For too many businesses, sustainability is still seen as something to be bolted on – often as an afterthought – to keep investors and other stakeholders happy. A tick-box approach is thought sufficient to meet regulatory and stakeholder requirements to adopt Environmental, Social and Governance (ESG) policies.

At Actis, we take a completely different approach. We believe that by investing in sectors which provide solutions to global ESG challenges, like sustainable infrastructure, as well as taking an active management approach to embedding such values in our portfolio companies, we are doing more than helping the world meet its sustainability goals. We think that creating sustainability leaders also adds significant financial value to a portfolio company, throughout the period of our ownership and beyond. We draw on 30 years or more experience in making these claims. We don’t just talk, we walk.

SUSTAINABILITY IS IMPORTANT NOT JUST TO CREATE RESILIENT, SUSTAINABLE SOCIETIES: IT IS ALSO CRITICAL TO DELIVERING FINANCIAL VALUE FOR OUR INVESTORS.

There are a number of reasons why we hold this view. Embedding sustainability is critical to risk mitigation for example in preventing value erosion for investors. Around the world, there are a growing number of ESG risks that can threaten a company’s value, from climate change – such as extreme weather events or shifting long-term weather patterns – to the growing public focus on diversity and inclusion. One of Actis’ core skillsets is assessing issues like these during the due diligence process, and subsequently developing mitigation strategies to ensure any potential problems are resolved during our ownership.

EMBEDDING SUSTAINABILITY IS CRITICAL TO RISK MITIGATION.

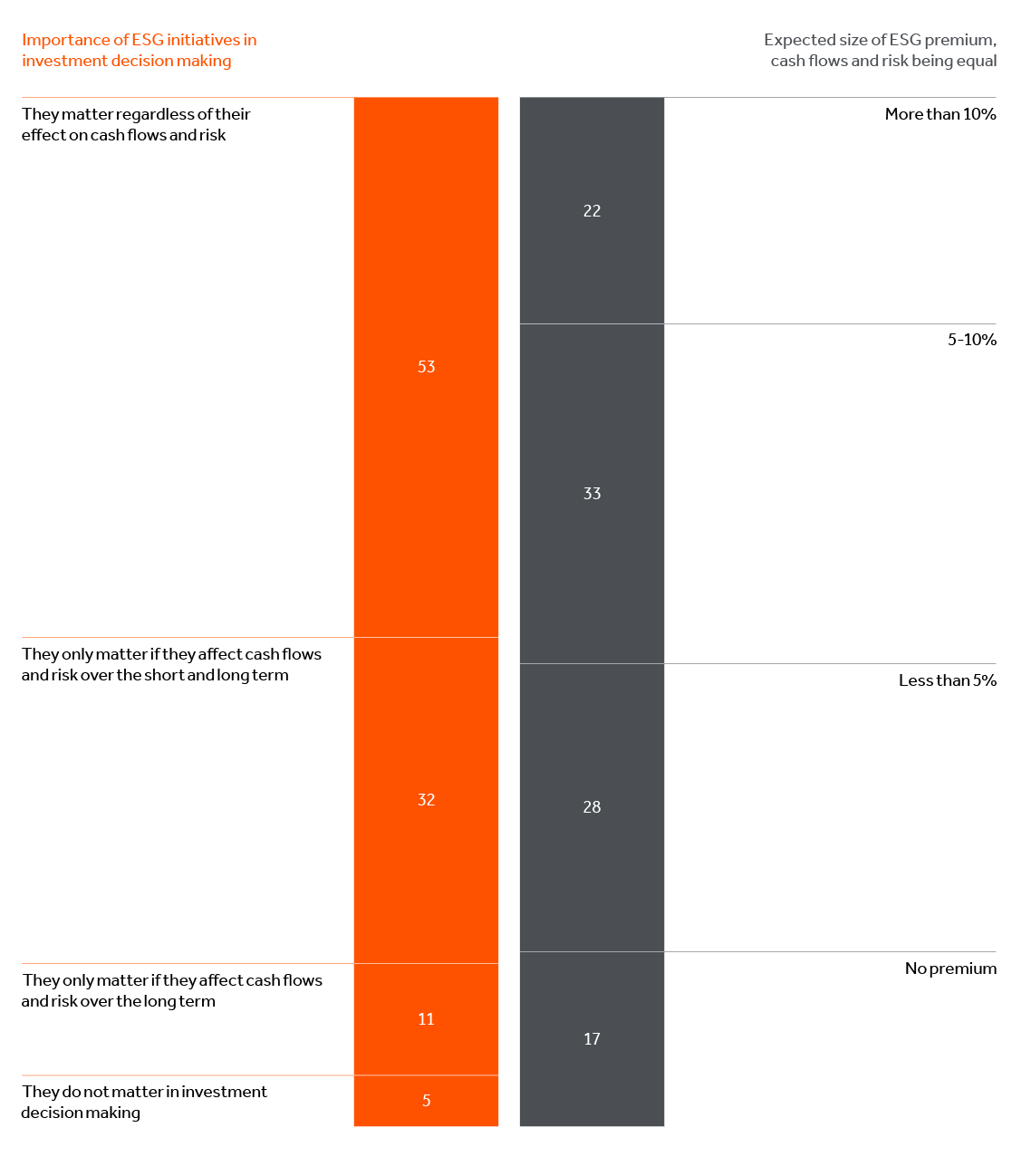

Sustainability is also a value creation tool as it offers the potential to access more revenue streams. Assets which have proven and demonstrable ESG characteristics are in higher demand than those that have not, and can therefore achieve the best price, a point driven home by McKinsey & Company in Exhibit 1. Hyperscalers – large scale e-commerce, search or cloud computing businesses – will for example only use data centres which have the most robust sustainability credentials, in order to meet the demands of their own investors.

EXHIBIT 1: MOST SURVEYED INVESTORS NOT ONLY CONSIDER ENVIRONMENTAL, SOCIAL, AND GOVERNANCE INITIATIVES TO BE IMPORTANT – THEY’RE ALSO WILLING TO PAY A PREMIUM

Note: Figures may not sum to 100% because of rounding.

Source: Exhibit from “Investors want to hear from companies about the value of sustainability”, September 2013, McKinsey & Company, © 2023 McKinsey & Company. All rights reserved. Reprinted by permission.

A third reason to embrace sustainability is that it can offer wider access to finance and a lower cost of capital. Many lenders will now only fund projects which can demonstrate a strong sustainability profile. For our part, last year we were able to secure US$1.2bn in impact-linked financing for our Actis Energy 5 fund because we could show the proceeds would be directed only to projects that would deliver social and environmental improvements, and that these improvements could be objectively measured.

Last year we secured

US$1.2BN

in impact-linked financing for our Actis Energy 5 fund

There are other reasons why sustainability drives increased value. Investing thoughtfully in communities close to our assets is often important to give us a social licence to operate and can help lead to the smoother running of our businesses. Meanwhile by taking an ESG view across our whole portfolio, we can drive synergies: our sustainability and operations teams are constantly working closely with the businesses we invest in to identify efficiencies and other cost saving opportunities. We are only in business to deliver competitive returns to our investors – losing sight of that priority would not be good business practice.

Subscribe to The Street View

Receive the latest news & updates from our experts.

In addition, taking a strong sustainability approach to our investment principles is increasingly important when it comes to talent acquisition and retention. Many potential employees will only work for businesses which match their own values and ambitions. A commitment to investing in purposeful, sustainable and impactful businesses is, therefore, a critical differentiator for us to ensure we hire the best, most passionate, and most committed employees. The various Actis voices you hear in accompanying articles should attest to this point.

SUSTAINABILITY IS ALSO A VALUE CREATION TOOL AS IT OFFERS THE POTENTIAL TO ACCESS MORE REVENUE STREAMS.

Equally important, a higher quality, more sustainable company can command a superior exit price. Sustainability increases the number of potential buyers and leads to greater competition in the sale process, generating outsized returns. We know this from experience. For example, when we sold Sprng Energy – our Indian renewables platform – to Shell, the business’s high ESG standards were a key factor in the success of the deal. Meanwhile during our five-year joint ownership of Lekela – which generates clean energy across Africa – we created a business which became a role model for what a sustainable company should look like on the continent and which we exited with a significant US dollar uplift despite operating in crisis impacted countries such as Egypt and South Africa. Indeed, the business was rated in the top 1% of ESG-rated companies globally by Sustainalytics. The approach we took was critical to achieving a successful exit from the investment.

WE THINK THAT CREATING SUSTAINABILITY LEADERS ADDS SIGNIFICANT FINANCIAL VALUE TO A PORTFOLIO COMPANY, THROUGHOUT THE PERIOD OF OUR OWNERSHIP AND BEYOND. WE DRAW ON 30 YEARS OR MORE EXPERIENCE IN MAKING THESE CLAIMS. WE DON’T JUST TALK, WE WALK.

A commitment to embedding sustainability is likely to prove even more important in the years ahead, thanks to the rapidly evolving regulatory landscape. There has been a huge increase in regulators’ interest in sustainability in recent years. Indeed, there is now an alphabet soup of regulations around the world. In Europe alone we have the European Union’s Sustainable Finance Disclosure Regulation (SFDR), its Corporate Sustainability Due Diligence Directive (CSDDD), and the Corporate Sustainability Reporting Directive (CSRD). More broadly, there is also the Task Force on Climate-related Financial Disclosures (TFCD), with the Taskforce on Nature-related Financial Disclosures (TNFD) to come. Meanwhile the new International Sustainability Standards Board (ISSB) will make sustainability reporting and auditing mandatory as part of a company’s integrated financial accounting. Natural capital will soon become another strand for investor attention and our experience in Kenya detailed in the article “Delivering nature positive Infrastructure” evidences our credentials in this space.

Taken together, this new regulatory environment – not just in the EU but around the world – will force the issue of sustainability deeper into the heart of business decision making. It will move sustainability even further out of the voluntary domain into the regulatory one. Firms that fail to pay the appropriate attention to these changes will create a significant business risk for their investors, employees and other stakeholders.

This new regulatory focus places greater emphasis than ever before on businesses to demonstrate in clear and objective terms the way they are helping the world meet its sustainability challenges. At Actis, we believe that our investment approach – which embeds sustainability at the heart of all the businesses we own – has been meeting this goal for years. Sustainability is important not just to create resilient, sustainable societies: it is also critical to delivering financial value for our investors. Thanks to our decades of experience operating in some of the fastest growing economies in the world, we believe that by creating more sustainable companies, we are able to best deliver the returns our own investors require.

One footnote – Actis’ close partnership with our portfolio companies is the only practical delivery method we know to achieve these aims. Please read the accompanying company voices section to get a more first-hand view of this in action. We need and engage with many expert advisors – as seen in the external voices section of this publication. And listen to the passion and detailed knowledge of our colleagues in the Actis Voices section. Taken together we feel well placed to deliver for our stakeholders.