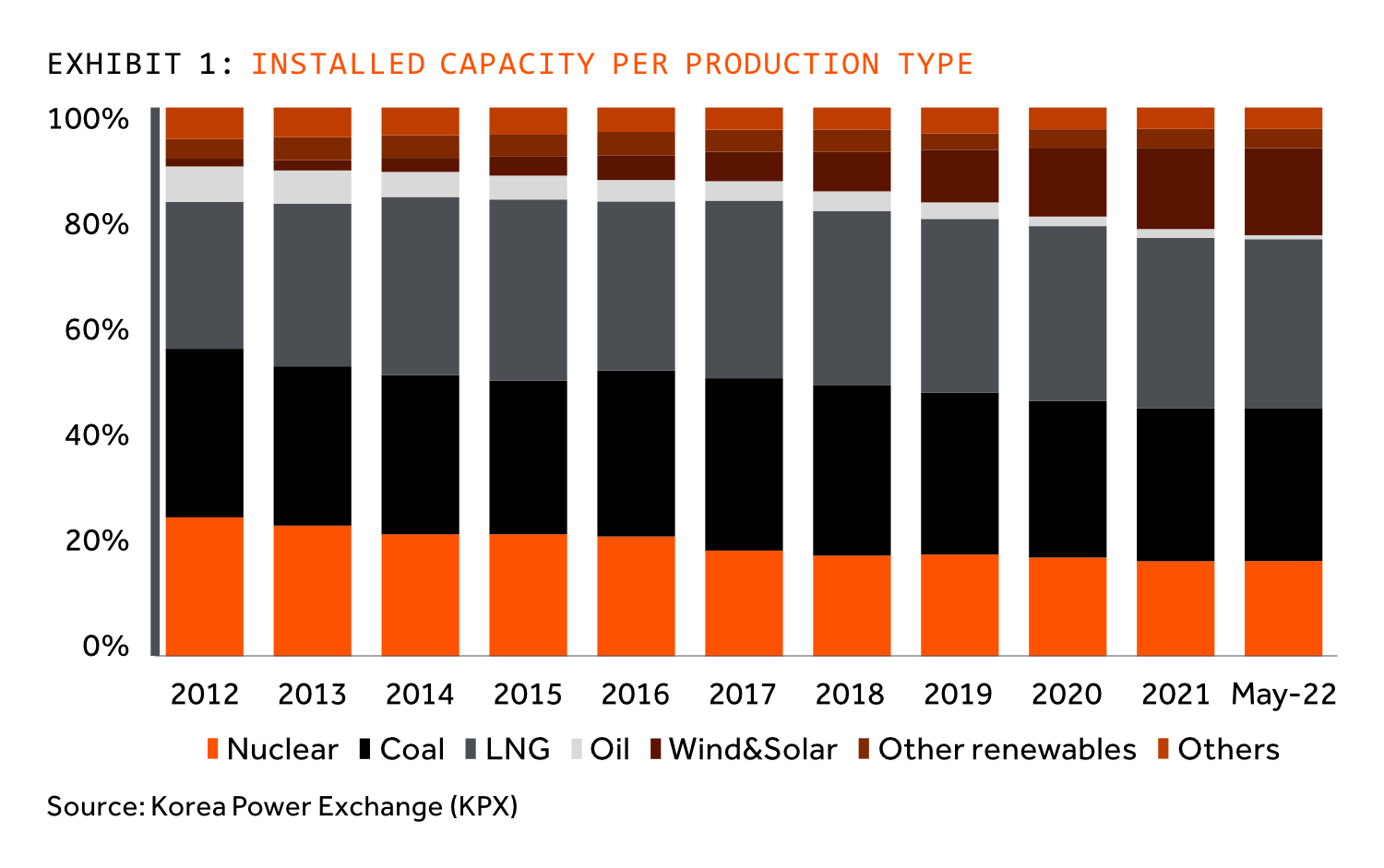

To that end, it called for a strengthening of the nuclear economic ecosystem, creating and growing a new energy market, and transitioning towards a green economy by establishing scientific initiatives in order to achieve carbon neutrality. It aims to boost the share of nuclear in the country’s power mix to 30% by 2030, from 27.1% last year, while lowering the country’s dependence on fossil fuel imports to under 70% by 2030, compared with more than 80% in 2021. When it comes to renewables, the country wants to establish a new distribution plan based on a more sustainable energy mix, strengthen next generation renewable technology, and improve the competitiveness of core turbine parts that rely heavily on imports. It also aims to provide incentives for low carbon solar production and encourage the commercialisation of building-integrated photovoltaics.

While growing back the reliance on the nuclear, importance of the renewables, especially wind and solar will continue to grow driven by the nationwide commitment to GHG reduction and the prolonged development process (from permitting to commissioning) for nuclear power plants (Exhibits 3 and 4). The new regime has kept the Nationally Determined Contributions (NDC) target by 2030 unchanged. The NDC target was set in 2015 and later was tightened in December 2021 meaning that growing reliance on the renewables is essential to achieve the target, especially given that the development of nuclear power plants as well as extension of the operating life still take a significant amount of time.