India spent $38bn in FY2018-19 on a host of welfare programs primarily related to food, fuel and fertilizers for agriculture. Spending on welfare benefits has grown at 10-12% annually over the last few years, but has been beset by a number of problems.

Large scale corruption and inefficient administration have undermined the effectiveness of welfare programs, leading to significant leakages and denial of benefits to intended recipients. Technology is helping tackle this head on enabling effective transfers and reduced corruption. The savings can be recycled into lower taxes, increasing investment and consumption. Near 360 million bank accounts have been opened in the last 6 years, a tenfold increase.

DIRECT BENEFIT TRANSFERS:

In order to reform the delivery of state welfare benefits, India launched Direct Benefit Transfers (DBT) in 2013 to pay cash benefits such as wages, subsidies and incentives directly into bank accounts of beneficiaries through electronic systems.

The main advantages of DBT include plugging of leakages as the government directly transfers funds to the recipient and better targeting of benefits by eliminating fraudulent and fictional beneficiaries. This is in sharp contrast to the prior process of providing welfare goods at subsidized prices in public shops, which was clunky and inefficient, and had no reliable means for identifying eligible beneficiaries.

DBT was initially rolled out as a pilot project over two phases with the objective of covering 536 programs across 65 ministries of the Government. The implementation is being phased in and covers 439 schemes currently.

Technology has played a pivotal role in the complex task of delivering DBT. The three key pillars underpinning the technology architecture for DBT include bank accounts for universal financial inclusion, Aadhar numbers as a means for identification and authentication of beneficiaries, and mobile banking which offers an alternative mechanism of payment and withdrawal.

Financial inclusion

The first step in enabling DBT was to provide access to a bank account to the intended beneficiaries of welfare schemes. India had a very low penetration of bank accounts in 2013, especially in rural areas.

To tackle this issue, the government launched a financial inclusion program in August 2014 to expand and provide affordable access to financial services such as bank accounts, remittances, credit, insurance and pensions.

Under this program, a no frills bank account was opened for citizens based on bio metric identification and all DBT transfers were to be made directly to these bank accounts.

As part of the financial inclusion program, 15 million bank accounts were opened on the first day of its launch and 30.2 million accounts were opened within a month. To date, 361 million bank accounts have been opened, including 214 million account holders from rural and semi-urban branches.

Aadhaar (Biometric identification)

India’s national biometric database which has enrolled more than a billion citizens is estimated to be ten times larger than any other biometric database in the world and termed by the World Bank as the “world’s most sophisticated digital identity scheme”.

The biometric identification project called Aadhaar – meaning “foundation” in Hindi was launched ten years ago with the express objective of plugging leakages in India’s social welfare payments.

At the time of its launch in 2009, only sixty million out of 1.3 billion Indians had a passport and hundreds of millions either had no official identification at all or a weak form of it, issued by local authorities. Consequently, they were unable to open bank accounts or receive state services.

A decision was made to create a national biometric database, which would enroll all Indian citizens and collect their names, addresses, phone numbers, fingerprints, photographs, and iris scans. Each one of the citizens would be assigned a random twelve-digit number that is unique to him or her.

Unique Identification is a mandate for cash transfers as it enables the effective delivery of benefits directly. Government is able to transfer the benefit directly to the bank account to which the Aadhaar number is attached, which removes the space of intermediaries and plugs leakages in delivery.

Mobile Banking

Mobile penetration in India is c.85% with 1.1bn mobile phone subscribers. Given this high level, mobile banking offers the potential for significantly improving the usage of banking services in India by enabling DBT beneficiaries to transfer money and make payments without having to visit a bank branch.

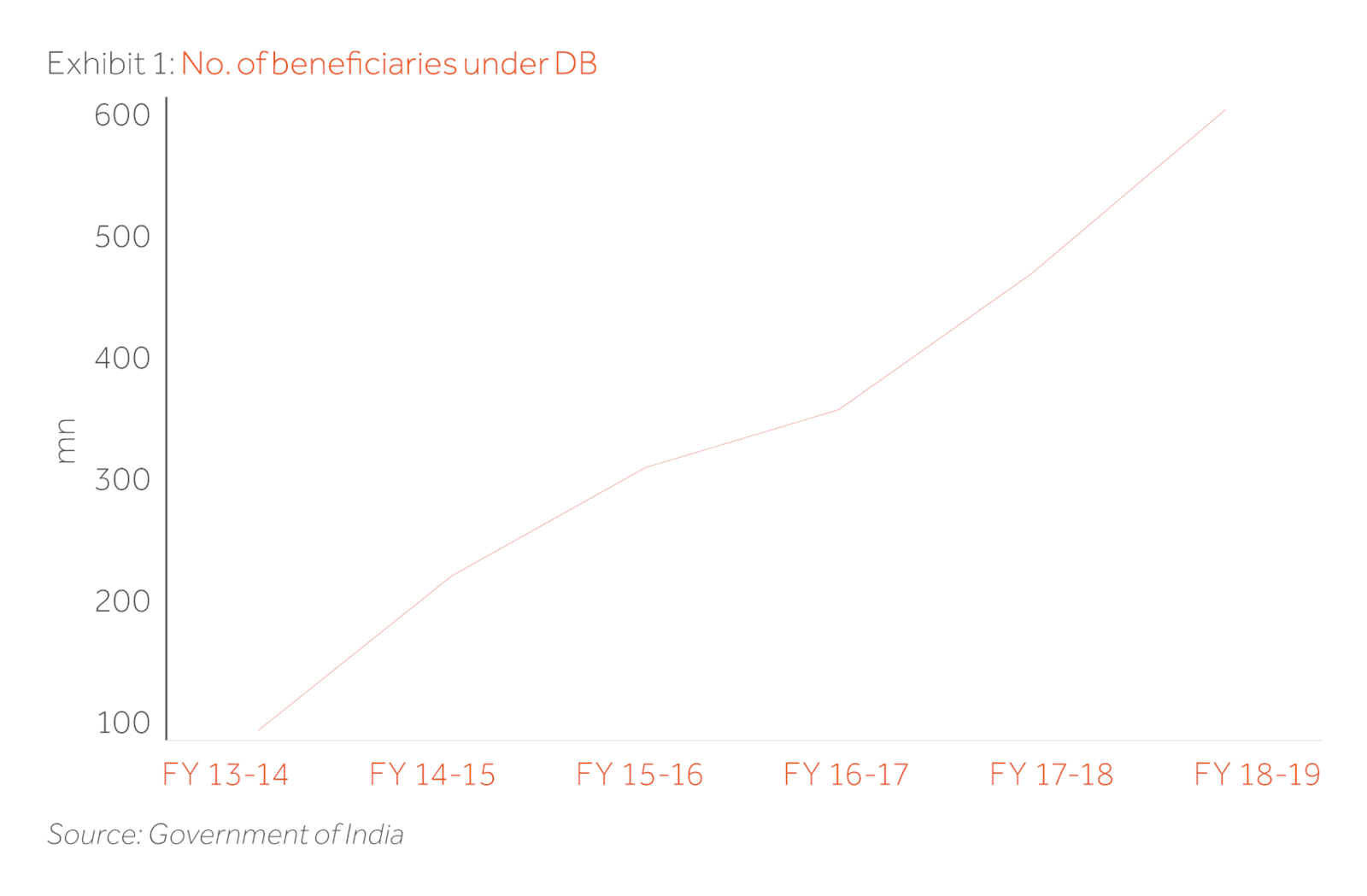

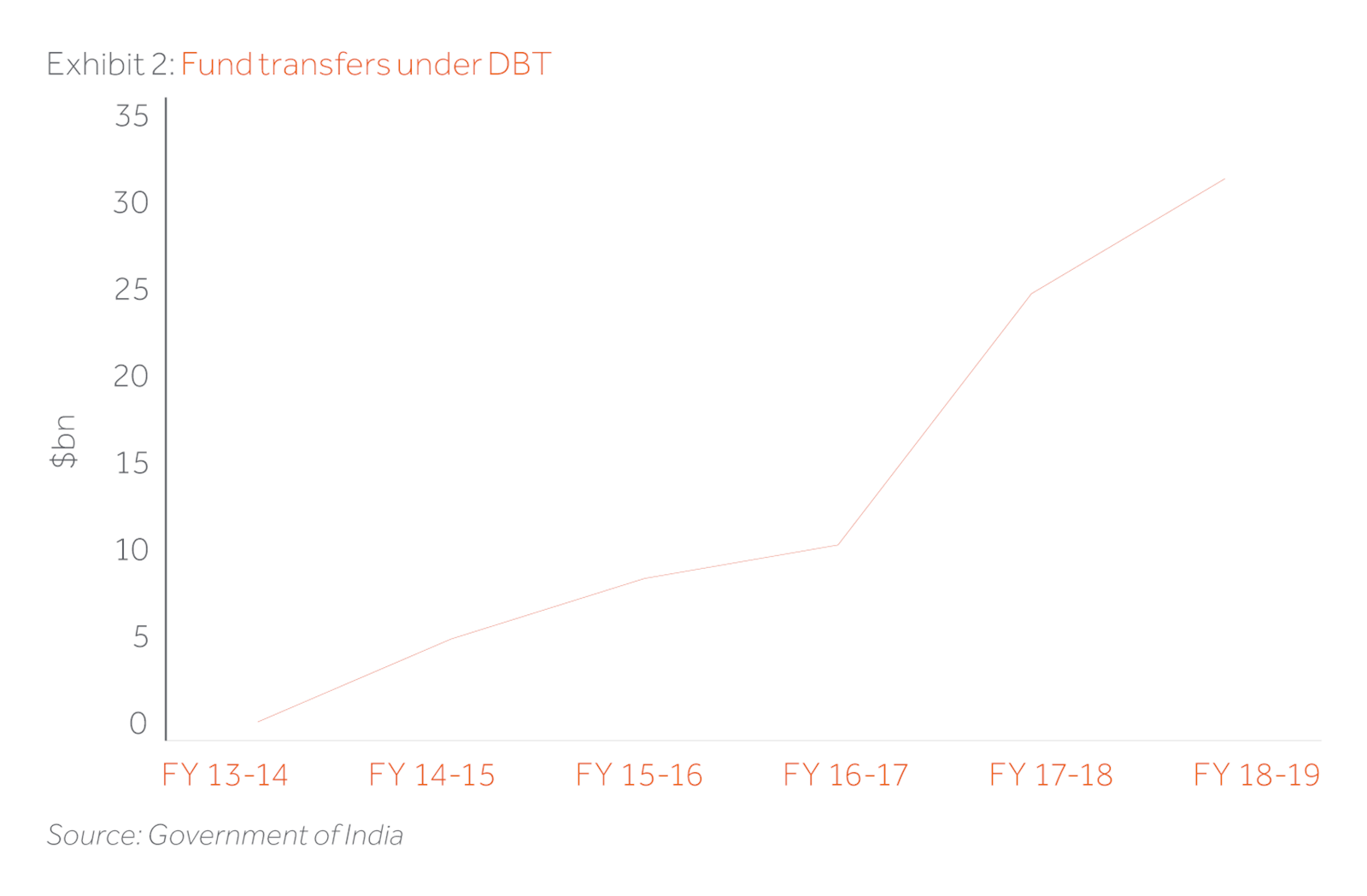

An impressive success

As per government data, since its implementation in 2013, DBT has been expanded to cover 439 welfare schemes. Transfers of $30bn were made directly to the bank accounts of 590 million individuals during the year. The direct transfer of benefits to genuine beneficiaries generated savings of $7.4bn in FY2018-19 alone.

On an aggregate basis, since 2014, the government has transferred $92bn in subsidies directly to the bank accounts of the poor through DBT and generated savings of $20bn through plugging leakages by eliminating intermediaries and middlemen.

More to be done

Even though the DBT scheme has been a significant success for the country by enabling more targeted delivery of state welfare programs and eliminating wastages, the scheme has its critics primarily on account of denial of benefits to eligible citizens because of their inability to procure an Aadhaar card. In some cases, citizens who are elderly or disabled are unable to walk to the distribution sites to verify their identities and remain outside the coverage of the scheme.

On the other hand, DBT has received criticism for being too slow in its implementation and not being extended to cover all welfare programs in India, the largest of which, food subsidy, still remains outside of its coverage.

Notwithstanding these criticisms, it is quite evident that DBT has materially altered the landscape of benefits delivery in India and holds the promise of much more.

From starting as a pilot project in 2013, to generating material financial savings for the government, DBT’s journey has been quite impressive. A more robust financial and payments system is driving financial inclusion and a deepening economy and a lower country risk premium.