Wednesday 7 August 2019 saw a major step in much needed reform of Brazil’s antiquated pension system, when the lower house approved proposals before final approval in the senate, expected in late September.

After decades of debate, often muted by years of positive demographic bonus and economic expansion, it is encouraging to see a difficult and intrinsically unpopular reform moving forward.

Interestingly, the approval was achieved despite the discredit of government leaders in a fragmented congress and the pessimism of many reputable market participants just a few months ago.

In addition to the expected savings of c. R$900bn over 10 years, the pension reform sets the ground for a return to stability, reduces risk perception and potentially unlocks a long list of other desirable reforms, both macro and micro, across Brazilian economy and society.

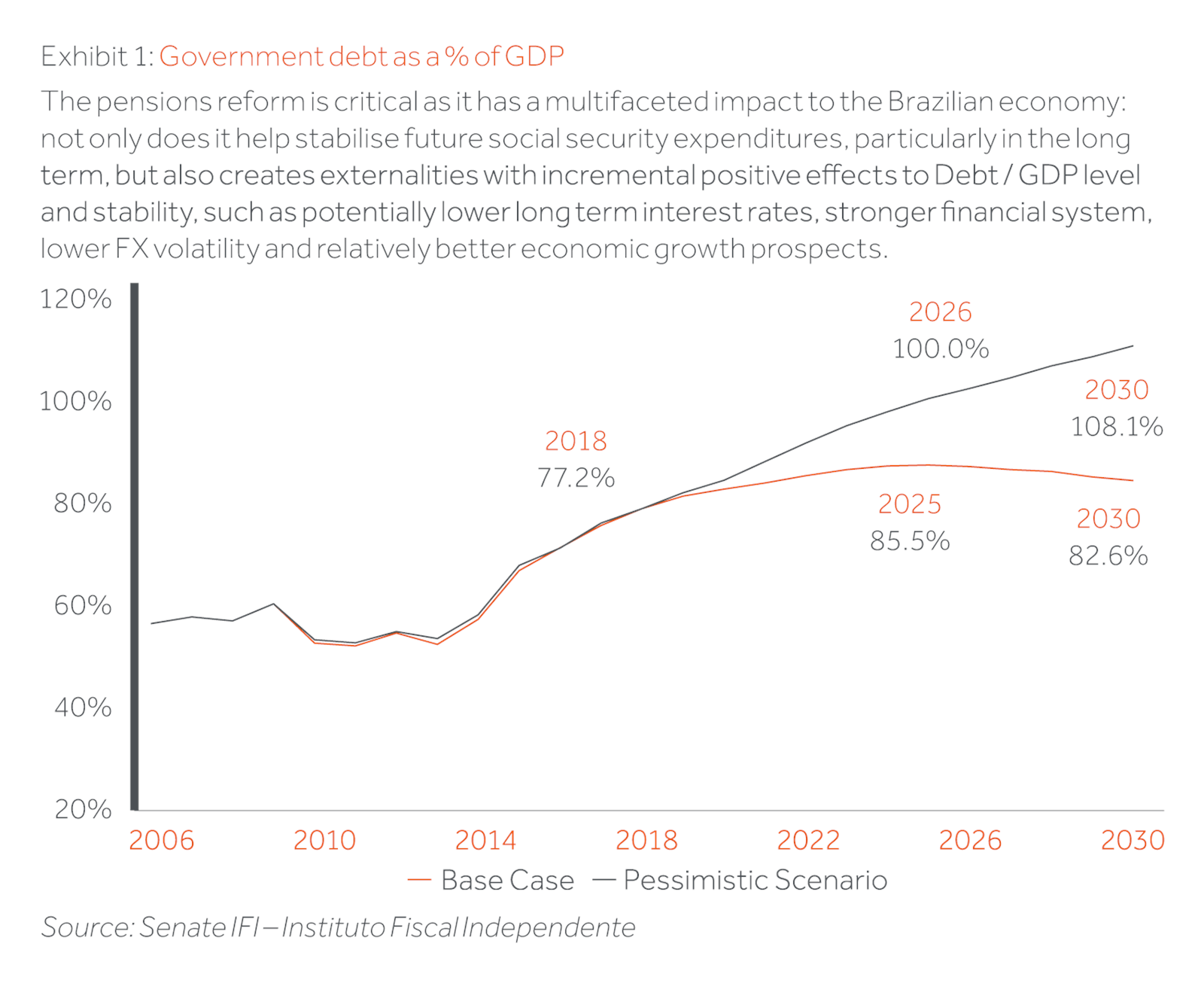

The reform has a multifaceted impact to the Brazilian economy: not only does it help stabilise future social security expenditures, it also creates externalities with incremental positive effects to debt/GDP level and stability, such as lower long term interest rates, a stronger financial system, lower FX volatility and relatively better economic prospects.

Despite all the noise around Mr. Bolsonaro’s controversial rhetoric and his dwindling popularity, behind the scenes his economic team is gradually making progress. Privatisations, trade liberalisation, tax reforms and reduction of the so called “Custo Brazil” (cost of doing business in Brazil), are all long overdue critical structural reforms which are now back on the government’s agenda.

If implemented these should lead to greater productivity, renewal of sustainable growth and give support to a structurally low interest rate environment, all key for long-term economic development of the Brazilian economy.

In addition, the pensions reform will naturally increase the number of Brazilians planning their future retirements. As financial services investors, Actis is seeing financial services businesses providing new savings and pensions offerings; opening up new investment opportunities.

Longer term, the reforms could allow Brazil to develop a solid base of domestic savings, which would eventually help reduce currency and financial volatility as Ewen Cameron Watt wrote in our June 2019 edition “Saving the Future”.

It is clearly too soon to celebrate just yet but the tangible progress is encouraging in a country full of untapped opportunity. Elsewhere – from Chile to Mexico, Malaysia to Korea pension fund reform has led to stronger domestic financial systems and relatively reduced exchange rate volatility. Latin America’s most populous economy may continue this trend… stay tuned.