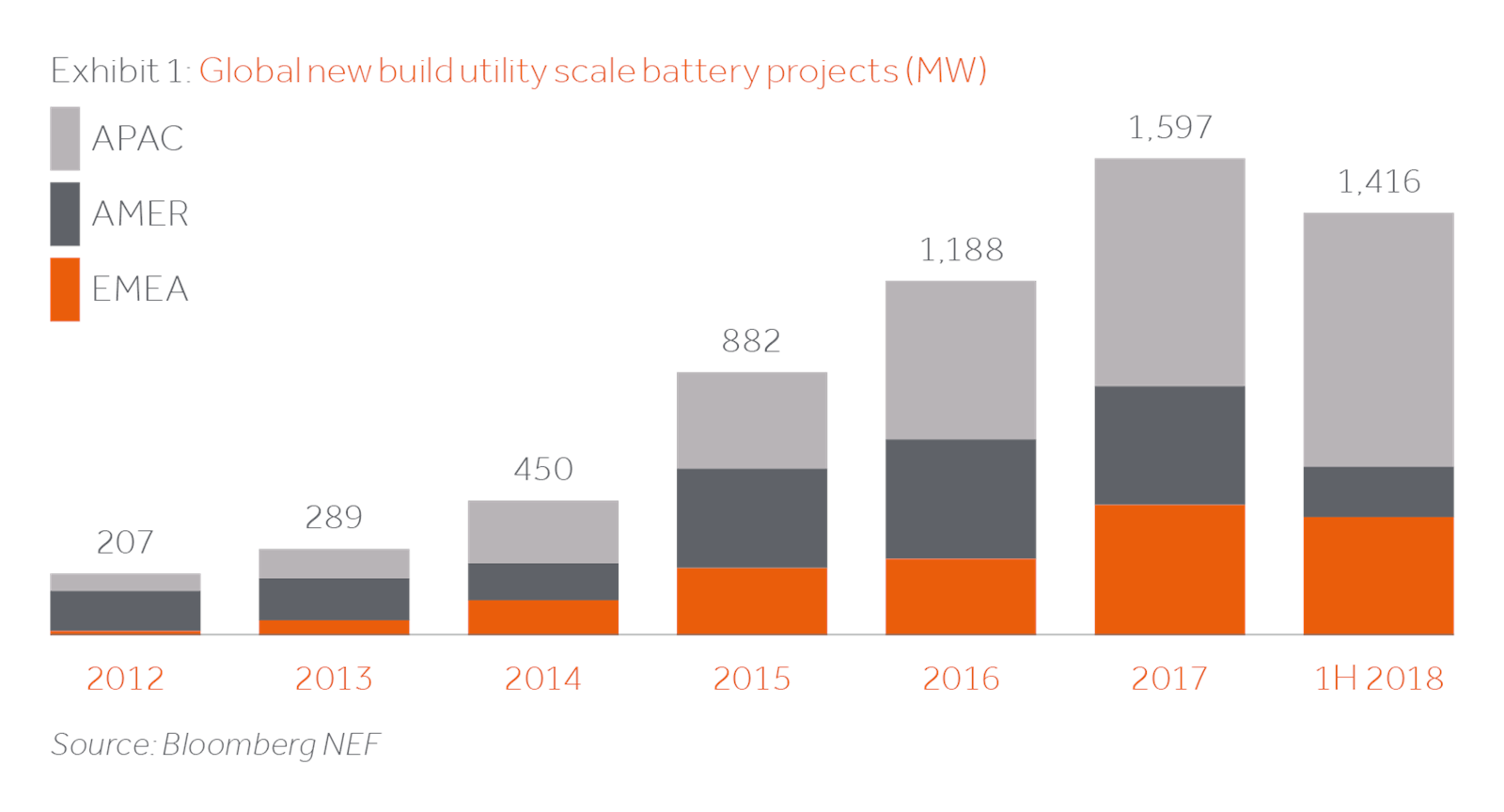

The Energy Sector is abuzz with talk of the “Battery Storage Revolution”. Recent studies[1] estimate that energy storage in the emerging markets will grow by over 40% per annum in the next decade, producing over 80GW of new storage.

Drivers of this growth include; continued rapid uptake in renewables, declines in costs and the development of cost effective micro-grids permitting the first-time electrification of isolated regions. However, much of this rhetoric has been heard before so why is the common battery such a headline grabber now and is it really such a disruptive force?

What is undisputed is that widespread availability of energy storage reduces the risks of intermittent supply and the associated challenges to the management of effective transmission grids. Intermittency of supply has been one of the key reasons constraining the growth in the penetration of renewables historically, as wind and solar in particular are impacted by climatic conditions and consequently are ill suited to provide a base load into the system. Storage could usher in the next phase of Energy Darwinism which many refer to as the age of renewables.

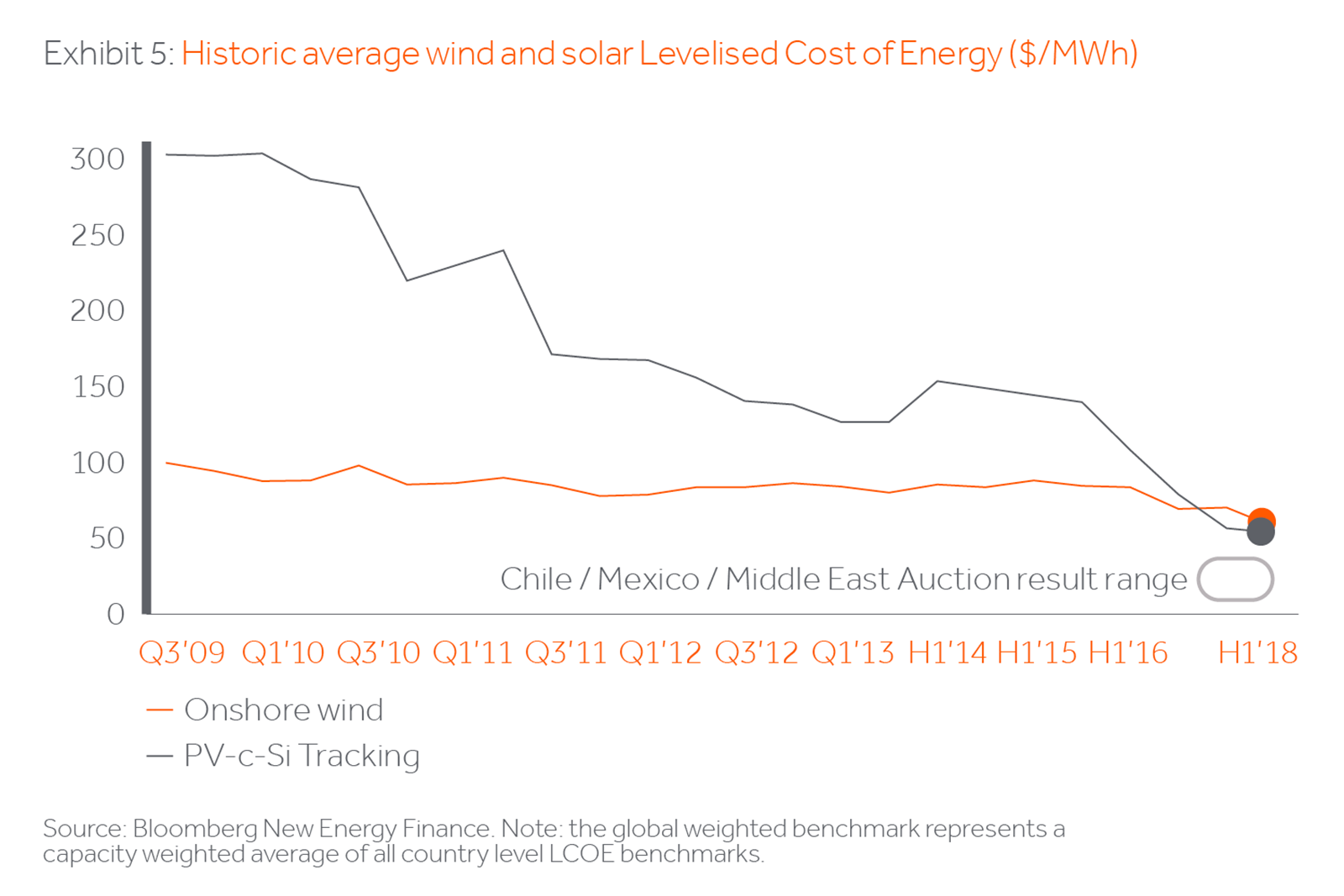

So why now? In simple terms, cost. As the price point of storage reaches (unsubsidised) grid parity, we enter a virtuous circle leading to more deployment and associated supply side growth. This in turn allows for the further funding of R&D and the entry of new producers, and so the cycle continues. So the key question – are we there yet? Well maybe. Unfortunately, it isn’t so straight forward, as regulation can de-link value from price and there is no “one size fits all” in terms of “grid parity”.

Disruptive enabler in the fuel mix

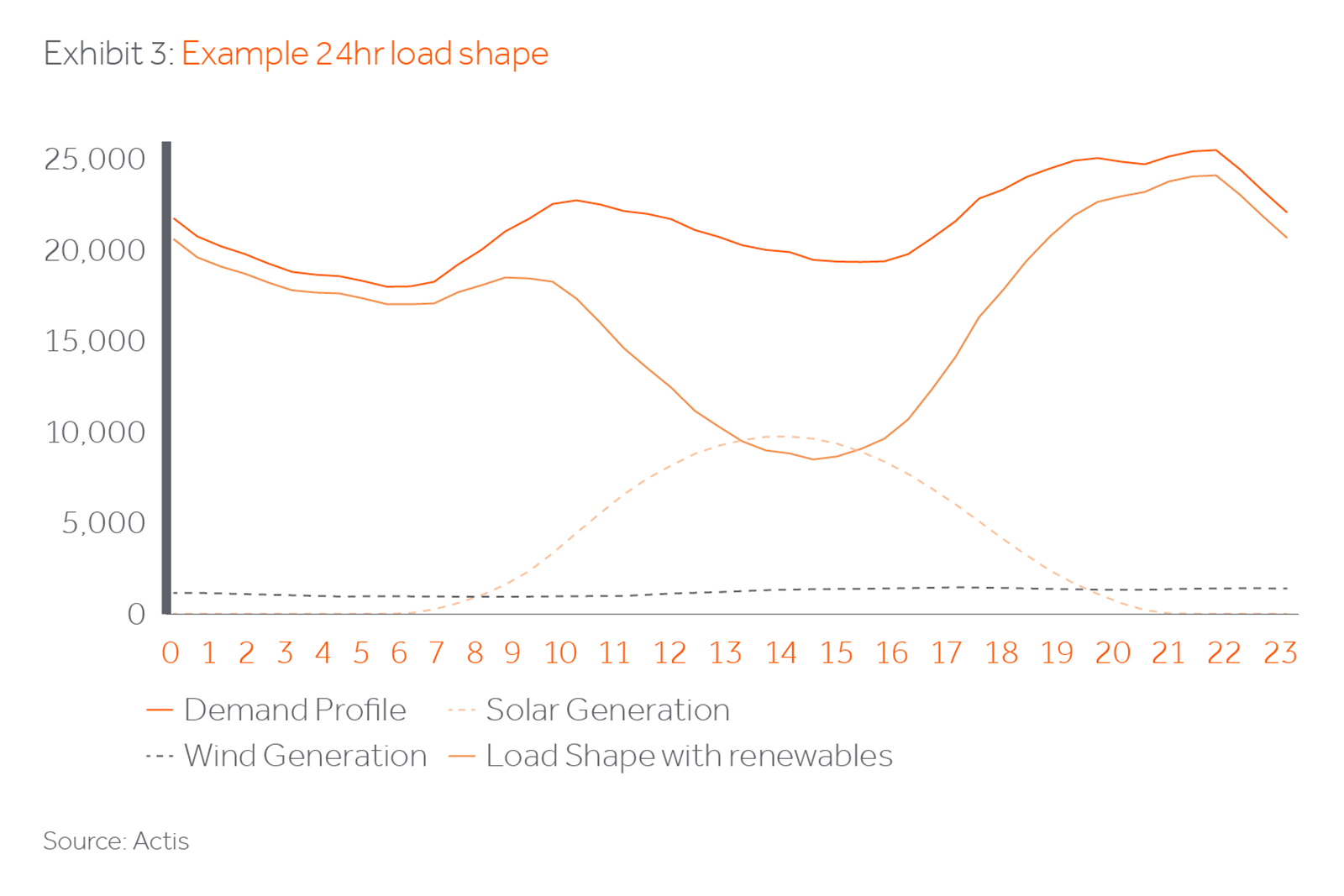

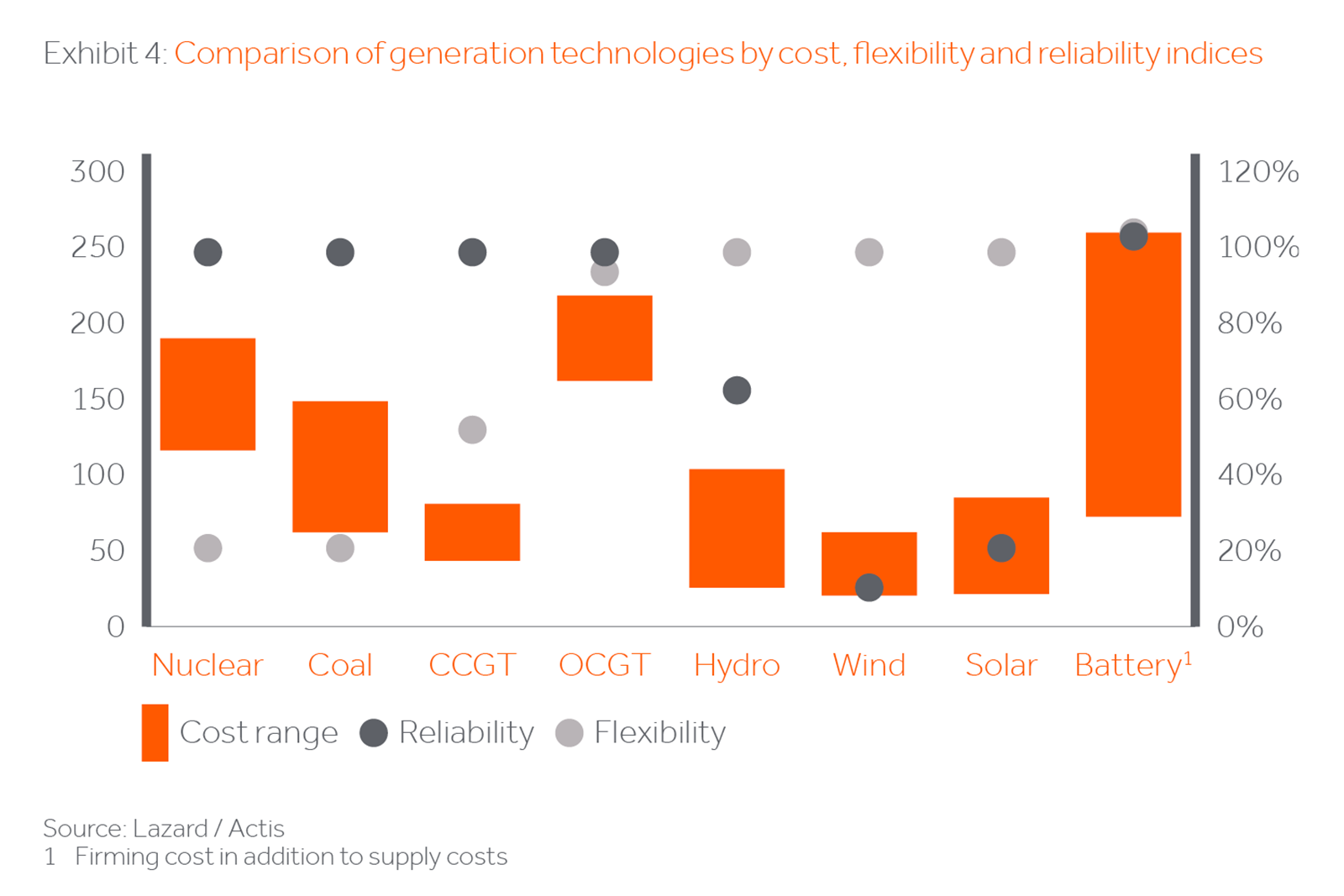

When we pay our energy bills, we are in effect paying for two things, energy and the ability to use it when we want. The ability to use energy when we want to creates a “load shape”, i.e. a changing, demand profile, which needs to be filled by the market. This is an important consideration as not all plants are the same in terms of meeting these needs. Base load plants like nuclear and coal are very good at providing energy and somewhat worse at meeting shape requirements (driven by both technical limitations and the need to amortise the high capital cost across higher volumes). Combined Cycle Gas Turbines (CCGTs) are good at both; Open Cycle Gas Turbines (OCGTs) are not good at providing energy (being inefficient and thus expensive) but are an excellent option to meet the needs of the “peaks[2]” of the load shape. Intermittent supply from renewables can have the effect of exacerbating the peaks, with the cost of meeting this peak demand being a key factor in determining the overall system fuel mix and cost.

The optimal generation composition has traditionally been a mix of low marginal cost, inflexible “base load” plants, and higher cost, flexible “peaker” plants. Base load plants include Coal and Nuclear ($60 – $140/MWh[3]) or Gas fired CCGT ($40 – $80/MWh). The peaks and shaping would be filled by the flexible margins of the base load plants (CCGT can vary load by approximately 50% and Coal / Nuclear by 20%), hydro in combination with Gas / Liquid fuel Open Cycle Gas Turbines (OCGTs) or Reciprocating Engines ($160 – 280 /MWh). But the rapid decline in the cost of renewable energy introduced a challenge to this model. To date, penetration of renewables has largely been facilitated by the significant availability of flexible capacity from existing base load assets, but due to the intermittent nature of the energy they supply, renewables also have the effect of making the load shape more volatile thereby increasing the demand for flexible capacity and so too the cost.

At present the renewables / peaker blend on a standalone basis isn’t enough to replace thermal energy, so renewables could only represent a maximum of the margin allowed by the flexibility of the installed base load mix installed (i.e. 20 – 50% of a grid). This equation could now change as batteries, charged by cheap renewable energy are capable of delivering stabilised supply at a blended cost below that of traditional base load generation.

Source: Bloomberg New Energy Finance. Note: the global weighted benchmark represents a capacity weighted average of all country level LCOE benchmarks.

What Batteries can’t do…..yet.

This all works in theory in meeting short term fluctuations in demand, but what about balancing the mix over a week rather than intra-day? That depends on many factors but the short answer is that the cost of batteries is directly related to their storage volume rather than their power capacity[4] and as a result, storing and shifting volume from day to day rather than small amounts from hour to hour is currently cost prohibitive.

What Batteries can do, which isn’t being talked about

While the primary financial driver for Independent Power Producers is to gain revenue through wholesale pricing arbitrage across the day, ancillary services and/or capacity charges (both of which can be effectively thought of as providing grid stability for a fee) also play a part. While each market is different, battery uptake is somewhat hampered by this economic model, where the ancillary services are undervalued and the other benefits which batteries provide are not paid for through tariffs including:

- Increased utilisation of transmission assets allowing deferral of expansion requirements and improving profitability of the infrastructure investments (Batteries can be located throughout a grid thus they support load being shifted geographically in a more efficient manner, allowing bottlenecks to be relieved over longer periods of time)

- They are very efficient at providing grid support services which enables grid operators to more effectively manage the grid stability and quality of electricity (i.e. less outages and brownouts)

- By allowing more penetration of renewables, batteries improve geo-politically related security of supply and cost escalation risk by reducing reliance on fuels as well as the decarbonisation of the grid.

What does this mean for investors?

While the headline effect is a continuation in the growth story of renewables there are also a number of opportunities and threats which are less obvious, and these include a shift towards more merchant supply and fewer long term contracts, as well as a more existential threat to the current utility suppliers who run today’s baseload plants.

Despite the various issues, the commercialisation of batteries for grid storage is emerging with Australia, India, South Korea, the Middle East and the USA all seeing large scale battery solutions delivered into the market at competitive rates. The green shoots are most evident where regulatory support is available and also in sunnier climates. In our view, the continued cost decline of renewables and batteries at a time when fossil fuel prices are increasing only leads to one conclusion – storage is coming and it will spread to other markets in the near term. As leading investors in renewable energy, we see this as further stimulus for accelerated penetration of these technologies across all markets in due course.

[1] IFC and Navigant

[2] A grid has a daily load shape which changes across the day with an evening “peak” typically corresponding to people using home appliances. There was a time where you could actually see Coronation Street commercials (and the associated tea people would be brewing during this time) within the load shape.

[3] Source: Lazard’s annual Levelized Cost of Energy Analysis (LCOE 11.0). The Levelized Cost of Energy (LCOE) is the all-in charges needed to pay back both operational cost and capital recovery, depends on a plant’s utilisation, fuel, operational and capital costs.

[4] Prices for batteries are largely driven by storage capacity measured in MWh, i.e. today’s costs for Lithium-ion batteries are in the range of $250 – 300k/MWh, i.e. 1MW plant discharging in 1hr would incur a capital cost of $250 – 300k. To extend that 1MW discharge to 10hrs (i.e. 10MWhrs) the cost would increase by a factor of 10. A 10MWh battery could be discharged over the span of say 1hr which would imply 10MW of capacity.