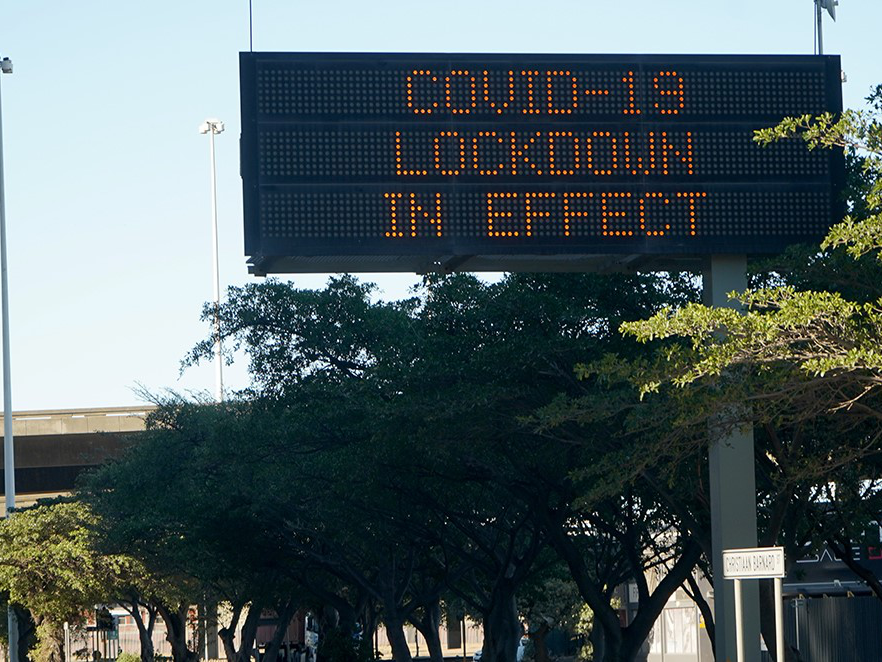

Welcome to this special edition of The Street View. Given global circumstances with many of our markets in varying degrees of lockdown, this edition provides both the “street view” and “a view of the street”.

Despite these challenging times, there has been no lockdown in our activity set at Actis and, just as importantly, our portfolio companies are working hard to deal with challenges in the current environment. In this edition we highlight results from Actis surveys of our portfolio companies undertaken by Ed Williams and David Kunzmann, from the Private Equity Value Creation Group.

The good news is that preparedness is high and that Actis is supporting portfolio companies and management teams to battle with unprecedented challenges. The not-so-good news is that the majority of those surveyed see this as a multi quarter crisis. Only time will tell.

This global disaster is playing out in different ways and speeds across our world. No one should doubt that this is a human tragedy of epic proportion, one which falls hardest on the poor and disadvantaged. We do not lose sight of this point and it is encouraging to see the emphasis on managing through this crisis placed by Governments, multilateral agencies, corporate leadership and Actis professionals everywhere.

In a series of “Street views” and “Views of the street” – some at ground level, some from apartment windows – colleagues from Mexico City to Nairobi to Seoul share what is happening on the ground in their countries. Thanks to all of them for these insights and to Shami Nissan our Head of Responsible Investing for her insights on our concerted efforts to focus and innovate with a strong emphasis on the human dimension in this time of crisis.

Of course the human tragedy is reinforced by stark economic reality. No one should doubt that the crisis requires mobilisation of capital to support economies and their people. Multilateral agencies are playing a big part here alongside Government intervention in fiscal and monetary space. Portfolio capital has fled at the margin which exacerbates financial pressure in these economies.

I look at the incentives and realities for portfolio flows in a reprint of an article – “Emerging Markets and COVID-19”. I also take a brief dive into our fair value currency model to explain some of the workings and philosophy we employ to assess this key area of risk.

We are attempting as ever not to be just another “Wall Street” view, but to give you a unique ground floor view of this crisis. No one is complacent about the current challenges but equally we remain attuned to potential opportunities and obligations – whether they be support on a human level or investment opportunities that emerge. We will be bringing you further updates including past and present experience on the front line of global investing and stewardship.