Press releases

For all media enquiries, please contact us

New

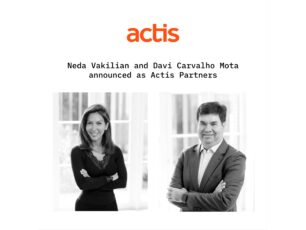

Actis promotes Neda Vakilian and Davi Carvalho Mota to partner

LONDON, 2 April 2024: Actis, a leading global investor in sustainable infrastructure, has announced that Neda Vakilian, Head of Actis’ Investor Solutions Group, and Davi Carvalho Mota, Director in…

Read article

Actis backs solar platform Argo Energy in first South Korean energy investment

27 March 2024

Actis agrees sale of fibre operator Octotel

25 March 2024

Actis to acquire Swiftnet for US$355m with plans to create a leading independent telecom tower platform in South Africa

22 March 2024

Actis backed Nozomi Energy significantly expands solar portfolio to reach 100MW milestone

20 March 2024

Actis launches new Brazilian transmission platform and acquires operational transmission asset totalling 743km

21 February 2024

Actis to acquire a portfolio of operational hybrid annuity model road assets in India

08 February 2024

Actis-led Consortium Acquires Telecom Tower Portfolio in Western Balkans

22 January 2024

General Atlantic adds sustainable infrastructure strategy, as Actis joins platform to create a $96 billion AUM diversified global investor

16 January 2024

Actis successfully exits first real estate investment in Vietnam

18 December 2023

Actis Wins 4 Sustainable Investment Awards 2023 From Environmental Finance

29 June 2023

Actis to sell BTE Renewables to Engie and Meridiam

21 June 2023

Actis launches $500m renewables business in Japan and makes first acquisition

09 May 2023

Actis to acquire 11 data centres in the Americas

28 March 2023

Actis appoints Neda Vakilian as Global Head of Investor Solutions Group

27 March 2023