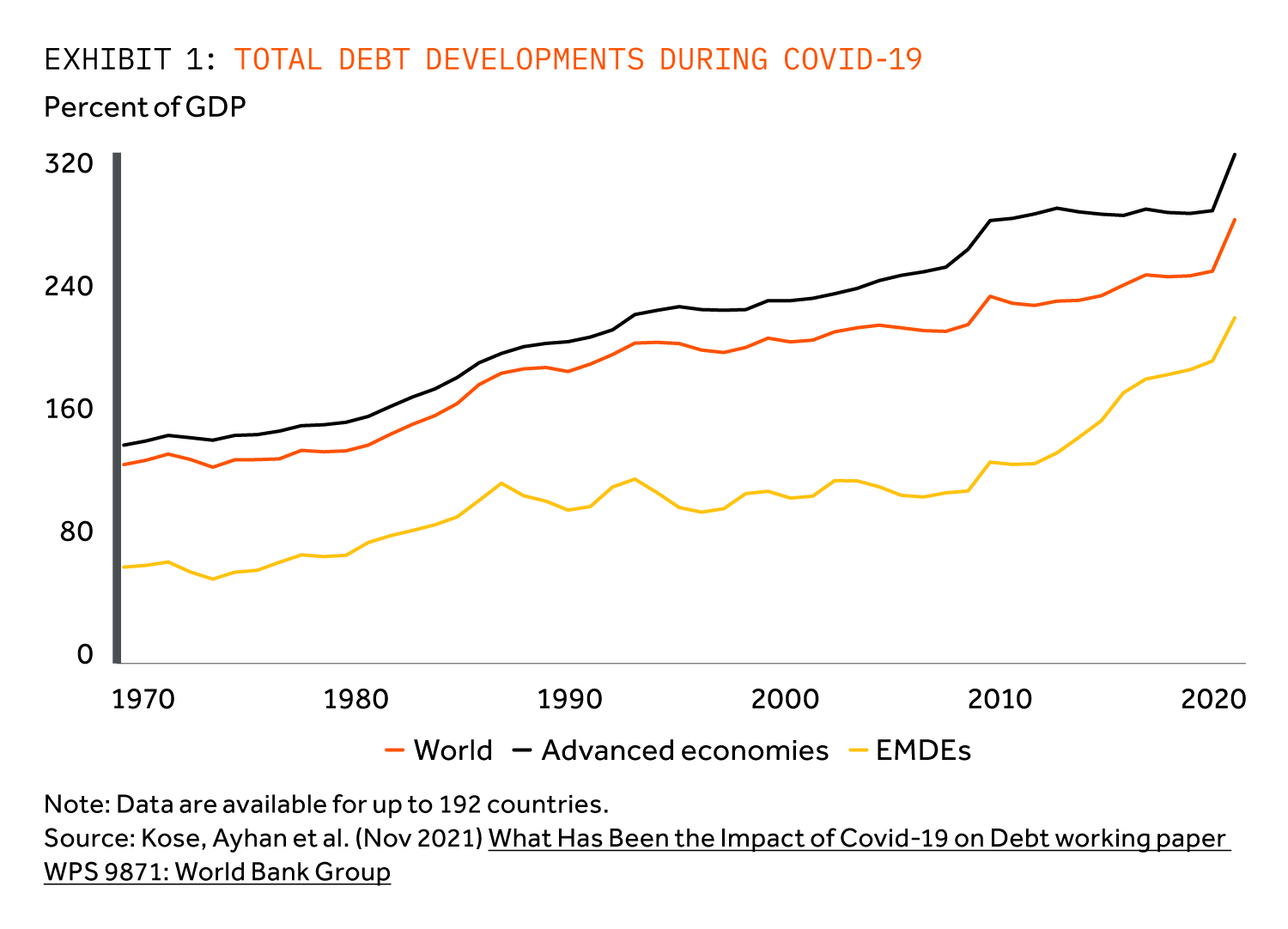

The pandemic has left many governments with a significant clean-up bill and stretched balance sheets. Total debt increased to 263% of GDP in 2020 and 90% of all countries saw their borrowing increase. Debt sustainability has become an important challenge to long term recovery in many global economies. In borrowing from the future-which is what debt does-having a plan to enhance future growth becomes ever more essential.

Moving into the third year of the pandemic investors must increasingly confront some of the harder questions around debt sustainability. Could this movie have a happy ending? Yes, it can. And infrastructure investment properly organised and executed plays an important role both for borrowers (countries) and investors seeking long duration assets.

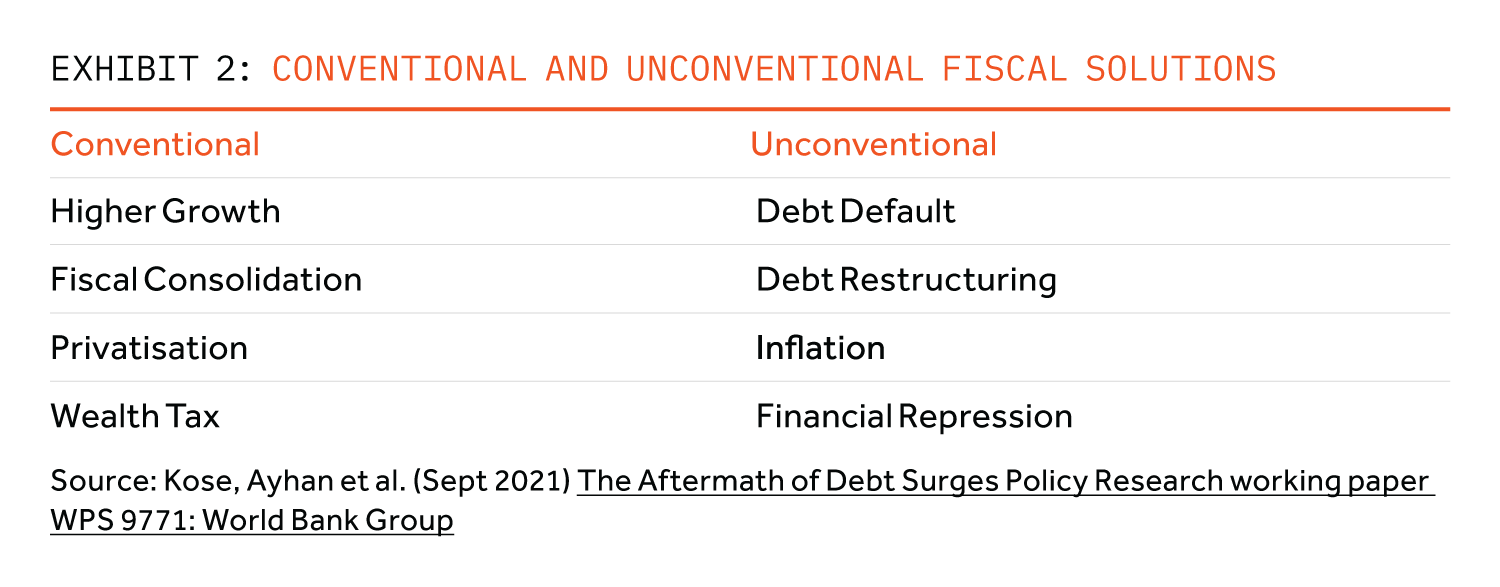

Case histories suggest fiscal solutions fall into two buckets: Conventional/Constructive on one hand and Unconventional/Destructive on the other (see Exhibit 2).

Infrastructure is a key enabler of the first three conventional solutions, whilst also aligning macro priorities with investor returns. Pack a wet towel on your head as you read on.

Neoclassical economic theory holds that investment and productivity are clearly linked. Theorists argue that increases in the quality of inputs have a multiplier impact on outputs (GDP growth). According to the World Bank study ‘Lifelines: The Resilient Infrastructure Opportunity’ (Hallegatte et al 2019) investing in foundational infrastructure – both physical and digital – is critical to stimulate innovation, which in turn is the basis for productivity gains and long-run growth.

Fiscal revenues are linked to growth as spending is more highly taxed than saving. The link from higher productivity to stronger revenue is clear.

As long ago as 1994 the late Edward Gramlich a former governor of the Federal Reserve and Professor of Economics at the University of Michigan proposed that the return to infrastructure investment was lower in advanced than developing economies. His proposition was that this arose because the main infrastructure categories were saturated in the former leaving a bias to repair and maintenance. In 2019, the International Monetary Fund (IMF) estimated economic multipliers from infrastructure investment for emerging markets (EM) of 1.6x that of developed markets (DM). In this case they calculated that there were clear implications that public investment multipliers-the bang for the buck-were inversely correlated to the level of initial capital stock. The lower the latter the higher the former. Furthermore, they suggested there was considerable spill over from public investment into the private sector who responded to these improvements with increased expenditure. Hallegatte et al show in their 2019 report that the return in EM was $4 for every $1 invested in infrastructure. But these returns can even be close to zero in some DM.

Whilst the development case for infrastructure investment is clear-cut, funding this is less straightforward. In The World Economic Forum’s study ‘Strategic Infrastructure’ it was estimated that the infrastructure funding deficit stands at US$1tn per annum. This is the difference between what is needed and actual spend.

WHILST THE DEVELOPMENT CASE FOR INFRASTRUCTURE INVESTMENT IS CLEAR-CUT, FUNDING THIS IS LESS STRAIGHTFORWARD

The infrastructure funding gap is particularly acute in EM and developing economies (EMDEs). In a 2020 study the World Bank estimates that EMDEs must invest on average 4.5% of their GDP per annum to achieve infrastructure-related United Nations Sustainable Development Goals. Most of these countries are not even near this spend rate.

The inability of infrastructure supply to keep up with the demand reflects severe public budget constraints, especially in the developing world. Given post-pandemic fiscal pressures, most governments simply cannot afford to act as principal financiers of infrastructure projects. Higher private sector participation is essential, particularly in the developing world.

Such participation-rich country savers funding poorer country borrowers-only meets demand if returns exceed those in the home market of investors. To borrow from legendary investor Charlie Munger, ’show me the incentives and I will show you the outcome’.

Such incentives exist and are being enhanced. Governments are likely to increasingly collaborate with private sector or offer outright concessions to bridge their infrastructure funding needs. This will increase the infrastructure investment opportunity space, including contract terms on offer. Currently around 20% of infrastructure projects in EMDEs are financed purely by private investors, and this share is likely to increase through to 2030. Private investment and partnerships allow governments to transfer life-cycle costs of infrastructure projects away from public budgets by creating investable assets and viable opportunities for the private sector. And private sector involvement will serve to buttress improvements in valuation transparency and standardisation of concession terms.

Infrastructure investments for institutional investors – which collectively sit on top of more than US$100tn of assets under management – and others is no charity. Much needs to be done in regulatory, financial, and societal space to attract this much needed investment. The case studies in this edition of Street View demonstrate that the dual outcomes of enhancing public efficiency and generating attractive private returns are possible. And, as past returns suggest, there are wide ranges of outcomes to investors by sector, geography, and asset manager.

THE CASE STUDIES IN THIS EDITION DEMONSTRATE THAT THE DUAL OUTCOMES OF ENHANCING PUBLIC EFFICIENCY AND GENERATING ATTRACTIVE PRIVATE RETURNS ARE POSSIBLE

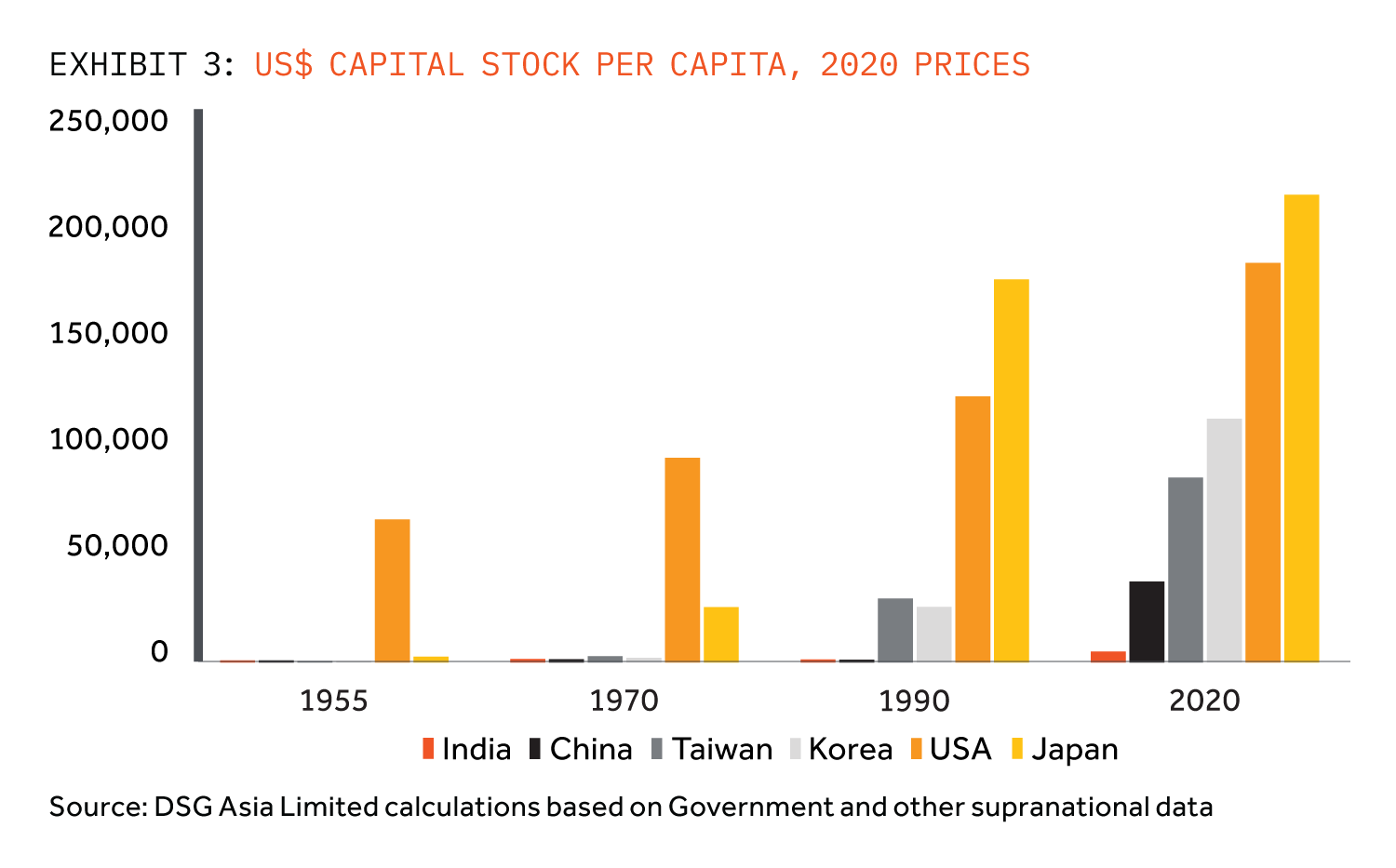

Marshalling this opportunity requires considerable change in practices. For starters, the discipline (and the framework) of capital allocation has to improve to avoid unproductive outcomes. The outcomes for inefficient power producers such as Eskom in South Africa, long drawn-out political disputes, and populist policy mixes (Brazil, Mexico and Nigeria provide examples) and muddled incentives (China and India) are examples of failures. Exhibit 3 shows that decades of a capital expenditure-led boom has still left China with higher debt and lower fixed capital stock per capita than Japan or Korea had at similar income levels.

The supply of bankable projects (and not just capital allocation) also has a material effect on productivity multipliers stemming from infrastructure. One example, according to G20 Infrastructure Hub, is the level of Project Preparation Facilities (‘PPF’s) which play a crucial role through technical and financial assistance in evaluating project identification, feasibility and structuring. PPF’s are expensive (5-10% of project cost) and most frequently found in less developed countries – 44% of PPF’s in 2020 were in Africa and only 4% in Western Europe.

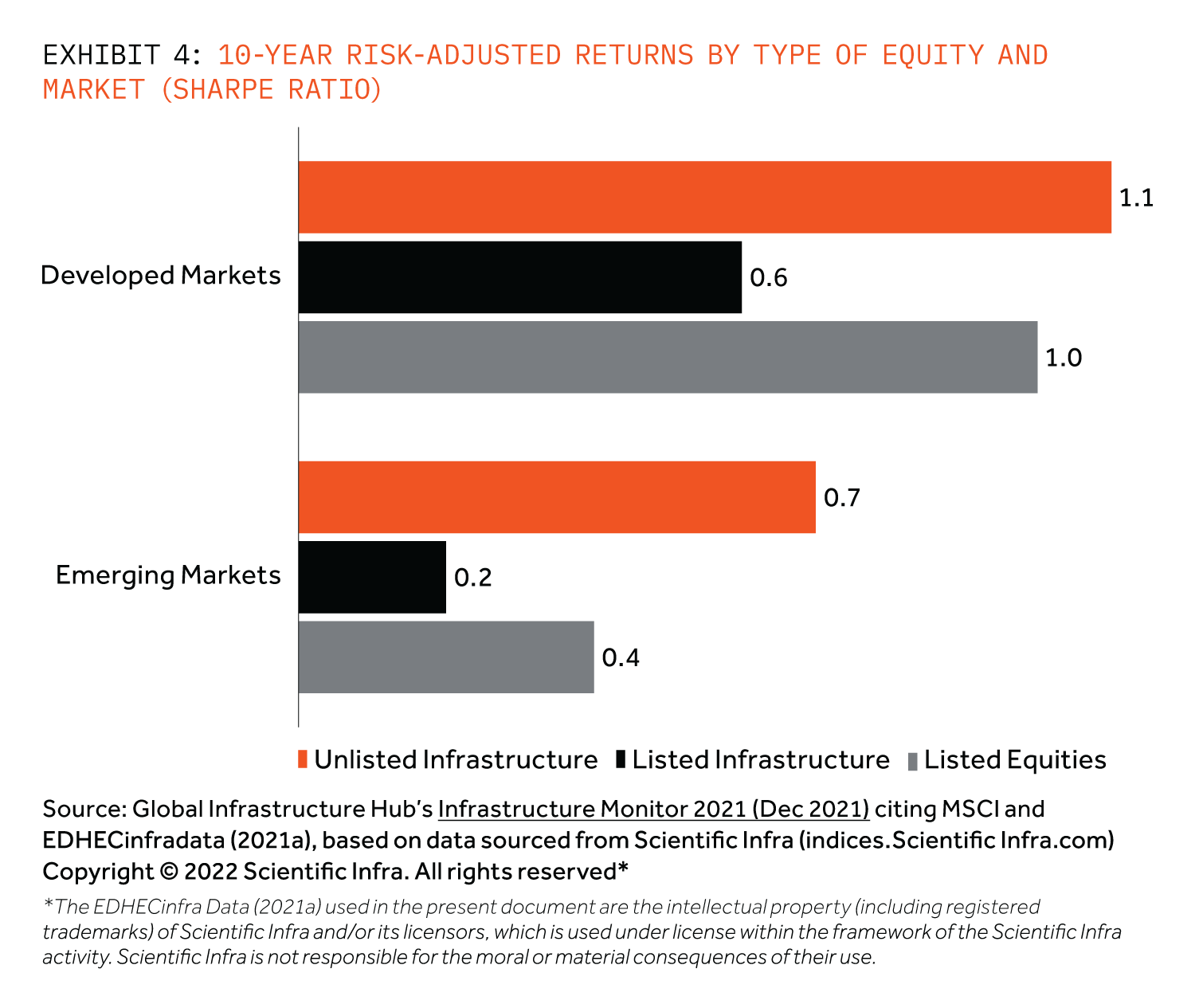

Countries with poorer starting infrastructure potentially afford higher returns to investment than in DM, according to the IMF’s 2019 Working Paper 19/289 entitled ‘Is the Public Investment Multiplier Higher in Developing Countries?’. The example of Japan since 1980 shows ‘pork barrel’ politics with ‘bridges-to-nowhere’ has limited sustainable economic impact. And yet investors as opposed to citizens have certainly done better in the last decade in DM than EM infrastructure. The 2021 G20 Global Infrastructure Hub’s Infrastructure Monitor shows that returns per unit of risk have been higher in DM than EM (Sharpe Ratio), see Exhibit 4.

Some of this difference arises from higher leverage in DM projects (about 60% of the excess according to the G20) and sector composition (in general renewables and utilities beat out transport and social infrastructure). Project size also matters as do financing costs. Telecoms until recently has been a poor risk in EM with 14% debt default rate over the 2010-20 period. By contrast Energy has been a standout with high returns and cumulative default rates of 6% over 20 years. The net effect has been that private sector investment has become increasingly concentrated in DM which now receive 75% of private flows yet are only 50% of the total stock of private infrastructure. And yet, the fundamental thesis that EM has the potential to deliver greater marginal infrastructure benefits remains intact. The key lies in project readiness and execution skill.

It requires an experienced infrastructure investment house with first-class planning and project management capabilities, as well as deep local networks, to deliver excess private capital returns. According to the 2017 Oliver Wyman study ‘Breaching the Infrastructure Gap’, poor planning and execution capacity, as well as limited acknowledgement of local culture, have been identified as critical reasons why private infrastructure investors have failed in the past to deliver expected returns.

Thus, execution matters, particularly in EM. We know from Actis’ own experience across hundreds of infrastructure projects that this is critical. We focused in The Street View last year on the role of improving management of facilities in returns to power projects and believe there is another 50% to go in this area. We wrote recently on digital infrastructure emphasising that demand was growing rapidly, but that execution skill sets (including the yield of a unit of data to a unit of power) determined outcomes.

At the end of the day though if economic returns are enhanced by infrastructure investment through productivity the path to fiscal sustainability is clear. Whilst fiscal constraints eat into development expenditure, the scope for privatisation and risk sharing increases. Productivity growth is central to this virtuous circle.

The fiscal path ahead is uncertain for all, perilous for some. Fiscal health must become an increasing focus for investors. But spending your way out of trouble so long as there is not infrastructure oversupply is logical. Properly executed it can also represent a profitable way forward for both public and private investors.