Asia is at the forefront of the climate change challenge. The region represents the majority of global population and economic growth to 2050, and is highly vulnerable to climatic impacts. At the same time it remains largely reliant on high carbon intensity industries and power generation technologies. According to McKinsey & Company (April 2022), approximately US$90 trillion is required to finance the energy transition to Net Zero in Asia to 2050, not to mention the human capital required. This represents an annual rise to about $3.1 trillion from approximately $2.1 trillion in 2020. While the energy transition value proposition is clear, especially in a region thirsting for energy security at a time when net fossil fuel imports are set to rise 200% by 2050 (IEA, October, 2022), challenges remain. For many countries however, rolling out renewables at the pace required to meet demand and reduce carbon emissions quickly, while maintaining grid stability, during a time of tightening liquidity, presents a challenge which looks insurmountable. New solutions are required to reduce the costs and barriers to decarbonisation.

Path to decarbonisation

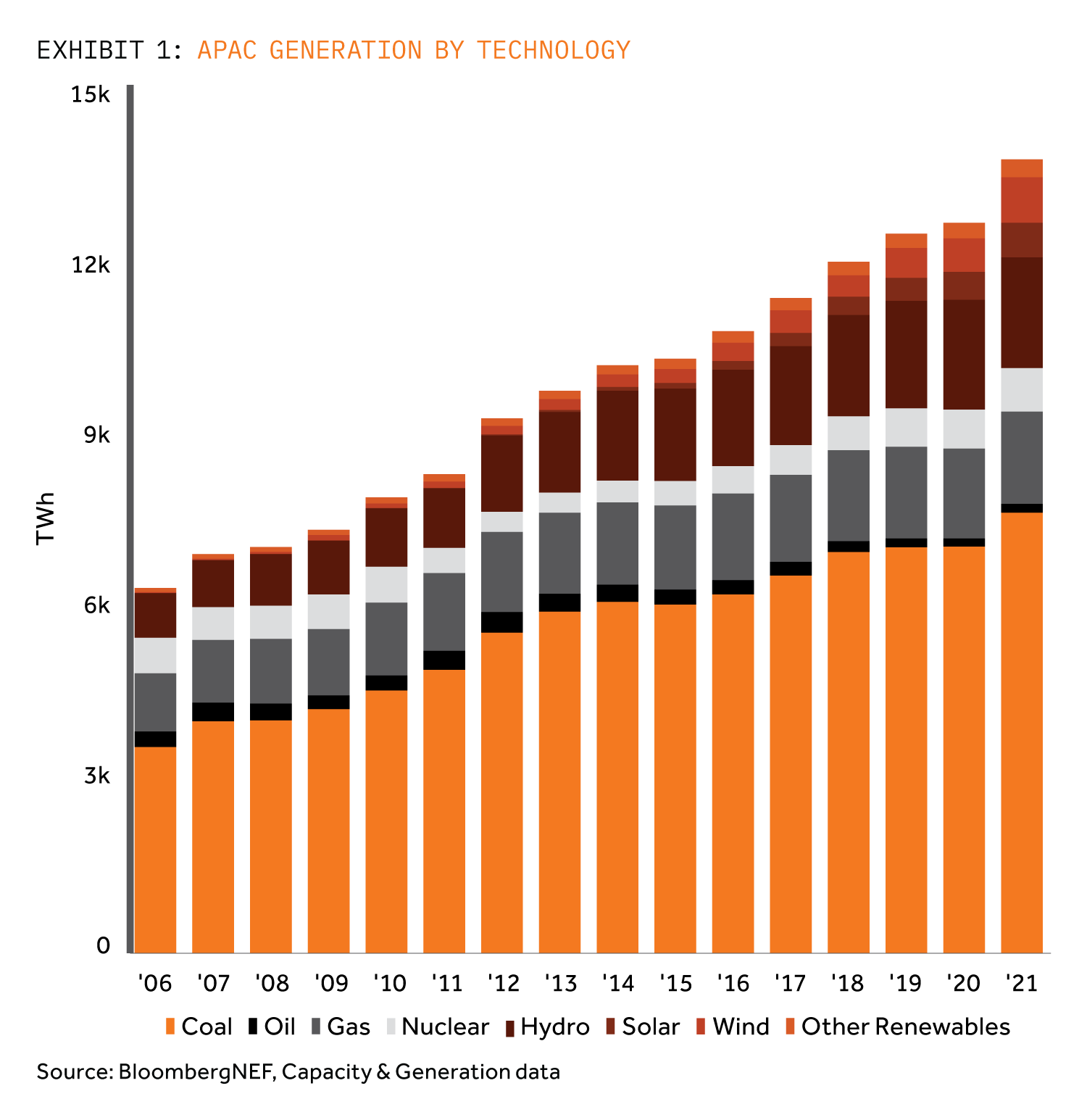

Reducing the underlying coal component of the generation profile (Exhibit 1), while meeting the rapid growth in energy demand, is the key issue to resolve in Asia. Coal and gas pricing volatility make the commercial case for accelerated growth in new build renewables the obvious “low hanging fruit”. However, keeping up with the growth rate and poor transmission infrastructure between load centres and windy / sunny areas has resulted in continued build out of the thermal fleet.

China and Vietnam have seen challenges delivering accelerated renewables programmes. For instance, transmission line build-out has lagged renewables development, resulting in the controlled reduction in output of renewables in order to balance energy supply and demand. While these challenges can largely be mitigated through better planning, regulation, and the use of private-public partnerships to harness more capital and human resources, it is unlikely to be sufficient.

Gas has half the carbon intensity of coal, has a more flexible dispatch, and has a lower capital recovery component to the cost. The recent inclusion of gas in the european union’s green taxonomy supports this position of gas having a pivotal role as a sustainable fuel source in the energy transition.”

Pricing of carbon and clear regulatory approaches could certainly spark accelerated deployment of technologies to tackle these challenges.

While some of these solutions are not currently commercially viable, regulation to internalise the cost of carbon would rapidly change the paradigm. As with the renewables sector, these technologies would also subsequently benefit from economies of scale and learning curves. However, over the medium term, Actis doesn’t see a world where regulatory change will be sufficient to cover the cost of carbon-free firm power (i.e. H2, ammonia and/or nuclear), which would require carbon pricing in excess of $100/tCO2). As a result, to prevent new coal being added to the fuel mix, Actis believes that gas is the only credible stop-gap. Gas has half the carbon intensity of coal, has a more flexible dispatch, and has a lower capital recovery component to the cost. While gas pricing on the spot market was volatile across the 2022 on the back of Europe’s pivot away from Russian gas, it has largely recovered towards longer term norms, and is unlikely to prevent longer term investment. The recent inclusion of gas in the European Union’s green taxonomy supports this position of gas having a pivotal role as a sustainable fuel source in the energy transition.

How do we ensure investments into non-renewable power generation are well aligned with a Net Zero pathway? We have developed an in-house Transition Tool with consultants SYSTEMIQ, that is run as part of our due diligence process.

Actis and the Energy Transition

How do we ensure investments into non-renewable power generation are well aligned with a Net Zero pathway? We have developed an in-house Transition Tool with consultants SYSTEMIQ, that is run as part of our due diligence process. It assesses climate transition risk by analysing the role of an individual asset in the local market in relation to national climate transition and decarbonisation plans. It identifies assets as “green” (Paris/Net Zero aligned), “misaligned” (where Actis will not invest) or somewhere in between which we call “Smart Olive”.

Applying the Transition tool to the seed asset of our Bridgin Power platform in Bangladesh enabled an informed view prior to investment, and fed into the transition alignment strategy implemented during our ownership.

For many countries, rolling out renewables at the pace required to meet demand and reduce carbon emissions, while maintaining grid stability, and at a time of tightening liquidity is unaffordable. New solutions are required to reduce the costs and barriers to decarbonisation.”

Actis also continues to leverage its deep industrial insight to ensure that capital allocation is efficiently targeted to defensive positions with intrinsic upside associated with operational improvements and/or regulatory changes. Actis’ track record in delivering operational improvements with the likes of AI based predictive maintenance (EchoEnergia) and drone based equipment surveys (Atlas, Pelicano, Sprng & EchoEnergia) while also positioned to capture regulatory upside, with the likes of Sprng successfully marketing carbon credits, demonstrating the value that can be gained from such forward looking strategies. The true value however is likely to present itself moving forward, in the form of risk mitigation to an ever more volatile macro-economic and regulatory environment.