An industrial revolution means much more than a technological leapfrog. Breakthrough innovations have to be commoditized for the significant improvement in productivity across industries needed for economic growth. As a global technology leader Korea is well placed for the Fourth, ICT driven revolution, which will accelerate data consumption growth. Demand for specialist commercial property including data centers to store data will keep on growing on the back of this revolution.

History of industrial revolutions

The first revolution which spanned much of the 18th and 19th centuries began with agricultural and transport revolutions. Mechanization swiftly followed along with mass urbanization. Britain led the way benefitting from an educated workforce, a well-functioning financial system and a captive imperial market. The second wave based on electricity and oil established the mass production method we still use today driven by the so-called Fordism. This consists of the Taylor system, conveyor belt assembly lines, and standardization of manufacturing parts. In this case, the United States blessed with ample natural resources, an entrepreneurial infrastructure and a massive domestic market was the leader. The new production method has saved many from a morass of material deprivation, yet it has also resulted in limited choices within product ranges. Revolution 3.0, the digital revolution, opened up new high-tech sectors through electronics and IT applied to the Fordism model, bringing rapid economic growth opportunities for emerging markets driven by enterprises searching for lower production costs.

Why is the fourth wave different?

The fourth wave integrates Information and Communication Technologies (“ICT”) into every industry for a quantum jump in productivity. Dwindling population growth and increased needs in a leveraged financial system for high return capital lite structures are powerful drivers of change. Global manufacturers have already become ICT based manufacturing companies as witnessed at a recent Consumer Electronics Show in Las Vegas.

What is really interesting about the application of advanced ICT is its potential for shifting the manufacturing paradigm from mass production with a limited variety to small-batch and mixed production with a vast variety of product. Yet improved productivity also comes with challenges. Growing inequality and unmatched growth between productivity and wages are challenges which need to be addressed through a social consensus on redistribution of the excess wealth.

The fourth wave poses a new challenge to emerging markets as it will eventually replace cost efficient labor forces with advanced automated production technologies as witnessed by Adidas bringing its production back to Germany known as SPEEDFACTORY and Japanese reshoring initiatives in electronics and autos.

Winning the Race

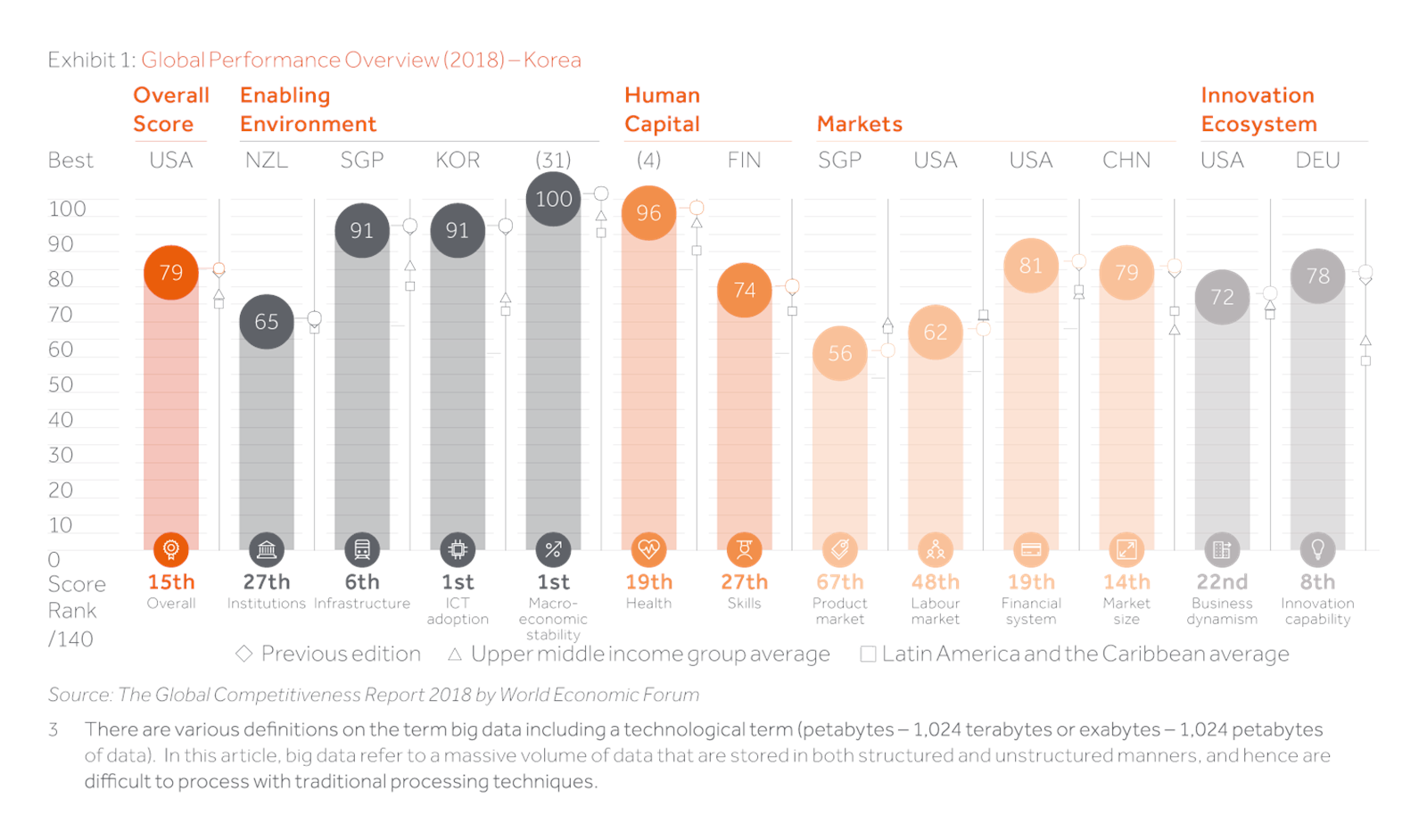

The major drivers for a country to lead this race are a solid manufacturing base, advanced ICT infrastructure, concentration of a highly educated population with strong spending power, government’s active support as a facilitator, and capital to foster industry growth. New entries into manufacturing by ICT players are much more challenging than the other way around due to manufacturers’ hands-on production expertise accumulated for generations and capex heavy infrastructures. Improvements in productivity by integrating ICT absolutely depends on analysis of big data including networks for collection, analysis, transmission and storage. Dense populations with strong spending power accelerate the data accumulation critical for operation of smart cities. Highly educated and creative human capital is the core driver for continuing innovation supported by governments promoting social cohesion.

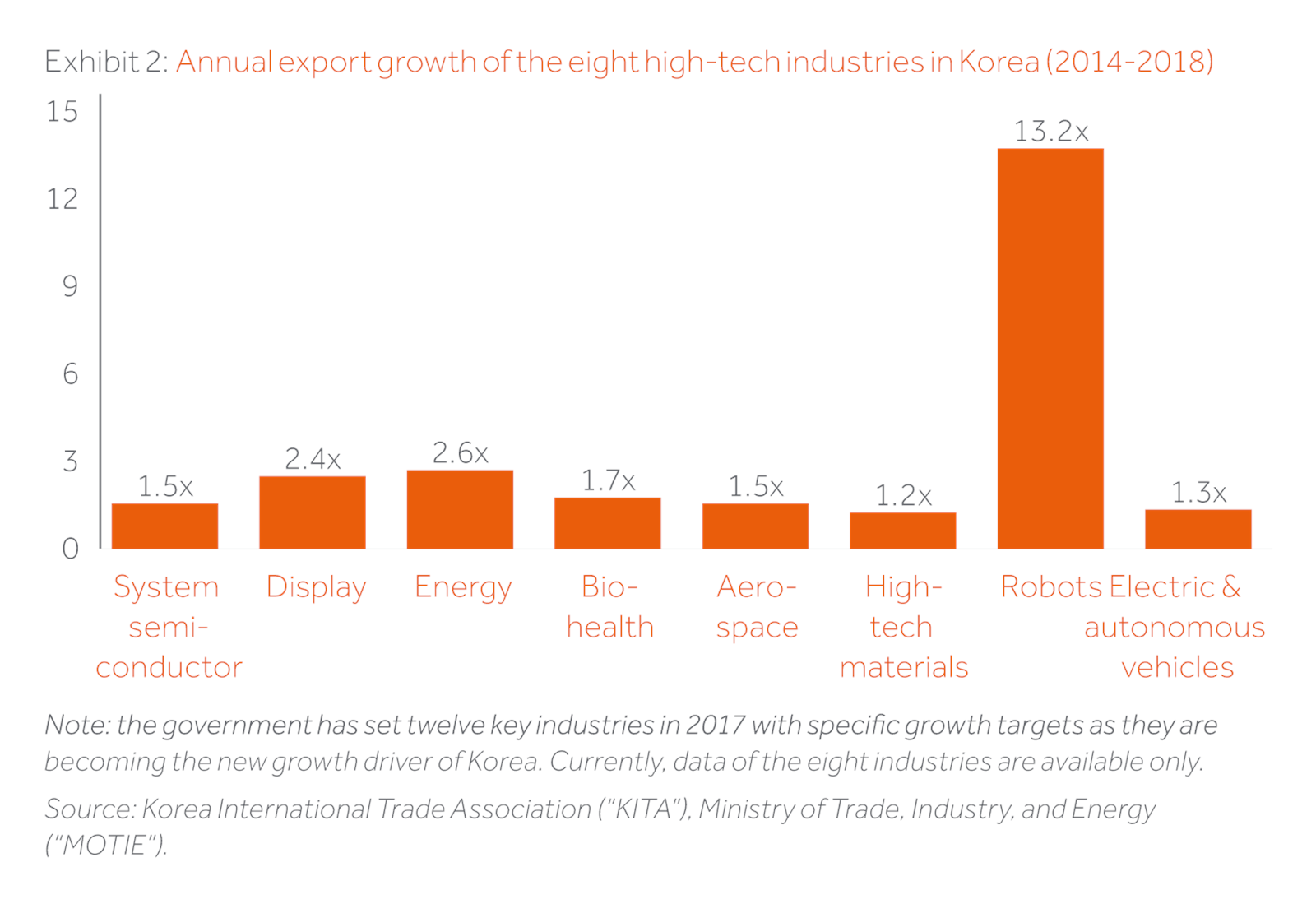

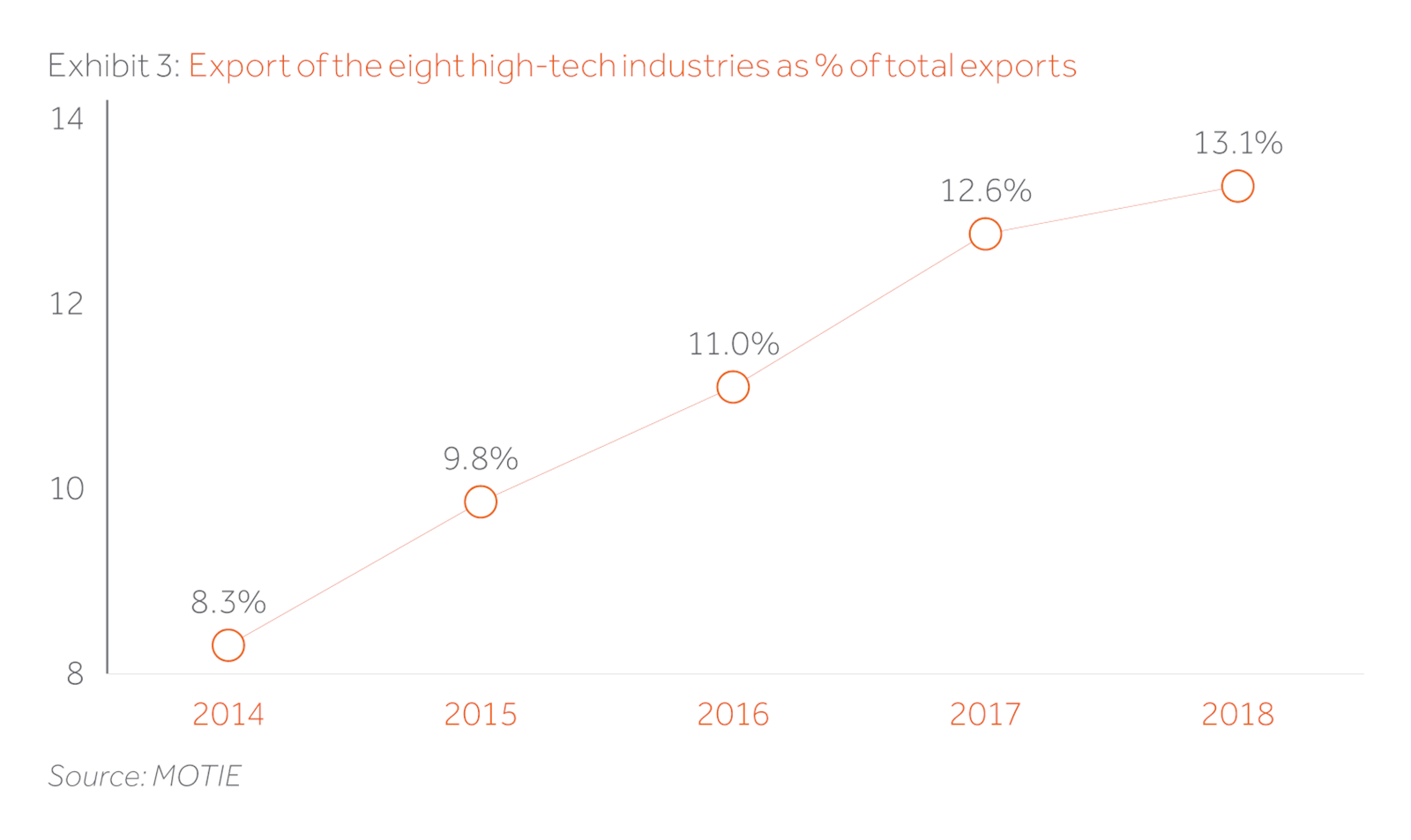

Korea has all these drivers. Competition in its leading industries has been fierce, yet Korea continues to maintain its pre-eminence through constant technological innovations. It has in fact taken a step further to expand into new tech intensive territories including microprocessors, image censors, foundries, mobile network equipment, rechargeable batteries for all kinds of electronics including electronic vehicles, biotechnology, advanced driver assistance system, construction of smart factories, robotics, and high-tech materials. The strong presence in these seemingly new territories have not been achieved overnight as corporates put years if not decades of investments in R&D and market development by leveraging technical expertise and capital accumulated in the leading industries. Outstanding growth across these high tech industries over the past several years definitely provided blueprints for a new growth driver in Korea.

Actis Opportunities in the Changing Industrial Landscape

As long term real estate investors we see attractive opportunities arising from this changing industrial landscape. Again, the fourth wave is essentially integration of ICT into every industry and to make a quantum jump in productivity, creation and deployment of big data for analysis is imperative. More gadgets and devices (“Internet of Things”) around us in our daily lives are getting connected to the web collecting data all the time. The analytical capability is a whole new frontier but from a physical infrastructure perspective two things are critical to make this happen: (1) next generation networks to allow data to transfer much more efficiently than the current technology and (2) sophisticated data centers in strategic areas to store vast amount of data that will keep on piling up.

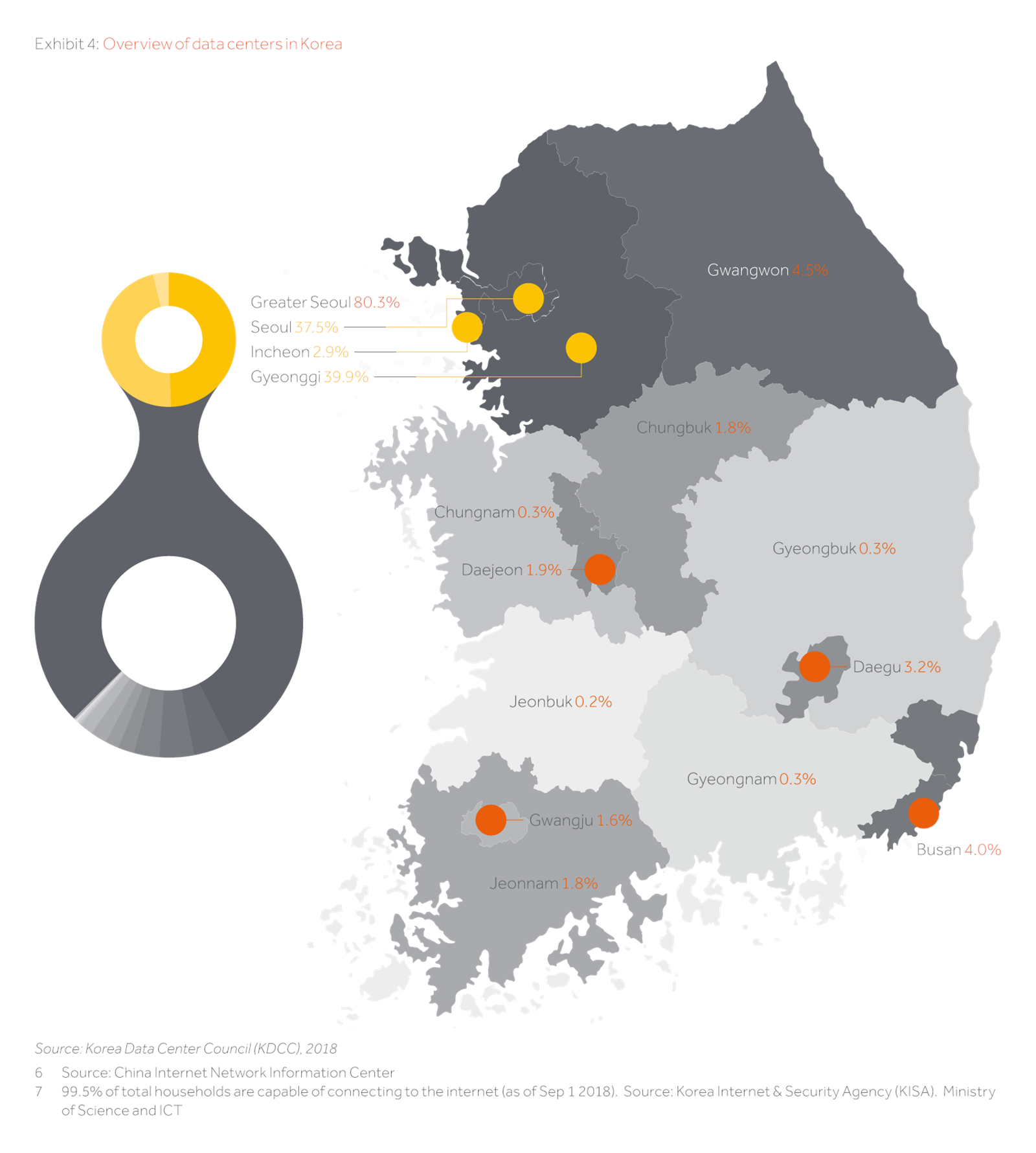

In our two markets in Northeast Asia – Korea and China data center development opportunities are still in relatively early stage compared to mature markets with de-regulated telecom markets, carrier neutral data centers and leading global operators such as Equinix and Digital Realty. Leading Asian markets such as Hong Kong and Singapore have been following the same path, yet much larger economies such as China and Korea have heavily regulated telecom markets and data center markets dominated by few entrenched players. In the early days, telecommunications was a government driven industry (still the case in China) with a national infrastructure dominated by a handful of large players. For instance, two of the top three players in Korea (SK Telecom, LGU+, KT Corporation) still depend on KT’s wired communication networks as KT was a government enterprise that established the networks across the country. Due to this high entry barrier, data centers have been mostly developed by carriers and a few domestic operators for their internal use and colocation businesses. In China, the dominant players are the three large state-owned telecoms, namely China Telecom, China Unicom and China Mobile, which operate across the full spectrum of data center services including development of the asset, leasing white space to operators, operating co-location and managed hosting, and development of value-added cloud services. Most Korean data centers are for corporates’ self-use and public services and the remaining commercial data centers are either directly operated by carriers or a few professional operators that are subsidiaries of Korean conglomerates. These few professional operators have recently been paying attention to the carrier neutrality, driven by large cloud service providers demanding more for high quality services. These facilities were also mostly built in the early days of data center development with inferior specs and hence are unfit for sophisticated demand of both cloud and colocation service providers. As of 2018, there are 30 commercial data centers across Korea of which only 5 can provide IT load greater than 20 MW, which is generally considered a minimum IT load for hosting cloud service providers.

Our institutional development model, which we refer to as “build to core” will continue to capitalize on opportunities in these larger Asian markets with a significant demand and supply mismatch of this relatively new asset class with a greater emphasis on partnership with quality operators. In China for instance, we have partnered with an experienced IDC developer/operator to develop the first hyper-scale carrier neutral IDC campus just outside of Beijing. In Korea, securing land title is critical in order to secure anchor tenants before construction begins as they require a greater level of certainty around delivery date. Hence, we partner with a major data center operator from the initial land acquisition stage including analysis of adequacy of data center development (e.g., power usage assessment, fiber optic cable connectivity, availability of substations nearby), building designs and specs and assessing a probability of securing permits and approvals. Once we complete the first stage, we are then able to secure quality colocation and cloud service providers as anchor tenants, which will allow us to quickly stabilize the development asset.

Securing land in prime locations will continue to be our challenge, yet with the advent of the 5th Generation (5G) wireless system, future outlook on demand for data centers is bright. China already has the largest internet/mobile network population on the planet, but the penetration rate is still less than 60% indicating an enormous potential for data growth. Korea as a global ICT leader has advanced network infrastructures with nearly 100% internet/mobile network and smartphone penetration rates. At the same time, it is facing an opportunity for a quantum jump in the once mature network infrastructure that will vastly improve everyday life by connecting everything around us.The 5G network infrastructure still needs to be further developed for maximum performance, yet once it does data usage will accelerate further with consequential need for specialist facilities.