December 1st, 2018 was a historic moment in Mexico. Political power passed from the duopoly which had dominated politics for nearly 100 years to the Juntos Haremos Historia (“Together we Will Make History”) coalition and its creator, Andres Manuel Lopez Lopez Obrador, better known as AMLO. How did this change arise and what comes next?

‘What’s on Your Mind’ – The Changing Mood of Latin America

2018 was a busy political year across Latin America, with elections in eight separate countries. Change was a constant theme, not least because of the evolution of electorates. For the first time in history, the majority of voters were drawn from the middle class, replacing the old rich/poor divide in Latin America. In tandem, levels of debate and electoral scrutiny rose alongside widespread adoption of social media as an electoral tool, mimicking trends seen in elections and referendums in developed countries.

Two connected themes stood out. Pent up anger and zero tolerance for corruption, stemming initially from the Lavajato scandals in Brazil, spread like wildfire across the region. In turn, this led to the emergence of profound disenchantment with traditional political parties who were seen to embody embedded corruption.

This was particularly so in Mexico,where the PRI’s virtual monopoly of power of the last 100 years was dismissed.

Why?

Headline numbers for the Mexican economy portray a country which has grown modestly but steadily over the last 30 years at around 2.5% per annum, enough to raise average per capita incomes over the period (the disaster of 1994’s Tequila Crisis and forced devaluation now seems like an age ago to many). But this obscures the ‘two speed economy’ of Mexico. The prosperous North and Central regions represent 90% of output, driven by a dynamic industrial and manufacturing export powerhouse. In contrast, the economy in Southern Mexico is worn down by poverty, underinvestment, and declining productivity has seen its economy shrink. A famous remark by an ex Minister of Finance captures this dichotomy describing Mexico as ‘a country with plenty of poor people, but not a poor economy’.

This inequality and rampant corruption levels, personified by an alarming rise in homicide levels across the nation, delivered the desire for material change. AMLO drew upon this to secure election as President on his third attempt.

AMLO’s Program – Shaking the Tree

AMLO is well known to Mexicans. His three attempts to gain election as President mean his whimsical and gregarious personality, his origins in the PRI party, his subsequent shift to the left, and his record as Mayor of Mexico City are familiar stories. However, since election in July a new facet has emerged, AMLO the statesman and President Elect (Mexico has a 5-month transition from President elect to actual leadership). Two clearly distinct, albeit pre-existing, features emerge.

First, he has a distinctly pragmatic approach, previously sighted during his tenure as Mayor of Mexico City. His new Cabinet and team are drawn from across the entire political spectrum. His economic team brings together ex World Bank leaders with left leaning academics and practitioners. He has stressed central bank independence, nominating as his first board member an Ivy League educated PhD. His team have fully supported signing of USCMA, perhaps better described as NAFTA 2.0, crucial to Mexico’s future growth and productivity. He is committed to a primary fiscal surplus with expansionary welfare promises funded by aggressive cost cutting and corruption slashing efficiencies. Bond markets will be watching the publication of his 2019 budget in mid-December closely, in order to test the validity of these commitments; an important jury given that over 40% of Mexican government debt is held by cross border investors.

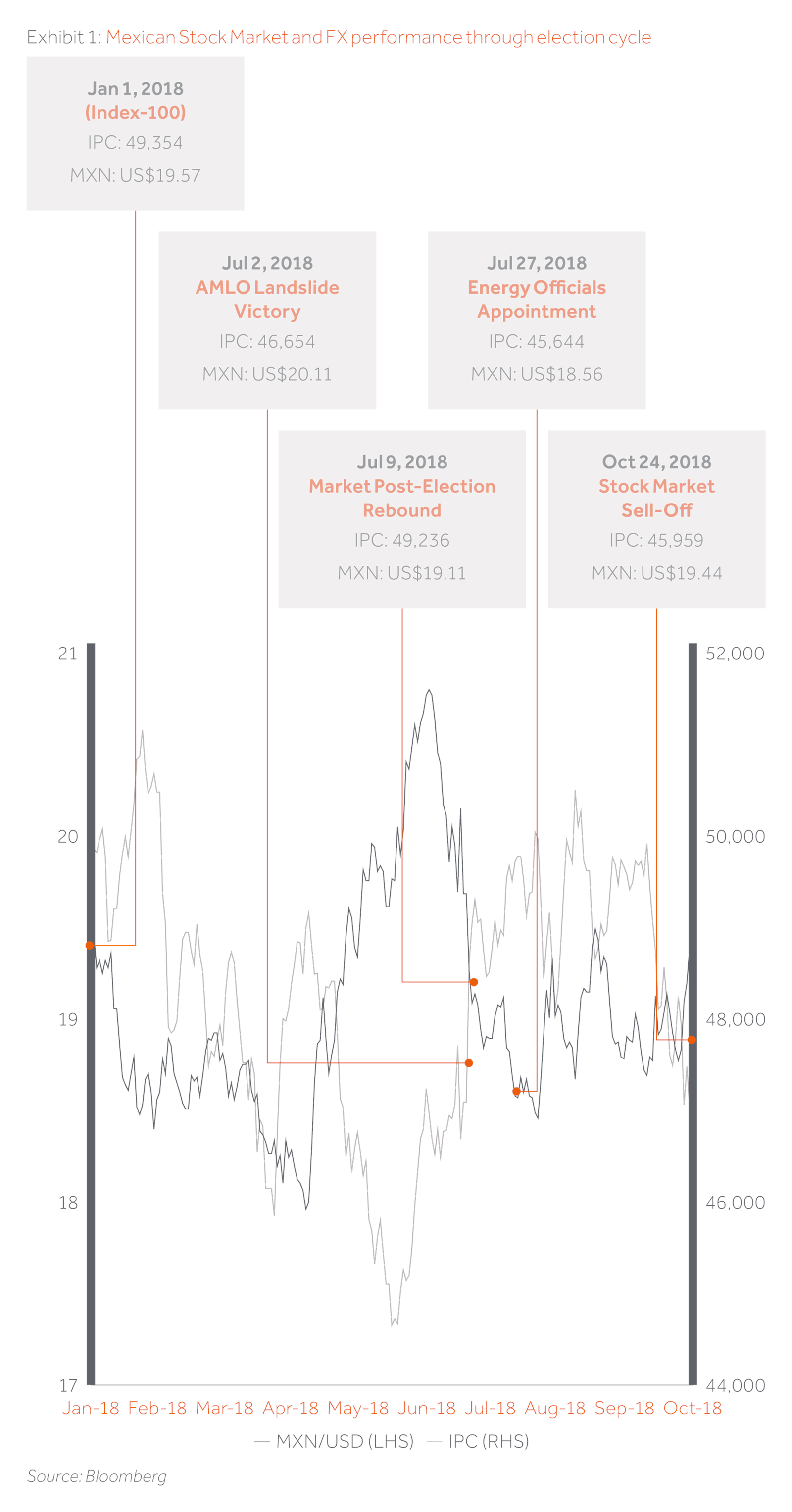

In parallel he has sent some critical messages of political style. His strong mandate and control of both chambers of congress provide a basis for an accelerated agenda. Top of the list is the fight against corruption. Markets and the business community were taken aback by this manifesting itself in the controversial cancellation of the new Mexico City airport project. The use of a perhaps less than kosher process involving a public referendum has understandably shaken confidence in the nature of the decision-making process. On the other hand, the project involved was controversial, seen as extremely costly and a potential source of rake off. Markets though have condemned the process sending the peso down by 5%, the stock market by 15% and credit spreads wider by 50 basis points in the weeks following the decision.

Mexican Stock Market and FX performance through election cycle

Here lies a potential pitfall. Mexico has a highly open and globally integrated economy (other than of course its Southern region). Foreign ownership levels of the bond and equity markets are high, the Mexican Peso is the most highly traded EM currency in the western hemisphere, and the country boasts a record-number of free trade agreements. What works for AMLO with his domestic electorate may not be so convincing to foreign suppliers of capital, and the government would be wise to balance its act to please both crowds. Long-term and private capital is more patient and creative in finding ways to work with AMLO and his program, yet not entirely disjointed from the public markets. The formation of a private sector advisory council, headed up by AMLO’s Chief of Staff and conformed by some of Mexico’s leading industrialists, is an opening of this conversation. Value will continue to be formed and found by investors in Latin America’s second largest economy, but the tactics will shift.

The Future…

AMLO’s strong opening hand includes a strong economy, low unemployment, declining inflation and balanced fiscal accounts. The exogenous threat posed by NAFTA renegotiation has abated (although a Democrat majority in the US Congress still poses a threat to ratification). His political mandate delivers a firm base with which to tackle corruption, to deepen and diversify political institutions and begin to address a huge inequality gap. A pragmatic approach to the problems in his in tray also augers well. Sustaining confidence with all stakeholders as to methods as much as aims will be critical in defining the outcome for Mexico in this new regimen.