The climate emergency

Climate change is front and centre for everyone. Global temperatures are at 3 million year highs. We face a significant threat to our current way of life if we do not adapt, quickly and dramatically, to the climate emergency. Rapid decarbonisation and a full scale energy transition are essential to halt the current direction of travel. Finance is front and centre in combatting this threat.

Predictions of the impacts of the climate crisis can seem biblical in their nature – droughts and floods, famine and extreme storms, ecosystem collapse and disruption of oceanic and atmospheric circulation. Some of these physical changes involve thresholds in the climate system beyond which major impacts accelerate or become irreversible and unstoppable.

The complexity of the climate system means that many outcomes are still unknown – direct effects can become nonlinear when thresholds are breached and biophysical systems break down.

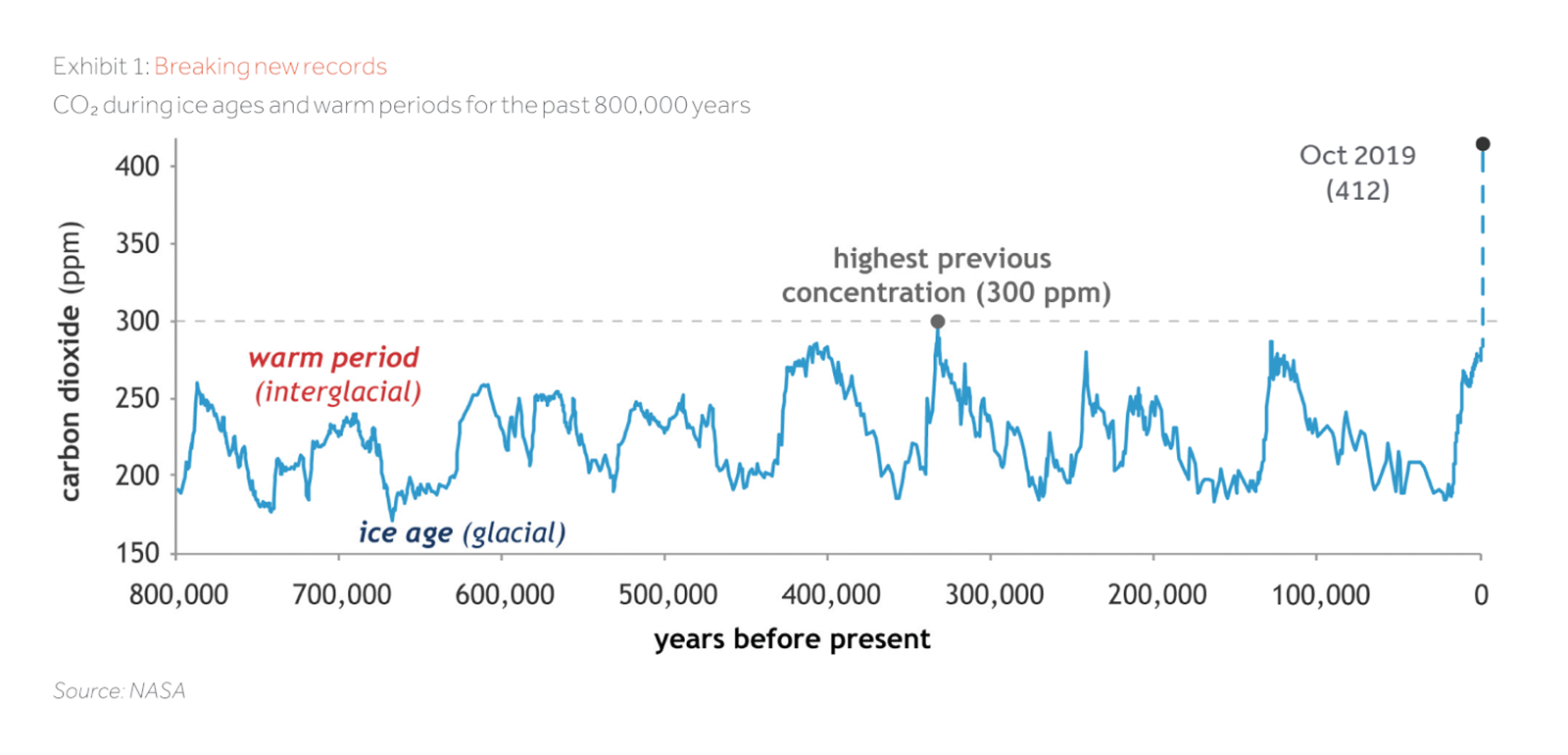

We could face severe food and water insecurity in some regions, the advent of climate refugees and mass migration, displacement and conflict – triggering the erosion of our political and democratic systems, themselves critical to finding solutions. We are entering uncharted territory- see Exhibit 1.

How long do we have?

The 2015 Paris agreement commits to limiting global temperature rise to 2 degrees Celsius (above pre-industrial levels), and to pursue 1.5 degrees Celsius, which would cause significantly less harm. The landmark UN Intergovernmental Panel on Climate Change (IPCC) report released in October 2018, uses the starkest language yet to underline the urgency, claiming that we have 10 years left to limit the climate catastrophe.

This means that how we respond this decade could shape the outlook for climate risk for the rest of the century. To limit warming to 1.5 degrees Celsius, we have to reduce our net carbon emissions to zero by 2050. This means huge changes to how we live, organise our cities, travel, what we eat, how we farm and how we generate electricity. All of these changes will be a crucial part of the investment land scape – in terms of returns, time horizons and payback profile.

There is some good news in that tackling the climate emergency is eminently doable – we know what needs to be done and we have the tools to do it. What we urgently need is for policy makers, business leaders and financial institutions to galvanise and act swiftly and decisively.

The role of the renewables revolution

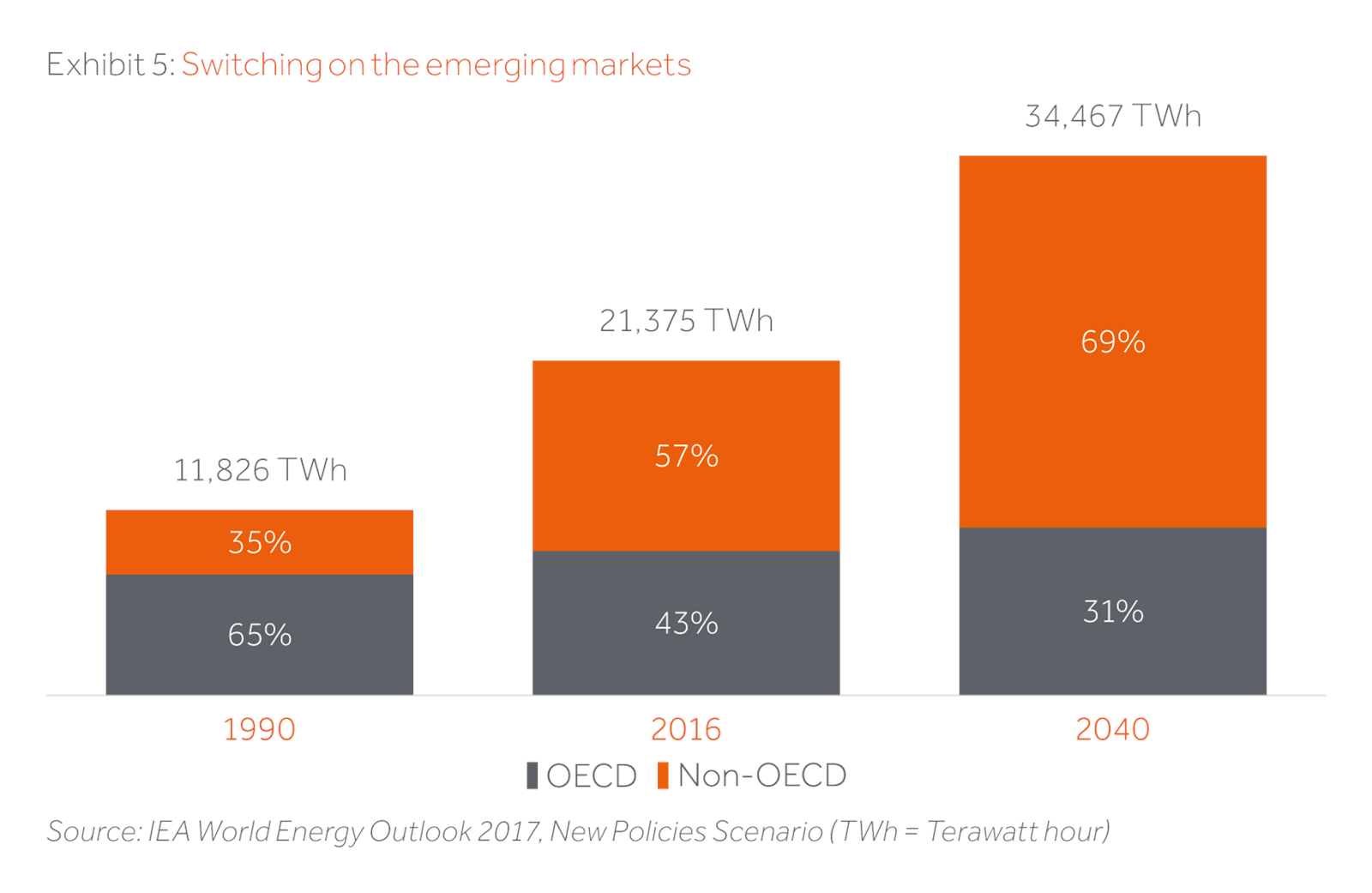

Global demand for energy continues to increase and the ‘renewables revolution’ is mission critical to a full-scale transition to a low carbon future. The last decade has seen cumulative investment into new renewable generation capacity exceed $2.5 trillion, and capacity quadrupled to 1650 GW. In 2016, for the first time annual new installation of renewables exceeded that of fossil fuels. Costs continue to decline for wind and solar – which are now the cheapest technology across more than two-thirds of the world (PV cell prices have fallen 90% in the last 15 years). By 2030 wind and solar should undercut commissioned coal and gas almost everywhere.

Despite such huge strides, wind and solar generation today remains at just 7% of the total and there is a clear need to accelerate the pace of the switch to renewables.

So, how to finance the switch? And what are the opportunities for investors?

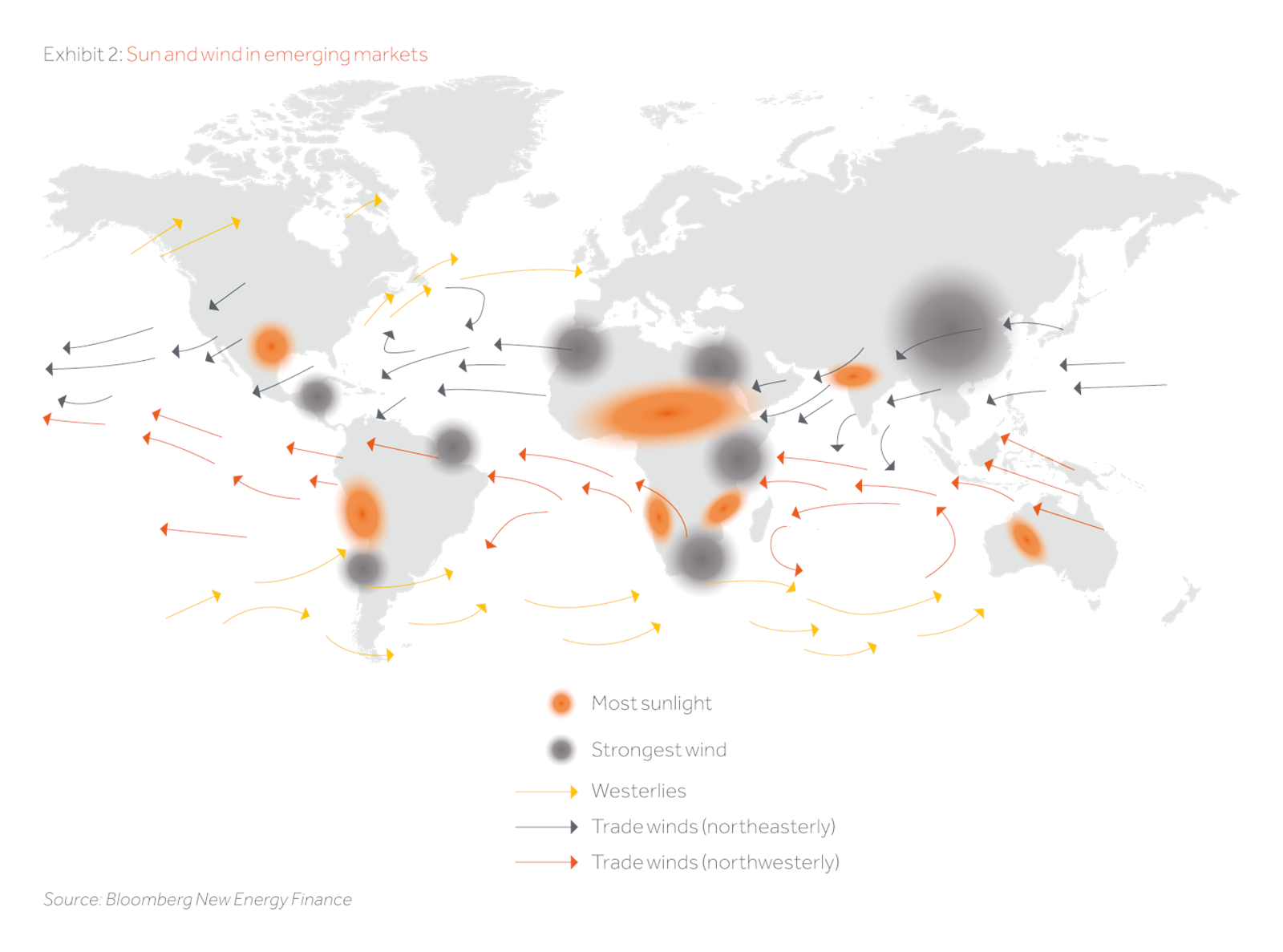

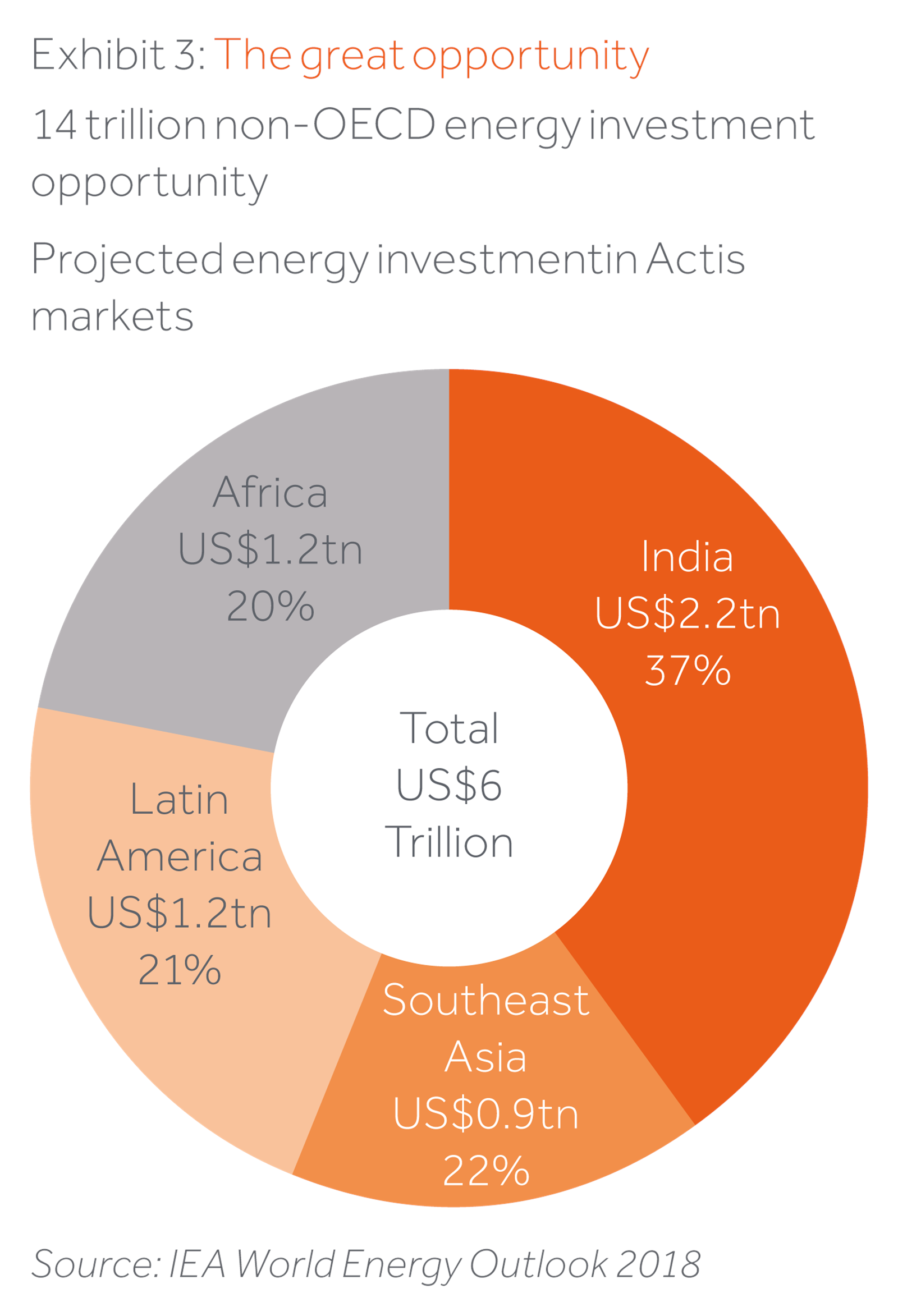

Projected energy investment to meet demand over the next 20 years is $14 trillion in new investment for non-OECD markets, equivalent to $1.7 billion of investment per day. It is in these markets that the sun is hot and winds are swift, creating capacity factors for solar/wind assets which can be three times that of European assets, for example. This represents major investment needs and opportunities as well as being an imperative for climate stability.

Climate stability depends on more than progress on generation and transmission. How you use energy also matters. End user strategies play a crucial role in energy efficiency and climate aware investing.

Actis is financing the transition

Financing the energy transition underpins our investment strategy in energy infrastructure. Actis has always focused on the least-cost, sustainable generation pathway for each of the countries in which it invests, investing in the most affordable technologies relevant for that market.

We are supporting the clean energy transformation of electricity sectors, driving the transition of a country’s power supply from low levels of access with carbon intensive technologies (typically coal, HFO, diesel) to a low carbon energy mix consisting of gas, wind, solar, hydro, distributed generation and potentially storage. Through distribution companies we strengthen grids, reduce electricity losses and connect new customers.

These are all the tools of the energy transition; they are commercially sustainable, and Actis is investing across this value chain in different markets, in different ways. Later in this publication you can read about what we are doing across the world by region.

Over the last 15 years we have committed $5 billion to 17 businesses responsible for the construction and operation of 116 power plants, with over 20 GW of power generation capacity.

Through our renewable energy generation platforms we have contributed to the avoidance of 4.7 million tonnes CO₂ emissions.

We have also invested in electricity distribution businesses through our ownership of over 140,000km of transmission and distribution lines, providing electricity access to millions of new customers. And in many cases these investments have delivered ancillary benefits in areas like water usage and public health.

Ensuring a Just Transition

We are proud to play a part in financing the energy transition, and through increased availability of electricity contributing to economic growth and social progress at a macro level. At a more localised level, our values-drive-value approach ensures we focus on our licence to operate – our businesses deliver tangible, measurable benefits to local communities so that the value we create is shared with our stakeholders.

This includes local job creation, training/upskilling programs to improve employability and boost income-generating activity, providing access to electricity, safeguarding ecological systems and addressing key developmental needs.

In this way, the energy transition in which we invest is an inclusive and equitable one. This is the Just Transition.

Actis delivers solutions

This special edition (printed on recycled paper) focuses on the climate emergency in particular but also sustainability more broadly. At Actis, we are proud of our track record of investing in a sustainable manner across all our asset classes. Our businesses are making important strides in decarbonising their operations and delivering services and infrastructure which contribute to the UN Sustainable Development Goals (SDGs).

In this edition, our Real Estate Team – Funke Okubadejo and Ferdinand Rivany discuss our trailblazing work with green buildings. James Mittell from our Energy team and Emily Morse from our Private Equity team combine forces to look at the fast growing potential of off-grid supply, whilst Preyavart Gadhavi from our Energy team updates us on progress in enhancing storage capacity. Preyavart also joins forces with James Magor to explain the importance of rare metals to the energy transition and monitoring their supply chains to limit human exploitation. We hear from James Mittell and Rowan Parkhouse about Lekela Power, now the largest wind platform in Africa. James Magor also provides us with an update on the Actis Impact Score™ one year in and how this helps us measure tangible positive impacts, as they align to the UN SDGs.

Our final section takes us on a whistle-stop tour across eight of our regions, with our contributing colleagues sharing their ‘street views’ and stories of how our portfolio companies are responding to global sustainability challenges and opportunities.

Investing in impact

Investment in impact assets which transform and enrich society-is still limited in scale. In some cases this reflects difficulties of definition or measurement. Stakeholder pressure is driving asset owners into seeking higher allocations to impact, recognising that simply excluding sectors from portfolios does not address the climate emergency. As an example over 70% of world fossil fuel production is state owned and it is hard to see governments giving up revenues which sustain their countries. In other cases countries are understandably reluctant to put themselves at a disadvantage to others through increased carbon clean-up taxes.

We continue to believe that real progress arises from action and innovation which delivers cost effective solutions with genuine impact. Our investments around the world prove this point – a track record of delivery has a far greater chance of impact than conference based platitudes. This document tells the story of how Actis has been delivering impact for over 15 years in regions and countries where investment is often difficult, whilst delivering effective returns to our investors.

Actis Sustains: Why, how and where Image

Expand image

Gas has a role to play in a Just Transition?

Power generation capacity is projected to grow to 12.5TW by 2040, with 85% / 4.7TW of this growth occurring in emerging markets. A secure supply of energy is required to meet increasing demand and, due to supply intermittency, cannot be footed by renewable energy sources alone. Maintaining a reliable energy grid is a fundamental requirement of an energy system.

Gas will play a critical role in the energy transition acting as a bridging fuel to a low carbon future.

Key benefits include:

– Providing flexible energy supply to counter intermittency of renewables. We are not yet at the point where economies can forgo centralised thermal generation completely

– CO₂ emissions (per unit of energy produced) from gas are around 70% lower than coal and around 30% lower than oil

– Gas is more efficient and more readily available than coal or oil in many key Actis markets (some African nations have significant indigenous reserves). Harnessing indigenous gas reserves and displacing reliance on more expensive, imported fuel sources enables funds to be diverted to other critical services and infrastructure

– Songas, a gas platform in our first energy fund, is an example of this. It is estimated that the platform’s use of indigenous natural gas saved the Tanzanian economy US$5 billion as it reduced use of expensive liquid fuels. It now supplies 21% of Tanzania’s electricity

– Aside from the CO₂ advantages of gas versus other fossil fuel sources (coal, HFO, diesel, burning charcoal) gas is also preferable in terms of impact on local air pollutions and human health e.g. SOx and particulates, waste management issues and environmental pollution from leaks and spills

– Inclusion of gas in a system versus 100% wind and solar, reduces overall power prices. This will change however as batteries and other forms of storage become cheap enough. Affordability itself drives economic wealth which enables economies and civil society to better mitigate for and adapt to climate change

Actis’ approach to gas

– Actis’ overarching strategy across energy and infrastructure is to identify opportunities for operational efficiencies to maximise energy production. This ensures as much energy as possible is generated from the same quantum of fuel type and that losses are minimised

– We see significant financial and environmental benefits in converting open-cycle gas turbine (OCGT) plants to combined-cycle gas turbines (CCGT). By converting the Azito power plant in Abidjan, Actis increased the generating capacity by 140 MW without any increase in gas consumption increasing the value of the asset while significantly reducing the carbon intensity. CCGTs emit fewer gases (sulfur dioxides, carbon dioxide and nitrogen oxides) into the atmosphere than OCGTs and are more efficient as they reuse waste heat to generate more power

– We focus on harnessing indigenous gas reserves to support national economies to meet rising energy demand in a self-sufficient manner, and to reduce reliance on imports