On the 24th of June, the experienced growth market investor could not help but feel a little bemused at the number of shellshocked faces around the post-Brexit breakfast table.

The 30% nosedive in the Nigerian Naira, just 4 days prior to the Brexit referendum, made the 10% decline in Sterling seem positively subdued. However, it certainly served to remind us all that foreign exchange dislocations are not the exclusive preserve of growth markets, and at the same time reinforced our conviction in the value of anchoring our perspectives on foreign exchange on longer term fundamental value.

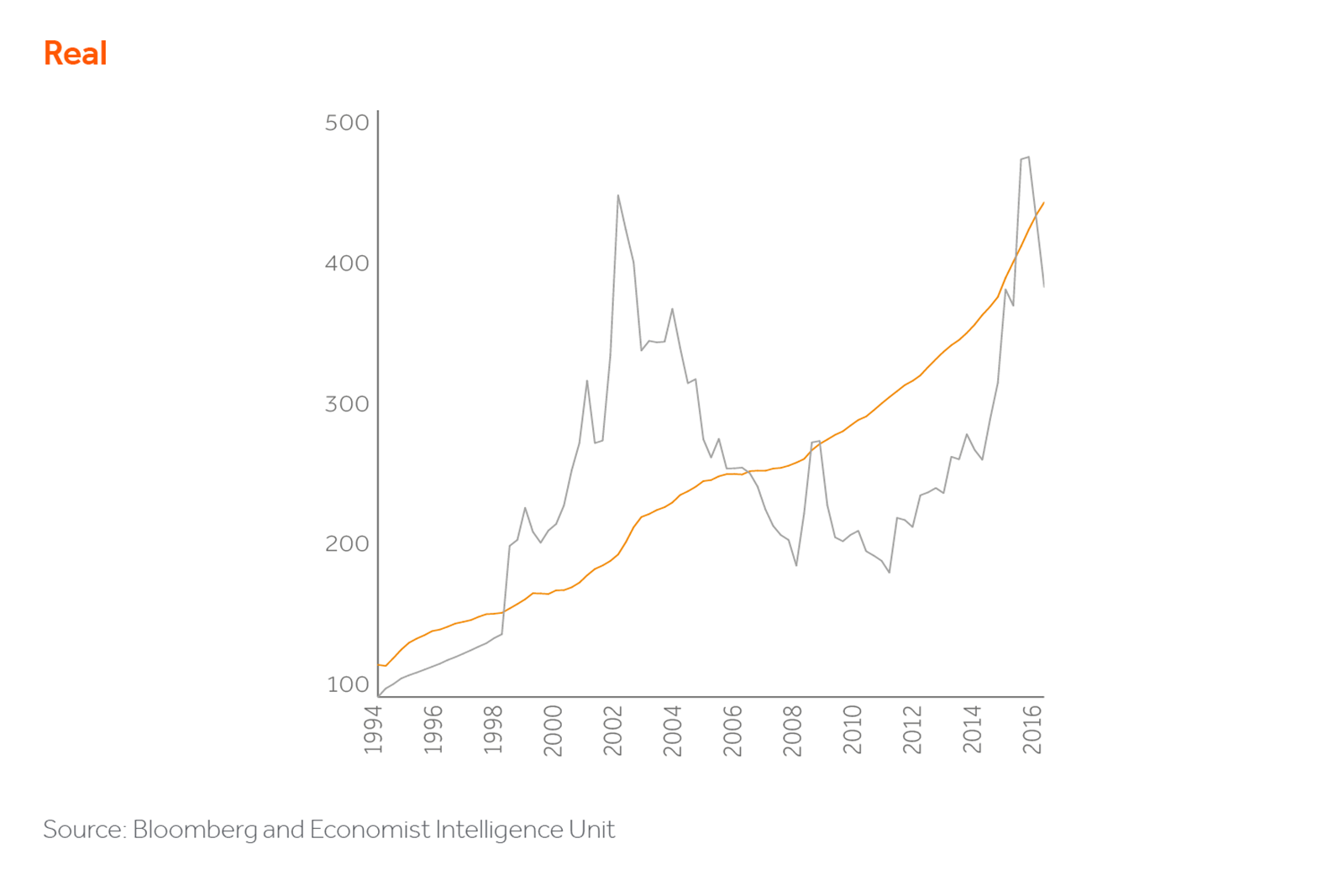

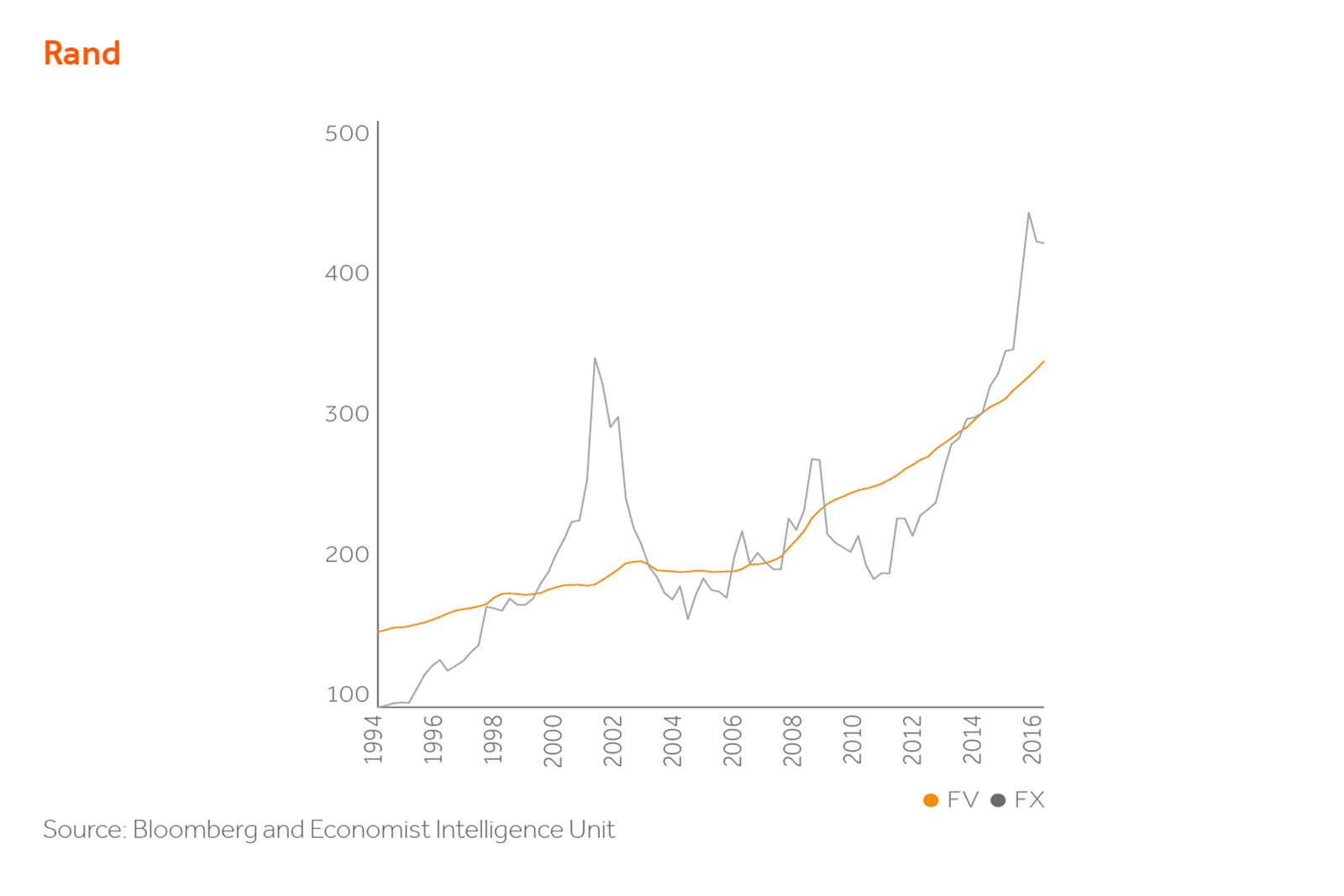

From south to south, the second quarter of the year saw EM FX movements significantly influenced by political developments, albeit that unlike the previous few quarters, this time the yo-yo went up as well as down. Both of our more liquid currencies, the Brazilian Real and South African Rand appreciated strongly, both from undervalued positions, buoyed by signs of improving democratic accountability in the respective countries. The renewal of optimism linked to the Rousseff impeachment in Brazil covered elsewhere in this issue, contributed to the Real going from R$4 to R$3.2, and the Democratic Alliance’s success at local elections in South Africa under-pinned a recovery in the Rand from ZAR16 to ZAR13.2. The subsequent standoff between President Zuma and his finance minister has reversed some of the gains in the Rand, which our model suggests remains one of the most under-valued currencies in our markets.

Q2 also saw the continued build-up of pressure on the Nigerian Naira and the Egyptian Pound, both of which have been defiantly overvalued for some time. While Bukhari reluctantly but sensibly accepted the inevitable and bowed to this pressure, his counterpart in Egypt, President Sissi appears intent on sticking it out for now. Our model suggests the Naira is now approaching its fundamental value, while maintaining the Egyptian Pound at current levels will require the IMF and the Gulf States to bridge the black market spread, a tricky circle to pyramid.

The Yuan and Rupee will both make for intriguing watching over the coming months. Rajan passing the baton to Patel reinforces the importance and focus on maintaining the Reserve Bank of India’s inflation discipline, potentially increasing pressure on the Rupee. Meanwhile, a move in US interest rates will likely put increased pressure on the Yuan, compounded should China report slowing growth. However, and just as Sterling felt the impact of political upheaval in the aftermath of the Brexit vote, we continue to believe that the Federal Reserve will have difficulty justifying an increase in interest rates in the immediate short term. This is less as a function of disappointing seasonal jobs data and perhaps more as a reflection of the risk of any tightening in US monetary policy being decisively Trumped in November.