Firstly, why hydrogen?

Society has realised that addressing climate change must be a priority. Rapid decarbonisation and a full-scale transition to a low-carbon future are essential to halt the current direction of travel. As a result, many countries, including China, South Korea, Chile, and the UK have committed to net-zero targets by 2040-2060.

Most of these net-zero plans have energy generation from renewable power as the key driver of decarbonisation. Renewables are low-cost, mature technologies with almost no emissions. Yet, for some sectors this is not enough. For example, transport and power generation need fossil fuels to provide flexibility and allow deeper renewable penetration. Industries including steel, cement, and paper manufacturing need gas as a source of high heat. Chemical processes, such as ammonia and methanol production use natural gas as their main raw material. In most of these cases, electrification is impossible or uneconomic. These are the sectors known as Hard-to-Abate.

Hydrogen offers a solution for the decarbonisation of “hard-to-abate-sectors”

Hydrogen offers a solution for the decarbonisation of these sectors as an alternative to fossil fuels. Examples of hydrogen’s potential include:

- It could become the fuel of seasonal power generation and long-haul trucking, where batteries may not serve well due to capacity and cost constraints;

- Synthetic fuels derived from hydrogen could power aviation and shipping vessels;

- Both heavy industries and district heating could take advantage of hydrogen’s high combustion temperature; and

- Chemical manufacturing and steal production could utilise hydrogen’s reactivity to replace natural gas in their processes.

Hydrogen also offers important benefits. Firstly, it can be produced using renewable power and emits no CO2 when burnt. It could provide energy security to countries that currently rely on foreign oil and boost local economies by creating high-skilled jobs in sectors that will be critical to the future economy. In short, hydrogen could look like the panacea that will solve all the world’s energy problems.

Unfortunately, hydrogen shows a similarly impressive list of disadvantages. Firstly, it is in essence an energy carrier rather than a source, meaning it needs to be derived from water or hydrogen carriers like natural gas, through energy intensive processes. These processes, despite being able to use clean energy like solar or wind, are expensive. For this reason, when comparing the cost of hydrogen to that of fossil fuels, hydrogen is currently at a disadvantage, as fossil fuels demand little to no energy during their extraction.

Hydrogen is also hard to liquefy and transport long distances. Massive energy losses from the liquefaction process make most of its applications unviable. Hydrogen’s small molecular size and high reactivity can also cause issues in its transportation infrastructure, as hydrogen can diffuse into materials’ molecular structures – for example into iron or steel – causing them to weaken and fail.

An understanding of hydrogen’s advantages and disadvantages helps us explore important considerations around its potential use. Whilst hydrogen’s disadvantages can make the forecast of an extensive hydrogen economy challenging, its advantages could motivate governments and institutions to explore and develop solutions, even if these currently seem remote.

Hydrogen production

When discussing hydrogen, we need to distinguish between four main colours as these inform us of their associated production methods:

- “Grey” or “Brown” hydrogen is produced using natural gas or coal respectively;

- “Blue” hydrogen is produced by cleaning grey or brown hydrogen using carbon capture and storage (“CCS”); and

- “Green” hydrogen is generated by electrolysing water using renewable electricity.

To produce grey and brown hydrogen, fossil fuels are broken down through thermochemical reactions to generate syngas, which is a mixture of CO, CO2, steam, and hydrogen. This gas is then processed, recovering the hydrogen, but leaving behind a considerable amount of greenhouse gases. As a reference, currently, more than 99% of the world’s hydrogen is grey or brown.

In plants with CCS capabilities, the process output is further cleaned to avoid most of the release of CO2, producing blue hydrogen. Several reports show blue hydrogen as a stepping stone for mass production, even though CCS has had a troubled history so far. CCS projects have faced permitting and financing delays of up to several years in some instances. Delays and massive cost overruns have in many cases resulted in investors abandoning projects.

“Hydrogen and oxygen are the only products of electrolysing water and the process leaves no other contaminants. If we were only considering the environmental impact, green hydrogen would be the obvious solution.”

In contrast to the previous three, green hydrogen production does not generate CO2. Hydrogen and oxygen are the only products of electrolysing water and the process leaves no other contaminants. If we were only considering the environmental impact, green hydrogen would be the obvious solution. Considering most country’s low emission targets and the challenges seen in the past with CCS, we expect governments to rely on green hydrogen as their production method of choice in the future.

The cost of green hydrogen

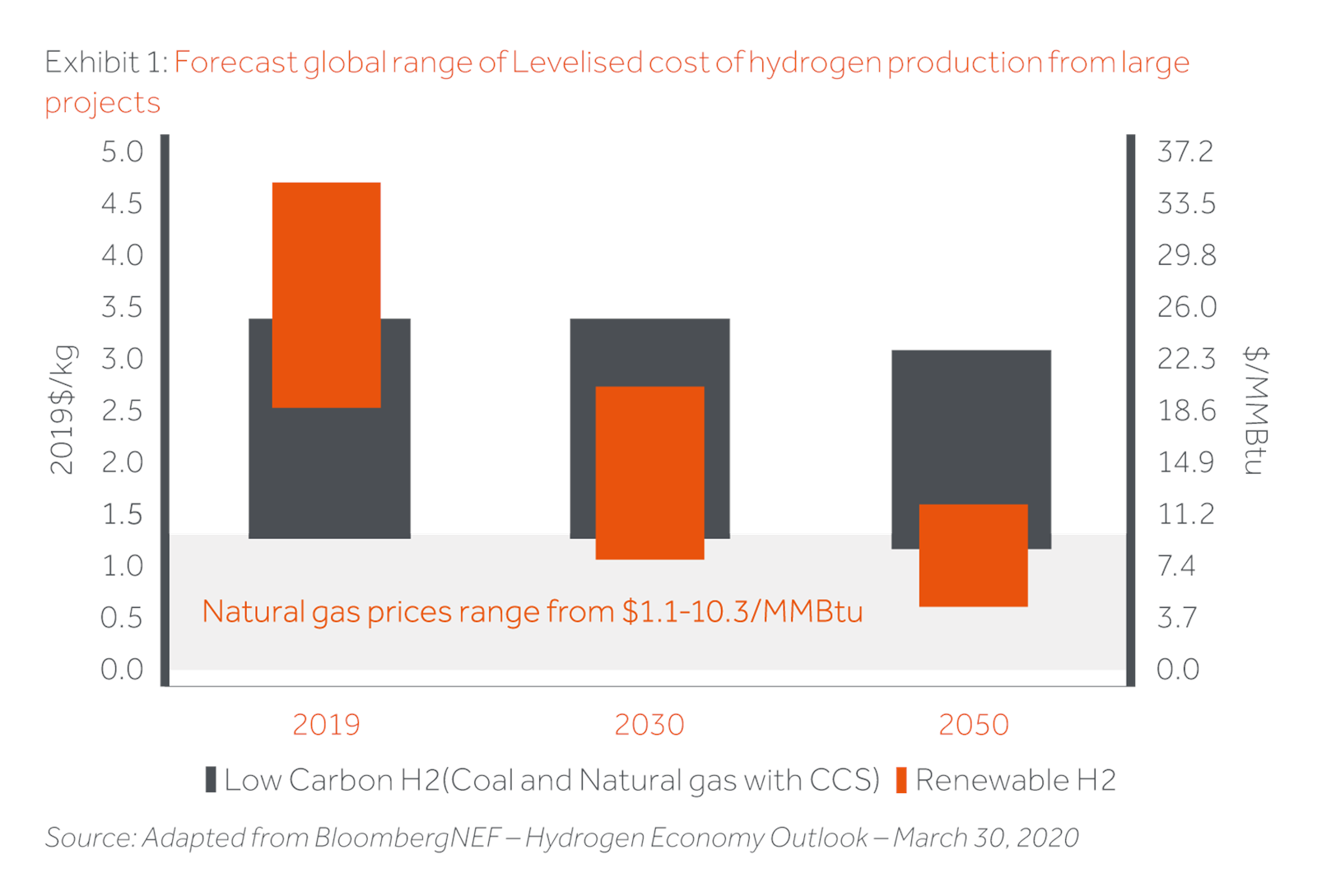

The production cost of green hydrogen depends on two factors: the cost of renewable power and the cost of the electrolysis equipment. Currently, green hydrogen ranges from US$2.50 to US$4.50 per kg – or US$18.60 to US$33.48/MMBTU (Exhibit 1) depending on the technology and location of the plant. With these prices, it is clear that green hydrogen cannot currently compete against almost any fossil fuel alternative (Henry Hub Gas at US$3/MMBTU or liquefied natural gas (“LNG”) at US$6/MMBTU). This mimics the cost disadvantage of solar and wind production 15-20 years ago.

“the cost of renewable power and electrolysis equipment should decrease at significant rates in the future…green hydrogen could achieve prices as low as US$1.00 per kg”

Luckily, most studies agree that the cost of renewable power and electrolysis equipment should decrease at significant rates in the future. BloombergNEF estimates that learning curves for electrolysing equipment will be close to those of renewable power generation – with learning rates between 13% and 18%. Evidence also shows that the cost of renewable electricity should continue to fall, with large parts of the world expected to produce solar or wind power at US$20/MWh by 2050 if not sooner. Under this scenario, green hydrogen can achieve prices as low as US$1.00 per kg, or US$7.44/MMBTU. At this cost and if the infrastructure is in place, hydrogen could replace natural gas in a significant part of the value chain by 2030.

Unfortunately cost alone does not capture the whole story. Two other aspects influence the hydrogen industry’s future. Firstly, enough infrastructure must be in place for hydrogen to scale up. Secondly, even at US$1.00 per kg, government support is essential for hydrogen to compete against cheap fossil fuels. Both aspects will be covered in the following sections.

Infrastructure

Clearly cheap and reliable ways to connect producers and users are needed for hydrogen to grow. For medium and short distances, given that hydrogen flows through pipes almost three times faster than natural gas, pipelines are a cost-effective solution.

In contrast, for long distances, it is necessary to liquefy the gas to move it at scale. Freighters and truckers can achieve this in one of two ways. They can either chill it to very low temperatures (only 20 degrees C above absolute zero) or turn it into a liquid organic carrier (ammonia, toluene, or methanol for example). In both cases, losses in the order of 25% to 30%, make these options unviable for most applications. Hydrogen will be, in most cases, too expensive to transport over long distances. As a result, for the next decades we expect to see large-scale hubs in places where production and demand coexist.

Similarly, given the intrinsic variability of renewable energy, having enough storage capacity along the supply chain will be essential to accommodate the needs of users and producers. Hydrogen needs far more storage capacity than fossil fuel alternatives due to its low density, requiring 3 to 4 times more storage volume than natural gas. Users and producers will need access to low-cost, large-scale options like salt caverns to allow large scale adoption. Unfortunately, these options are limited by each site’s geological characteristics. For example, users in places like the USA or Germany could take advantage of cheap salt caverns. In other places like Japan or South Korea, users will need to access other expensive options like rock caverns or depleted gas fields.

If we expect hydrogen to replace natural gas, solutions for transport and storage of large volumes of hydrogen over extended periods of time will be essential. Considering the hurdles this entails, we expect the lack of infrastructure to be a significant barrier to adoption. At the moment, there is no clear sight to when these hurdles will be overcome but government support on investments that otherwise would not be profitable will be key to bridge this gap.

Government policies

Although hydrogen is a hot topic, there are currently few government policies to support demand growth. Whilst some countries including Australia, Germany, Japan, and South Korea have national hydrogen strategies, most of them are early stage.

“If we expect hydrogen to replace natural gas, solutions for transport and storage of large volumes of hydrogen over extended periods of time will be essential. Considering the hurdles this entails, we expect the lack of infrastructure to be a significant barrier to adoption.”

BloombergNEF estimates that for hydrogen to scale up, US$150 billion of subsidies are needed by 2030 to support the demand. Without this level of support, hydrogen will not be able to scale at a pace that would allow governments to meet their low-carbon commitments. Furthermore, COVID-19 has increased uncertainty, weakened governments’ balance sheets, and made the prospect of large hydrogen support challenging in the short term.

It’s a different picture on the supply side. Both governments and private players are making plans to build green hydrogen production facilities. The EU alone is planning to invest US$550 billion by 2050 into green and blue hydrogen. The obvious caveat here is that without support for demand, a lack of reliable off-takers could hamper these plans.

What is required for a hydrogen revolution?

Even if hydrogen achieves cost parity with fossil fuels, decarbonisation must be central in governments’ agendas to support its growth. Countries will need to have net-zero targets adopted by law and have committed to defined dates. This should drive stringent carbon emissions policies and carbon prices, in turn generating a pull in demand.

Regulatory bodies must also adapt standards and regulations to accommodate hydrogen’s increased role and remove current restrictions. These bodies should create tools such as guarantee-of-origin schemes, for users to identify renewable or low carbon hydrogen and allow companies to trade hydrogen freely. Also, standardisation bodies must agree and harmonise technical norms to reduce market friction.

Finally, hydrogen markets and products will be essential to promote private sector investment.

Hydrogen is central to combatting climate change, we think. Decarbonisation based only on electricity will be too expensive and impracticable for many industries. Nonetheless, there are still many barriers to adoption. Transporting and storing hydrogen is challenging and requires massive investment. Cost parity is possible only in a few sectors without steep carbon pricing and regulation. As a result, government support to de-risk hydrogen investments will be key to hydrogen’s success as an enabler fuel to a cleaner economy.

Despite these challenges, governments and investors are already committing considerable sums of money to hydrogen production. It remains to be seen if this money will, over the next decade, help kick-start the hydrogen economy.

Based on what we’ve seen so far, over the next five to ten years we do not expect hydrogen to become a mainstay of the climate change arsenal. Nonetheless, we will continue to monitor the market to find opportunities that could fit within Actis’ investment strategy and, if appropriate, allow us to be a successful investor in what is a very exciting new technology.

- Hydrogen is central to combat climate change, we think: decarbonisation based solely on electricity is too expensive and impracticable for some industries

- There are still major barriers to adoption: transporting and storing hydrogen is challenging and requires massive infrastructure investment.

- Government support to de-risk hydrogen investments will be key to hydrogen’s success as an enabler fuel to a cleaner economy: Cost parity is possible only in a few sectors without steep carbon pricing and regulation.

Over the next five to ten years, we do not expect hydrogen to become a mainstay of the climate change arsenal. Nonetheless, we will continue to monitor the market to find opportunities that could fit within Actis’ investment strategy and, if appropriate, allow us to be successful investor in what is a very exciting new technology.