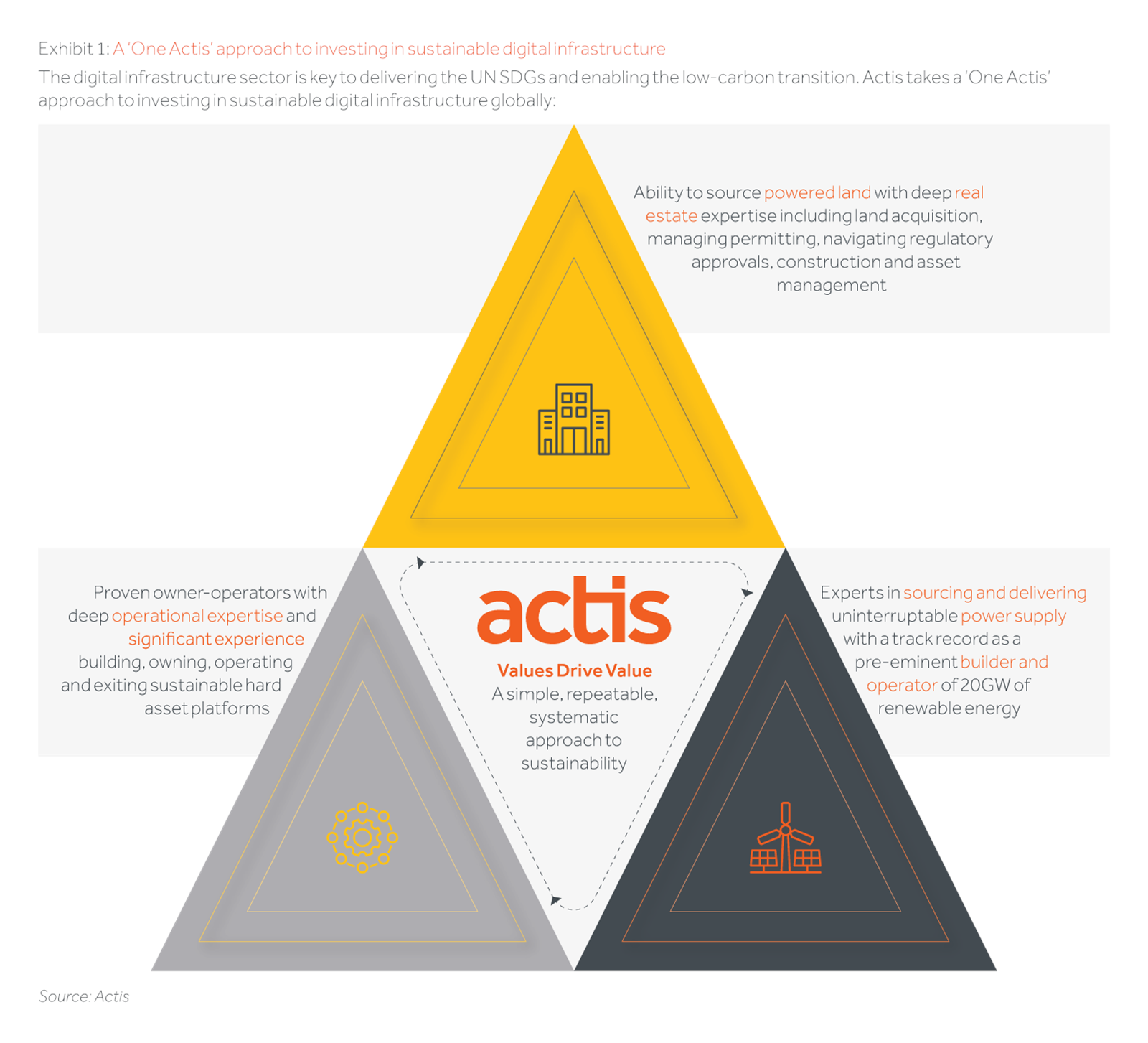

It isn’t that simple. Capital is flooding into digital infrastructure, diluting returns and driving up costs. Building and operating data centres spans real estate, construction, management and the delivery of uninterruptible power.

Sourcing land, managing construction risk, delivering, and managing uninterruptible power supply are core skills. Sustainable investing skills are crucial given data centres’ voracious appetite for energy.

It is hard to assemble these capabilities and there are acute skill shortages. An annual survey of data centre costs run by Turner and Townsend, reveals that most survey participants see labour and materials shortages driving construction costs up by double digit percentages per annum.

At the same time financial capital is chasing the digital infrastructure growth story with consequent dilution of returns. Data centre operators facing rapid growth are pressing for truncated construction times. Skill and experience are at a premium in meeting these challenges.

Actis has these skills and has successfully developed and invested in data centres from Seoul to Lagos.

The story told in this edition of The Street View is as much about the Actis skill set as the growth opportunity itself, with Gary Wojtaszek highlighting how investors can make sense of these future digital infrastructure trends.

We talk about the real estate skills involved – see Julian Kim’s despatch from Seoul on building and operating data centres in a fully developed economy with dense urban landscapes.

We address the question of power consumption in the article written by Barry Lynch, Head of Operations, Energy Infrastructure and Thomas Liu, Partner. Real Estate and Rodger Du from our Asian real estate practice describe how to navigate the issue of data privacy.

And, as sustainable investors, Polly Firman from our Sustainability team outlines the pathways to sustainable digital investment and opportunities to meet the UN Sustainable Development Goals.

We discuss the opportunities in our geographic markets through the eyes of our colleagues: in West Africa we profile Rack Centre, Thomas Liu explains how we’ve delivered a data centre in China, in Latin America (a huge opportunity) we hear from Mauricio Giusti, an expert in digital infrastructure in that region, and in India Ashish Singh and Ankur Trehan report ‘from the Street’.

What should be clear is that many skill sets are involved. These include having close in-house expertise and effective experienced advisors. We have been in the power and real estate businesses for decades as experienced investors. Our DNA has an unbreakable commitment to responsible investment, recognised through many sustainability awards over the years.

We take a ‘One Actis’ approach to digital infrastructure, drawing on these world class skill sets. And we see many opportunities to deliver for our investors in the fast growing but challenging world of digital infrastructure.