Russia’s invasion of Ukraine has brought energy security back into world focus to a degree last seen during OPEC embargoes in the 1970s. Soaring prices of natural gas and electricity have elevated inflation risk as was the case nearly 50 years back. Securing energy supply on a stable price basis is once again a global geopolitical issue. The previous narrative of energy transition has been supplanted by a singular drive to secure any supply for now whilst planning for a more robust future.

In the accompanying pieces from colleagues and trusted advisors we have tried to give a sense of how Actis as a major investor in power generation and distribution is tackling energy security. We recognise that an unpleasant version of chaos events in Europe have impacted the entire world. For some observers it seems that energy transition has been dealt a crushing blow by the fallout from the Ukrainian tragedy as governments scurry to restart coal generation and turn their backs on just transitions.

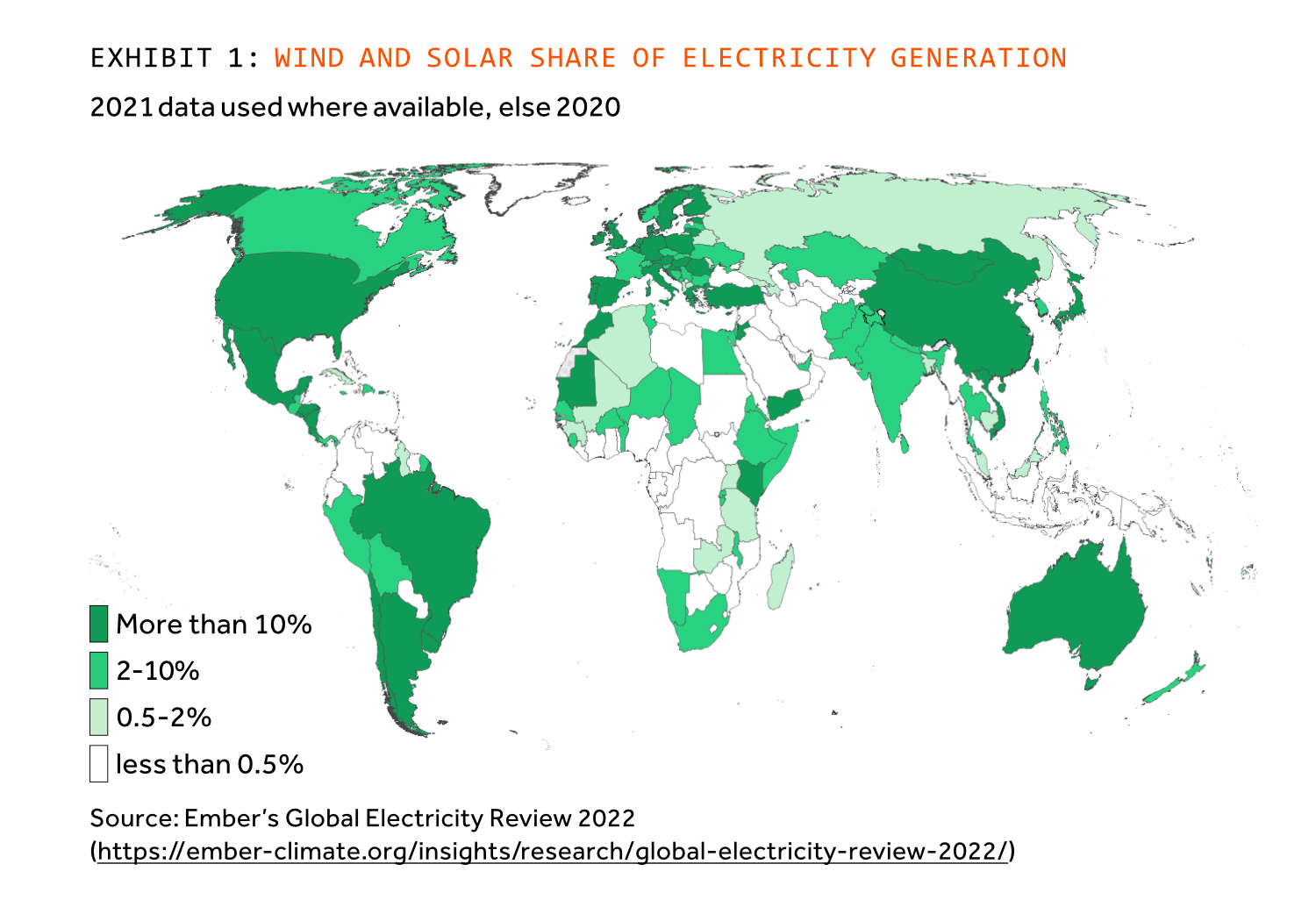

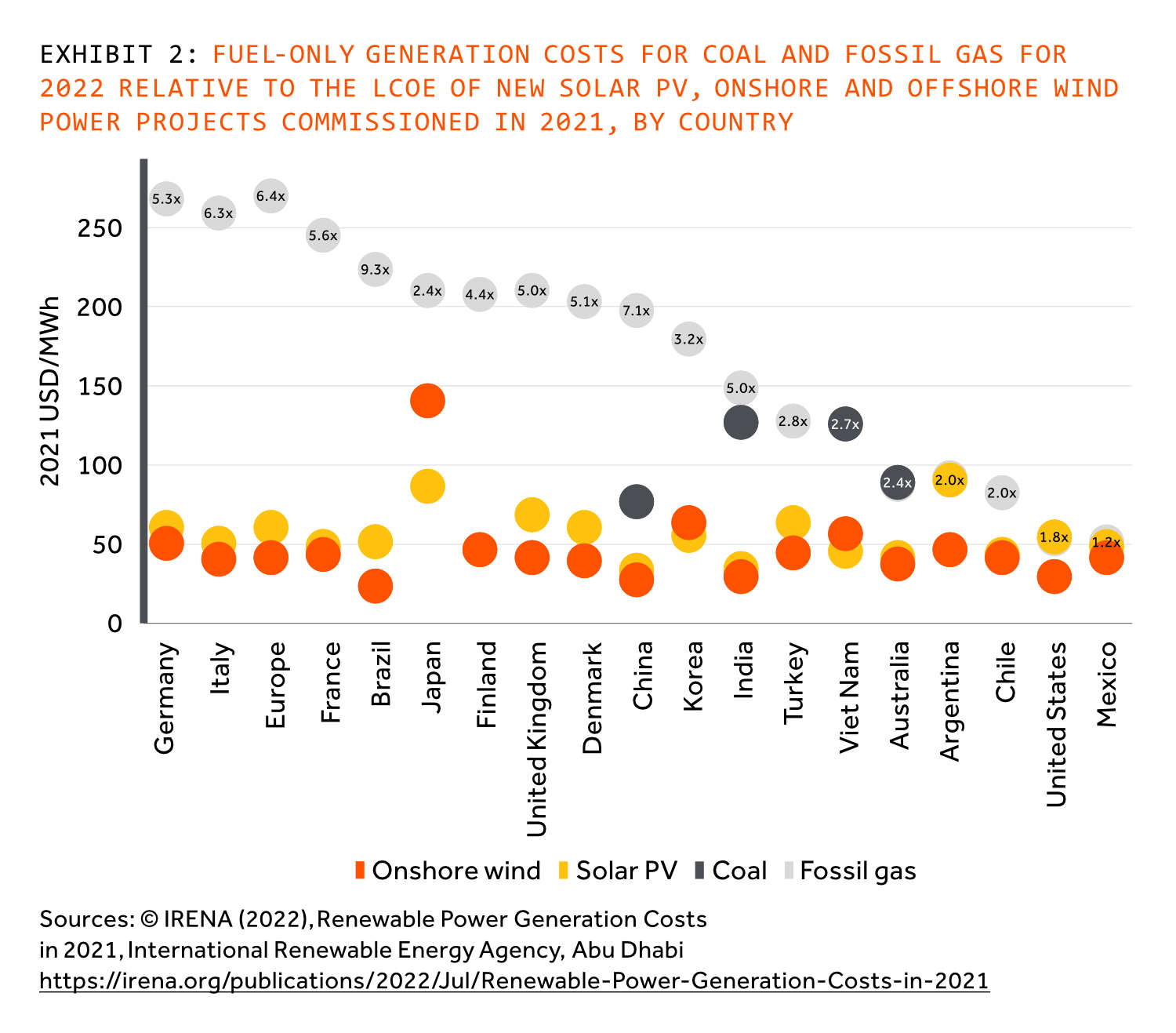

We see this as nonsense. A simple moment to consider the relative costs of renewables relative to fossil fuel at today’s elevated prices dismisses the claims that transition is in trouble. Prior to the beginnings of constrained Russian gas supplies to Europe in the autumn of 2021 most analysts reckoned that 80% of global solar and wind capacity was a cheaper source of supply than fossil fuel. Today that figure must be higher. The economic incentive to pursue energy diversification has risen not fallen (Exhibit 1 & Exhibit 2).

“The economic incentive to pursue energy diversification has risen not fallen.”

Not that it is all plain sailing

Governments battling inflation will be more reluctant to reduce the implicit post tax subsidy of sub optimal carbon clean up costs because it will inflate prices further. This subsidy, estimated by the IMF to be more than 3% of global GDP is one of the greatest barriers to full scale energy transition.

Supply chains for the critical components of renewables infrastructure are wide open to politically led disruption. Over 80% of global PV cell production is controlled by China who hold a cost advantage of anything between 10 and 35% over other global producers (in part because their own power costs are lower). Similar dynamics are beginning to emerge in wind turbines, rare earths and other critical materials.

We continue to believe that despite sharp price rises gas has a role to play as a transition fuel, particularly for countries with available domestic supply. We also believe that effective purchasing policies which seek to diversify supply play a role-as the article from Alberto Estefan and Maria Cox demonstrates how this has previously worked in parts of South America.

Staying with the theme of how we can invest to offset existing supply chain disruption Lucyna Stanczak-Wuczynska, an Actis senior advisor draws on her long experience of financing infrastructure in Central and Eastern Europe to outline the policy responses to Russian supply disruption. And Archer Kilpatrick from our Energy team writes about the exciting new investments we are making in the region.

Elsewhere in the world Julian Kim in Seoul investigates how South Korea – a major energy importer – is successfully combatting energy security through investment in diversification of supply.

Actis has a long-term commitment to responsible investing. So a must-read article comes from Marina Johnson of our Sustainability team. Marina outlines our Transition Tool and walks us through a first-hand example of how we have employed it to underpin a major new investment in Bangladesh.

Perspective and expert input form a key part of our decision making. So we are thrilled that Ben Backwell, Chief Executive of the Global Wind Energy Council, has written about the actions his organisation are taking to accelerate renewable energy generation. He touches on supply chains, government support, grid access, procurement policies and investment focus. His wise words are well worth a read.

Last and not least (he is my boss) our own Mikael Karlsson as Actis CIO reviews the whole topic of investing in energy transition and how this dovetails with energy security. Mikael draws on decades of experience in financing and constructing generation and distribution businesses in making the clear case that transition provides great investment opportunity.

The coming Northern Hemisphere winter will be a period of great stress in terms of energy supply. Blackouts may well return -I’m old enough to remember sitting public exams in the UK by candlelight, my weak excuse for average grades. It remains critical that policy makers, investors, industrialists, bankers and others resist short termism and plan for a better and more secure future. At Actis we are wholly focused on this ambition.