Janet wakes up in the thriving Asian metropolis she calls home. After a shower, provided by smart shower-heads – optimising water usage and dispensing desalinated water, powered by renewable energy – she makes herself a coffee and prepares for the workday ahead. She works from home most days, made possible by tremendous advances in digital tools and the world’s highest quality fibre networks. In the late morning she uses the renewable energy-powered, efficient mass rapid transit system rather than her shared electric scooter (which is more expensive during peak hours) to reach today’s meeting. The state-of-the- art office building hosting her meeting is primarily powered by rooftop solar panels and battery backup, whilst being kept cool by the latest district cooling technology. Janet’s day ends early and she meets friends for a drink on a shady patio, as her co-bot finishes up some of her to-do list – made possible by the tremendous computing power of regional data centres.

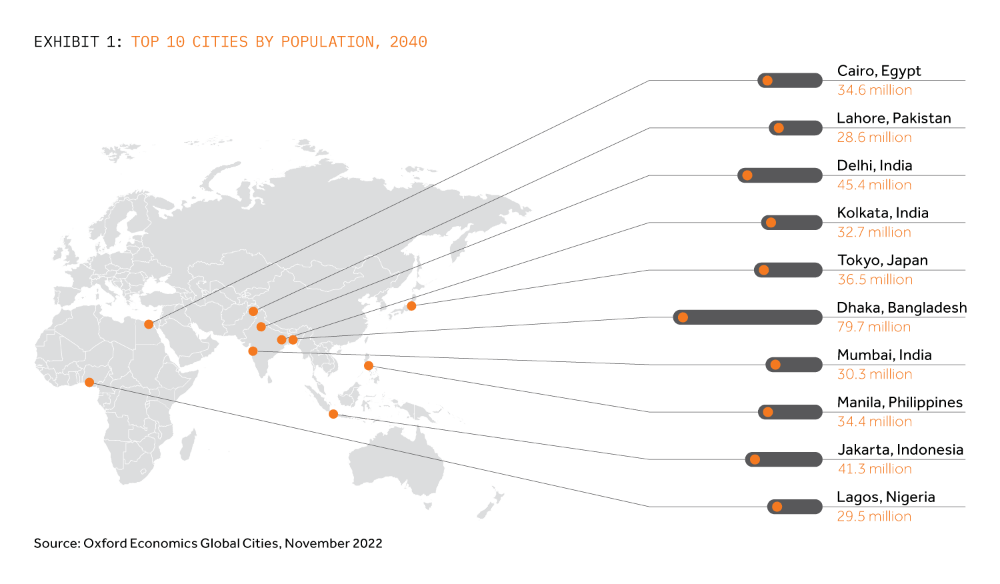

Janet lives in one of the major Asian meta-cities. According to the IMF, Asia accounted for a third of global GDP in 2021; this share could grow to over 50% by 2040, according to McKinsey Global Institute. ASEAN is expected to surpass the European Union and join the US, China and India as the four largest economic blocs by 2050. Urbanisation continues at a relentless pace: Oxford Economics estimates that by 2040, seven of the ten world’s largest cities by population will be in Asia (Exhibit 1).

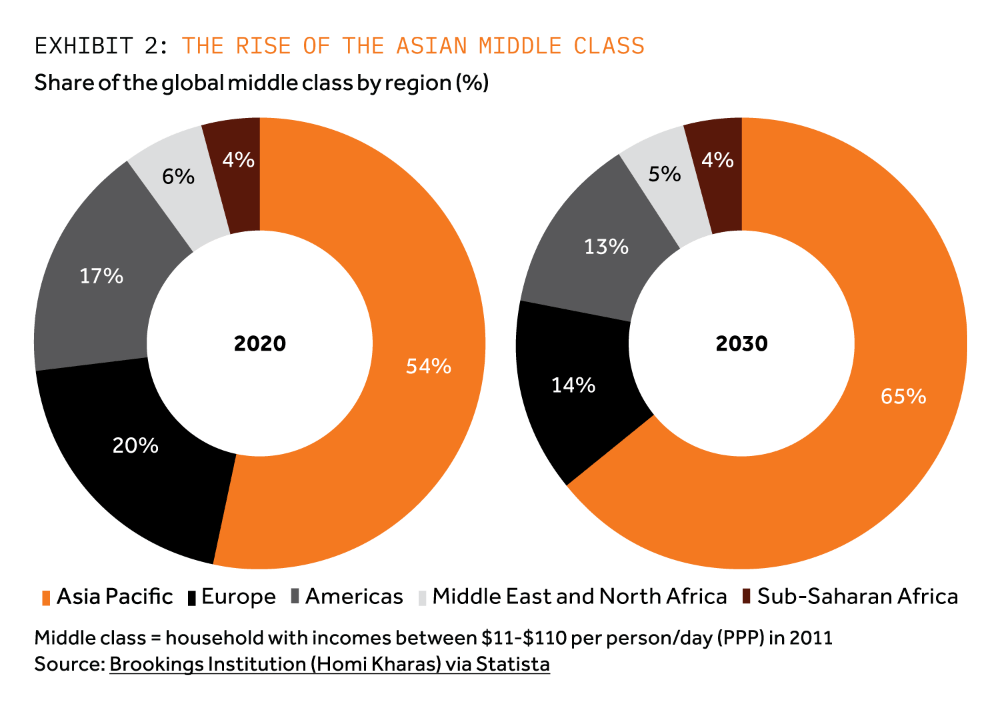

By 2030, two-thirds of the world’s middle class will reside in Asia. This vast group demands clean power and water, efficient cooling, fast and green transport, and world class internet connectivity. The future is now: Asia is already leading the world in these fields.

- The largest share of all energy transition spending is already taking place in Asia, according to BloombergNEF.

- According to the ITU, in 2022, over 53% of internet users globally were in Asia.

- Asia and MENA are already leading the world in district cooling and water desalination, to manage lower freshwater conditions.

Actis’ builders-and-operators mindset of implementing long term operational excellence is a key differentiator and helps us to build trust in relatively new sectors such as vietnamese renewables or indonesian toll roads.

Infrastructure investing mega-trend #1: the Great Catching-Up

This economic growth and consumer/ industrial demand in Asia will require $3.1 trillion of annual capital spending on physical assets to 2050 to finance the energy transition to Net Zero, up from $2.1 trillion in 2020, according to McKinsey & Company. There is explosive infrastructure growth across all major Asian countries, as they converge to developed economies.

First and foremost, Asia is leading the way with respect to renewable energy. India alone will build 500GW of renewable energy capacity by 2030, which exceeds the entire installed capacity in the European Union today.

Modern transportation closely follows, accounting for one third of this infrastructure gap, with most of the balance in the digital and water sectors.

Governments cannot fund all of this infrastructure spending from their balance sheets, a constraint exacerbated by post-COVID-19 fiscal stress. Outside of China, many Asian economies will depend almost entirely on private sector funding. Besides the need for capital to build new infrastructure, governments are also planning to launch asset sales, privatisations and concessions in order to support their fiscal stresses. Domestic debt financing markets continue to deepen in large markets such as India and South East Asia with increasing availability of non- recourse financing, complementing lending from global banks and DFIs; “bankable” projects designed to attract both this debt capital as well as professional equity capital are proliferating.

Many Asian markets offer mature, tested, and transparent regulatory systems, based on international best practice, expressly designed to attract foreign capital. India has led the way, welcoming FDI for 20 years into the renewables and toll roads sector, and is attracting many of the world’s largest institutional investors into its infrastructure programme. The Philippines recently amended its regulations to welcome foreign investors to take majority control stakes in most infrastructure sectors. Indonesia’s sovereign wealth fund (INA) has been establishing partnerships with leading foreign institutional investors to invest into its infrastructure, to serve its population of nearly 300 million. A significant influx of new sponsor capital will support the maturation of financing and governance frameworks.

Actis has been investing behind this movement for years, building two of the leading renewable energy companies of India, developing several leading data centres and logistics platforms across Asian markets, managing and operating toll roads in India, and leading the way in the smaller scale C&I power sector. Through Actis’ longstanding presence across Asia and our trusted relationships with stakeholders, we have been able to establish recognised sustainability leaders which align with the Asian infrastructure transformation.

Infrastructure mega-trend #2: Innovation & Leapfrogging, Sustainably

Beyond the theme of convergence and catching up, Asia is at the forefront of technological and digital innovation. The growing Asian mega-cities are not burdened by the same degree of legacy infrastructure which poses such a barrier in the US and the European Union (think fixed- line telecommunications).

Asian countries have demonstrated a remarkable passion for technology and have long been at the forefront of

technology and innovation leadership, from the robotics (45% global share), cars (Toyota #1 globally), and electronics of Japan; to semiconductors in Taiwan (66% global share); to the incredible economic transformations of South Korea, Singapore, and of course China, into tech powerhouses.

Actis has been investing behind Asian infrastructure for years, building two of the leading renewable energy companies of India, developing several leading data centres and logistics platforms across Asian markets, managing and operating toll roads in India, and leading the way in the smaller scale c&i power sector.

Building on this heritage, Asian companies are leading the way in sectors including solar panel manufacturing, advanced recycling, water management, and 5G. Sustainability lies at the heart of Asian infrastructure innovation, especially considering the long legacy of coal-fired power across many of the largest markets.

Actis is well placed to capitalise on these trends. We invest across the risk spectrum (growth and yield), positioning us to both acquire assets from developers and large strategics as well as invest directly into the sustainable infrastructure construction boom.

Actis’ builders-and-operators mindset of implementing long term operational excellence is a key differentiator against other financial investors, and helps us to build trust in relatively new sectors such as Vietnamese renewables or Indonesian toll roads.

Actis’ experience in developing sustainability leaders such as Ostro Energy, Sprng Energy and Temple Stay is second to none. Our fundamental belief that ‘Values Drive Value’ underpins every investment thesis, regardless of sector or geography, and gives the firm a clear licence to operate across a transforming Asia.

Actis believes that Asia needs to be at the heart of any global infrastructure investment strategy. The fundamental long term trends of economic growth, the rise of the middle class, the absolute need for clean power, water and transportation, buttressed by Asian global technology leadership, all lead to a once in a generation opportunity to invest into the sustainable infrastructure required to deliver this fourth industrial revolution.