The past few years have demonstrated that climate change is already upon us, as temperatures continue to break records, wildfires increase in intensity, coral bleaching events become more frequent and more regions endure flooding than ever before. It is a worldwide problem, but one that affects Asia disproportionately.

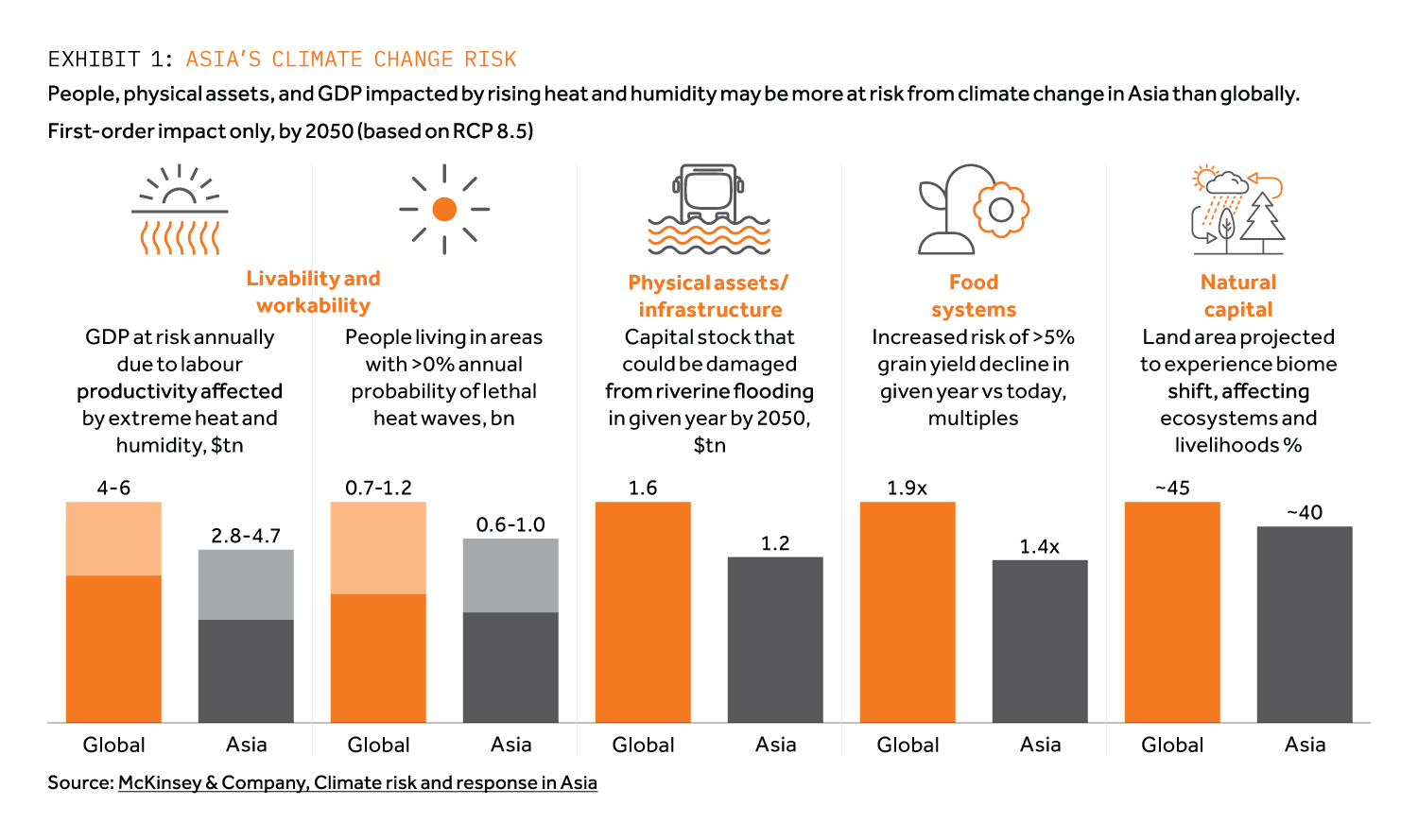

A report by McKinsey Global Institute found that between 600 million and 1 billion of Asia’s population could be exposed to annual lethal heatwaves by 2050 – that’s out of a global total of 700 million to 1.2 billion people affected. The report also states that 75% of the world’s capital stock that could be damaged by rivers flooding is in Asia and that between US$2.8 trillion and US$4.7 trillion of the region’s GDP is at risk annually as a result of lower labour productivity as extreme heat and humidity prevent work outside.

transitioning asian economies to net zero is vital if the world is to achieve global climate targets.

The figures are stark, particularly when Asia is home to 55% of the world’s population and accounted for approximately 40% of global GDP growth in 2022.

The scale of the issue means that Asia will need significant investment to mitigate and adapt to climate change. We believe that climate transition will represent the largest reallocation of capital in history, with estimates from McKinsey & Company of US$275 trillion of capital spending needed globally between 2021 and 2050 in the Net Zero scenario- of which an estimated US$90 trillion will need to flow to APAC countries. This represents an annual rise to about $3.1 trillion from approximately $2.1 trillion in 2020.

This investment is clearly in everyone’s interest, particularly given that transitioning Asian economies to Net Zero is vital if the world is to achieve global climate targets. Deployment of this capital will need to be broad-based, directed at a range of areas that decarbonise, create climate resilience and ensure a just transition that protects and improves the lives of vulnerable communities.

climate transition will represent the largest reallocation of capital in history, with estimates of us$275 trillion of capital spend needed globally between 2021 and 2050 under the net zero 2050 scenario.

The opportunity is here today

We are already starting to see private markets develop investment themes around climate transition in Asia, with some focusing on early-stage climate-related technologies, while others are following a strategy of buying coal-fired plants with a view to accelerating their closure.

At Actis, we see significant opportunity in a variety of areas related to climate transition in Asia, particularly with a focus on real assets. We have built 17 renewable energy platforms across our markets and have c. 31GW of energy generation capacity in our portfolio, equivalent to 28 million tonnes of CO2 avoided. This experience, combined with a history of investing in Asia for over 70 years, makes us extremely well placed to identify and create climate transition solutions.

There is a lot to play for, starting with sustainable energy investments given that APAC countries are expected to build 1.6 TW of new renewable capacity in the next ten years. In addition to large-scale renewable power platform investments, we see potential in investing directly in renewable energy projects or developing businesses with strong growth profiles within this space. Energy storage that helps mitigate renewable intermittency is also a vital component of decarbonisation, while emerging fuel infrastructure, such as that required for hydrogen or ammonia can be part of the investment universe.

Energy efficiency solutions are a second key area for Asia’s climate transition.

Increasingly decentralised and intermittent power sources, along with increased electrification of transport and buildings, will put pressure on grids. This means about US$13.3 trillion in investment is required worldwide for upgrading, reinforcing and installing power networks between 2022 and 2050, of which Asia will account for roughly 40%, according to Bloomberg NEF’s New Energy Outlook 2022. Smart meters, micro-grids and heating and cooling infrastructure will present additional opportunities. There are increasing moves to create district or centralised heating and cooling systems that are significantly more energy efficient than individual units.

The third main area we believe is attractive is sustainable transportation, as countries increasingly phase out internal combustion engine vehicles. Today, zero emission vehicles represent 6% of new passenger vehicle sales globally; by 2040, this is expected to rise to 75%. This will drive the need for new charging infrastructure, with more than 15 million charger connections expected in APAC in 2040. We see opportunities in fleet decarbonisation and charging, where there is strong potential for building economies of scale and generating secure revenues. Yet there is also need for investment to speed up emerging clean transport in areas such as aviation and shipping; new and alternative fuels will require production and supply infrastructure.

Investors want to put capital behind climate strategies

These real asset climate investments will benefit from infrastructure risk-return profiles, with long-term, contracted cash flows, inflation protection and attractive risk-adjusted returns. They are all areas that could have a significant impact on carbon emissions and contribute to addressing climate change.

We continue to see undimmed demand for investing into the themes of transition to Net Zero. As more investors set their own Net Zero targets and seek investments that contribute to decarbonisation, they are increasingly concerned that the funds they back meet not only their decarbonisation objectives, but also address broader social and environmental issues. The rise of regulation to combat greenwashing is helping to drive up standards across the investment community, with the European Union’s Sustainable Finance Disclosure Regulation (SFDR) having a meaningful impact. We are seeing some investors view SFDR Article 9 funds as the ‘gold standard’.

This is especially important for funds targeting regions such as Asia. The fact that Asia is likely to be so impacted by climate change means that any investments need to take a holistic approach to sustainability by ensuring that environmental issues are addressed at the same time as building economic and social resilience among local populations.

At Actis, our core philosophy that ‘Values Drive Value’ informs our approach to all our investments. This is why we have developed proprietary tools to measure and drive responsible investment practices across all aspects of ESG in our investments and in our firm. We believe this is essential to maintaining our licence to operate, but it is also fundamental to the way we generate returns. Our investment in pan-African renewable platform Lekela demonstrates this. Rated as the number 1 global utility company by Sustainalytics ESG Risk Rating assessments, Lekela’s track record for sustainability made it a more valuable business during the sales process. Our work with Indian renewable business Sprng tells a similar story. With industry-leading ESG standards embedded in the company, the quality of the Sprng platform attracted significant buyer interest, including from non-traditional renewables buyers such as oil companies.

these real asset climate investments will benefit from infrastructure risk- return profiles, with long-term, contracted cash flows, inflation protection and attractive risk- adjusted returns.

We believe that Asia has the capacity to address and respond to climate change. With fast growing and dynamic economies, supportive policy frameworks, a strong pipeline of new projects and technologies – and with the right investors – Asia has the potential to emerge from the climate emergency stronger than ever before.