The poor old Mexican Peso has taken a battering, not only in recent months, but over the last few years, losing 58% of its value and declining from 13 to 21 to the US$ between January 2014 and January 2017. The downward direction of travel has been common to many growth market currencies, but the reasons may be different, as whilst the Peso has not matched the Turkish Lira (64%) or the Russian Ruble (86%) to say nothing of the Egyptian Pound (161%), its fall has out-paced that of the South African Rand (31%) and the Brazilian Real (38%), both markets where the fundamentals have undoubtedly been materially more challenging over the same period.

So why this race to the bottom and why is there a clear difference between the factors affecting the Peso and those impacting our other currencies? In most emerging market currencies, the strength of the US$ has been exacerbated by the declining price of commodities and endogenous political developments. Mexico is distinctive in that the commodity impact is muted and the political issues it faces have been imported rather than home grown. Unusually, the fault here ‘does’ lie in the Stars (and Stripes) rather than within Mexico.

Not since the Tequila crisis in 1994 has the Peso experienced such a marked sell off. Relative currency stability has characterized the two decades since. However, history is not exactly repeating itself – in 1994, the Central Bank devalued the Peso, whereas today the market sets the FX rate. As managers of patient long-term capital, the question we have to ask is whether there is a basis for this devaluation? Is the market revising its view on fundamental value or reacting to policy statements released via Twitter?

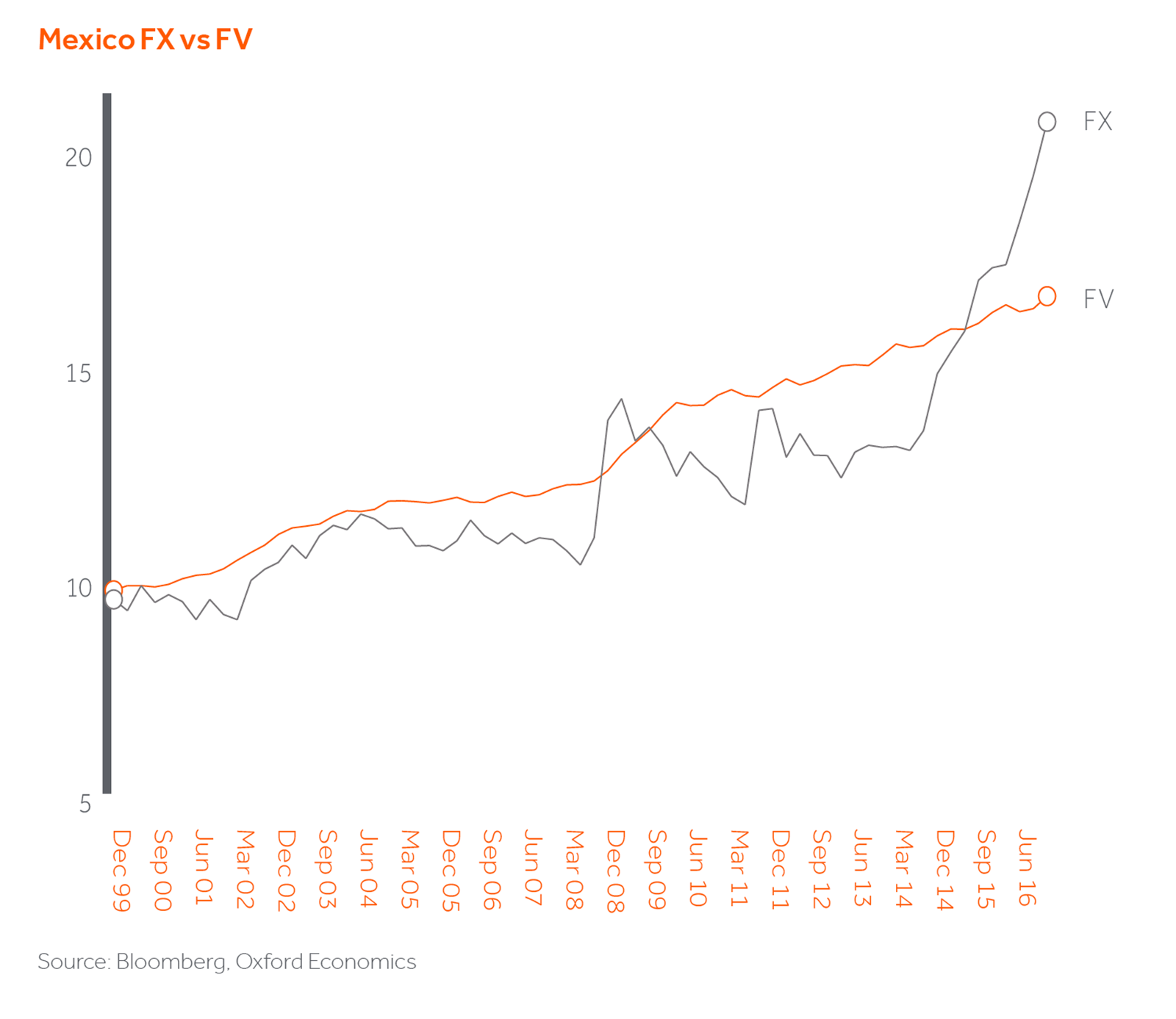

In the April 2016 edition of Actis Insights and Perspectives, we introduced readers to the way we look at currencies, focusing on Fundamental Value (FV) rather than the near-term oscillations of the Foreign Exchange (FX) rate. Our analysis is based on a belief, supported by compelling academic evidence, that in the long run currencies move in line with differential inflation rates adjusted for productivity differences between countries. While a multitude of other variables influence foreign exchange rates in the short run, in the long run our thesis is that they tend to gravitate to these fundamentals. In that article we profiled the Rand and Real, and concluded that these exchange rates were 15%-30% under-valued relative to Fundamental Value (FV). The Rand has since appreciated from ZAR16 to ZAR13.5 to the US$ and the Real from R$4 to R$3.2 to the US$.

Utilizing the same methodology to look at the Mexican Peso tells an interesting story (see below). The Peso has been tracking in line with FV since 2000, it is only in the last couple of years it has seriously diverged. What is more, the Peso is now amongst the most undervalued of the currencies we track. The FV analysis again suggests the Peso is between 20-30% under-valued relative to the US$. Whether it will strengthen in the short term and see our forecast substantiated in the same way as for the Rand and the Real is another matter, as the current political climate in the US most definitively leaves Mexico “between a wall and a hard place”. Our model would suggest, however, that it is perceptions and not fundamentals that have led to the current exchange rate situation, and while perceptions can persist for a long time, we continue to believe that in the long run, currencies will revert to fundamentals.