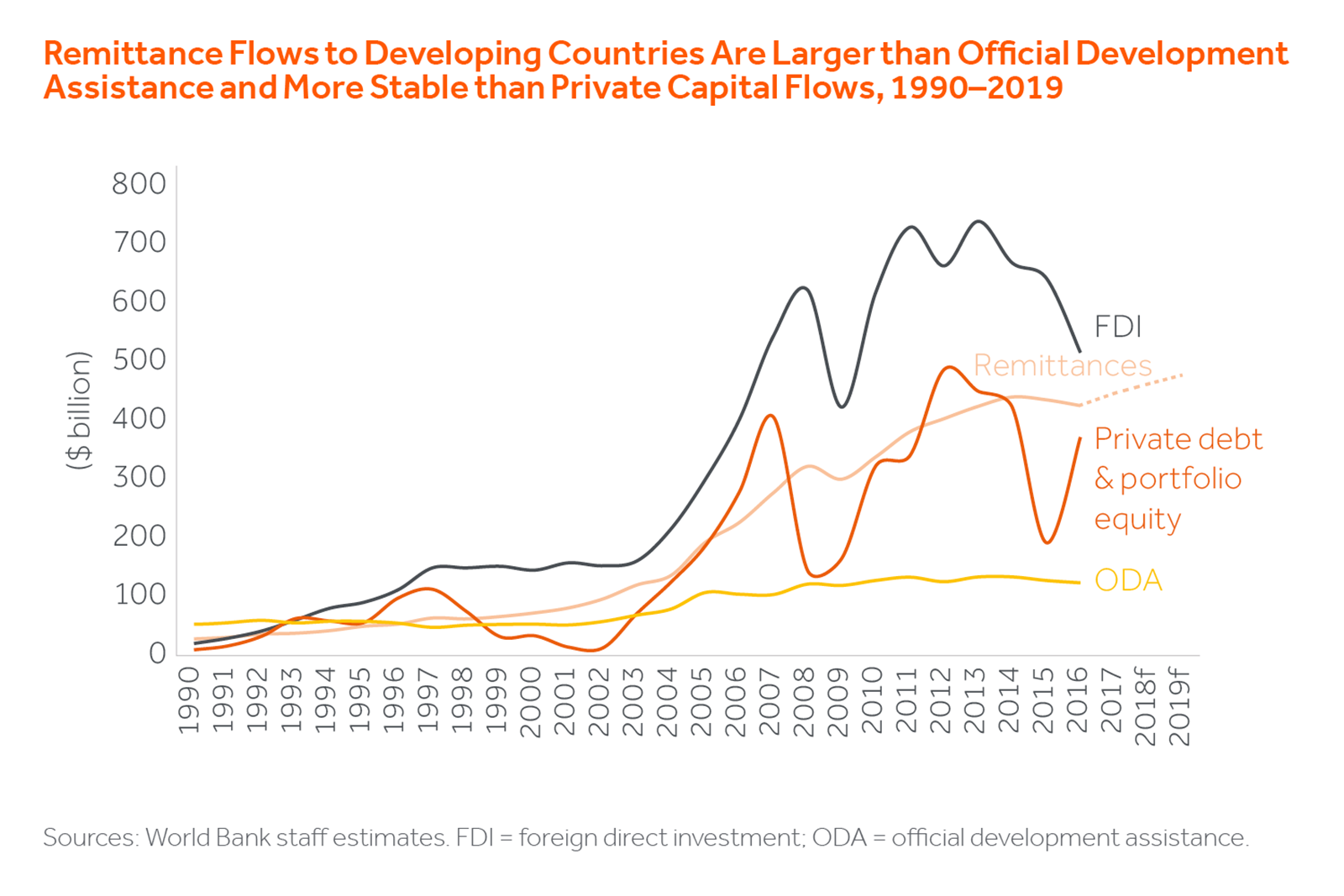

Sunday afternoon in Hong Kong’s Statue Square: – the normal hum of traffic replaced by thousands of voices. Hard working migrants using their day of rest to meet, catch up and visit neighbouring money transfer offices to send money home that support their faraway families. Similar scenes play out in Riyadh, Dubai, and London’s Whitechapel Road. Migrant worker remittances exceeded $600 billion in 2017, larger than portfolio flows supporting the lives of over 800 million people back home. The flows also matter to investors as they can smooth currency volatility in recipient nations and provide an important opportunity for fintech to reduce high transaction costs.

Cross border migrant remittances have more than doubled over the last 12 years exceeding $600 billion in 2017 once unofficial flows are included. Over 85% of these flows are to developing countries and in 71 cases exceed 3% of GDP in the recipient countries. They are 3 times the level of official aid and once China is excluded larger than foreign direct investment. They are more stable than portfolio flows (which they also exceed in size).