Post the COVID-19 pandemic, the energy sector is expected to accelerate delivery of decarbonised, electrified energy infrastructure as governments around the globe attempt to revitalise their economic growth in a more sustainable manner than ever before.

As the energy sector transitions towards cleaner and greener sources such as variable renewable energy, stationary battery storage will be a key enabler and is expected to attract US$964 billion1 investment over the next three decades; with over 70% of these investments in utility-scale, stationary battery storage projects.

Increasing penetration of Variable Renewable Energy (VRE) in global energy mix

Electricity demand is expected to more than double by 20502 by when VRE generation is expected to supply 62% of the world’s electricity (up from about c. 9% in 2019). The high penetration of VRE in the energy mix requires a considerably more flexible power system to balance supply and demand. Battery storage, an economical and mature, bankable technology is expected to play a key role in ensuring that cheap, green electricity is stored and provided to customers as and when needed. Global battery storage capacity is expected to expand many folds – reaching a total installed capacity of c. 1,650 GW/ 5,800 GWh by 2050; with 50% of the total investment (c. US$485bn) being made in utility scale batteries needed for Energy-shifting.

Significant learning curve and price reduction possibility for batteries

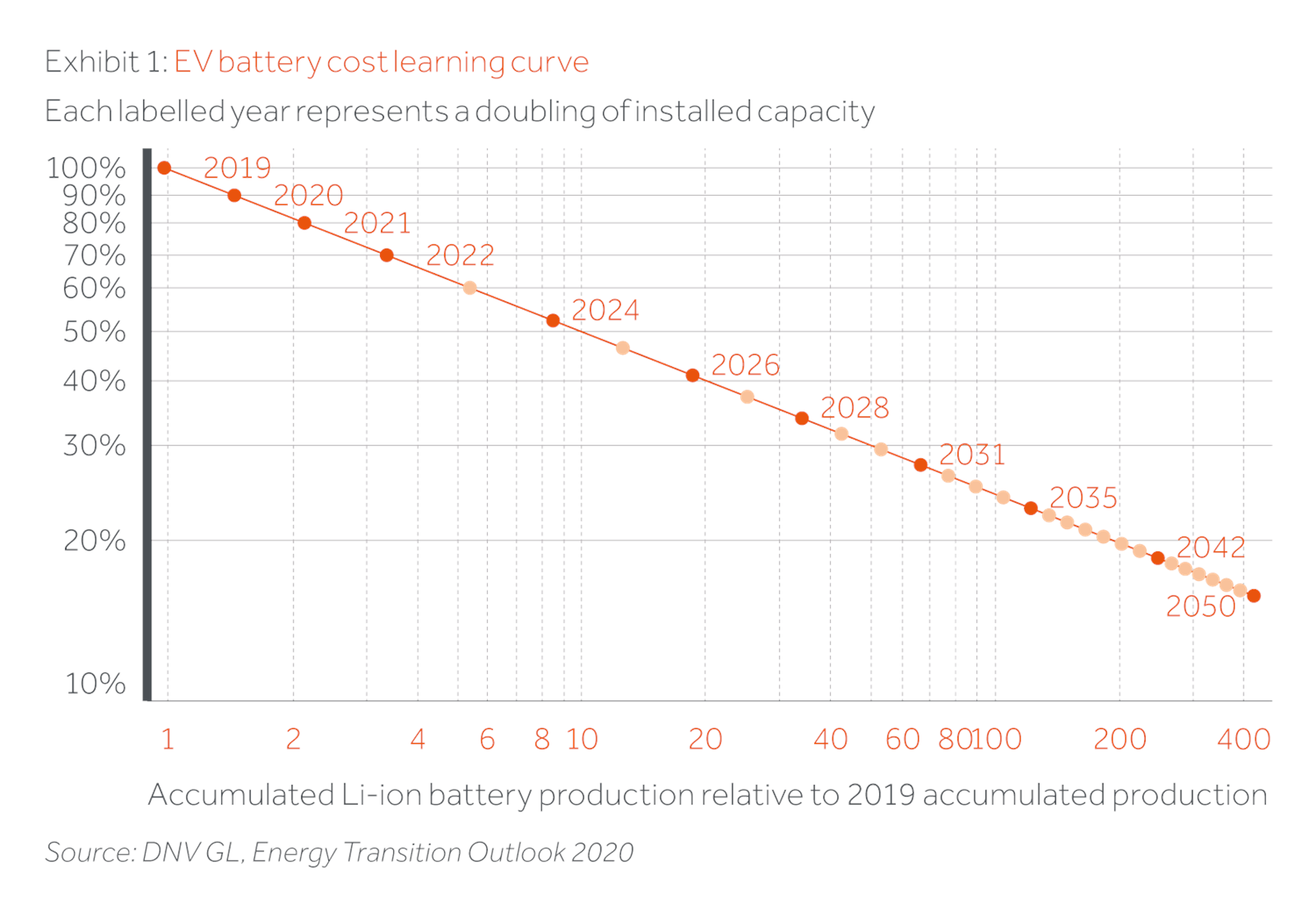

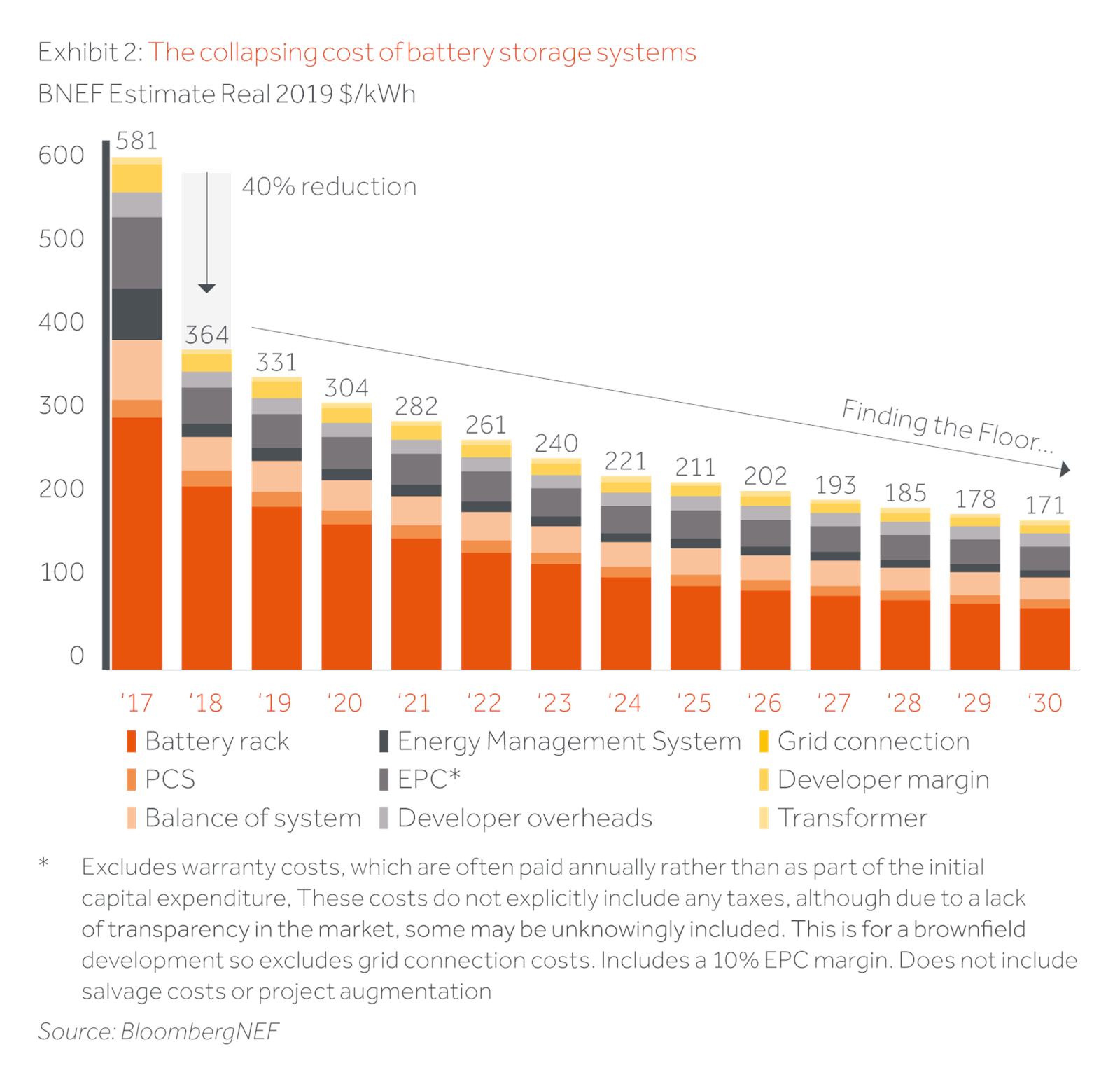

In the last decade, Lithium-ion battery prices have declined by over 85%, in real terms to $135/kWh in 20193. Riding on the back of strong demand for batteries from consumer electronics, electric vehicles and energy storage, we expect a further 60% reduction in Lithium-ion battery pack prices by 2030 ($70/kWh)4. The learning curve for batteries is expected to continue at 19% for the next decade, which means the battery prices will decline at a rate of 19% with every doubling of cumulative capacity-additions5.

Versatile application for battery storage solutions

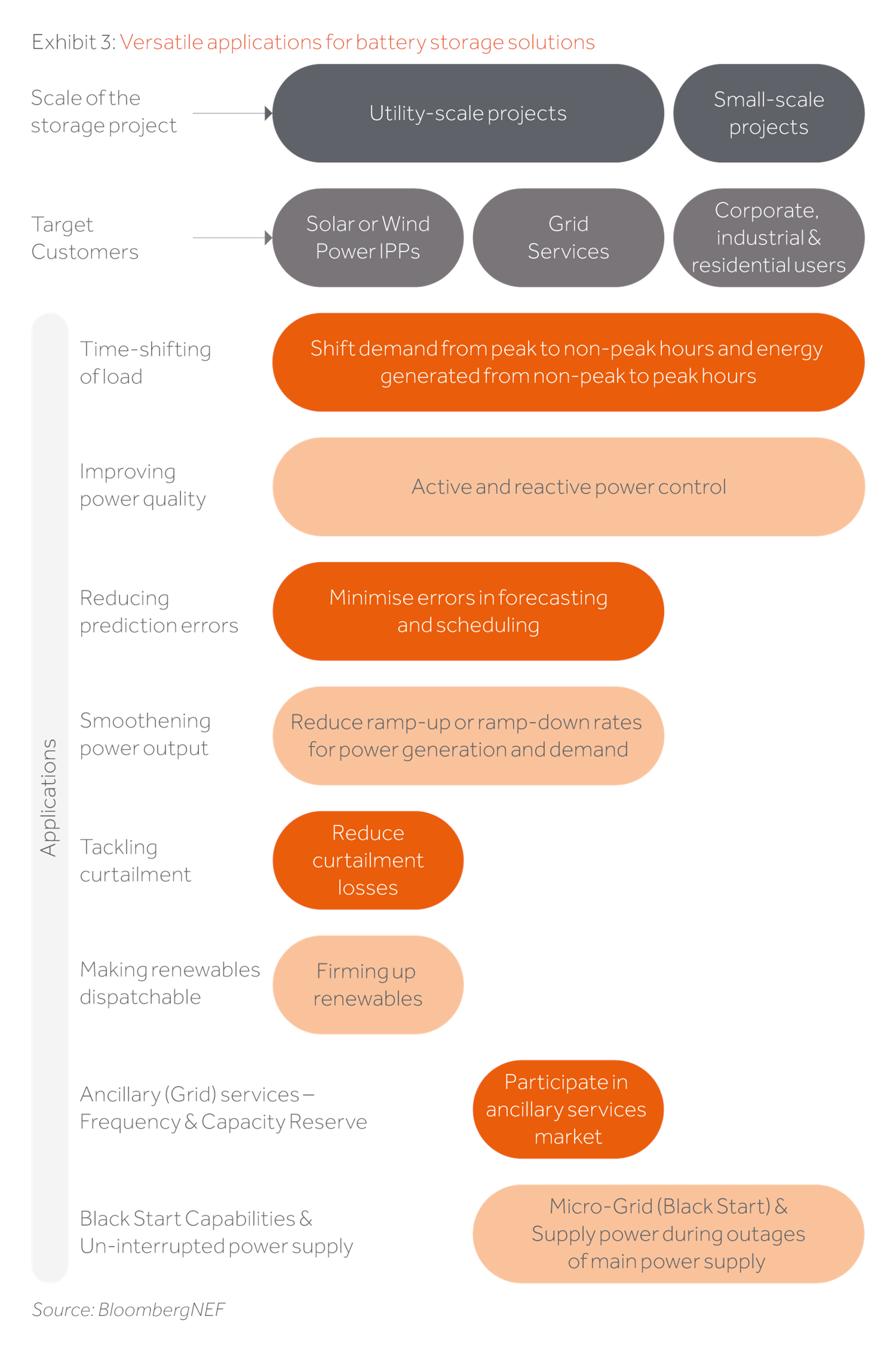

Battery storage provides a range of dynamic applications, improving stability during rapid changes in the load/demand, providing energy arbitrage/trading opportunity, avoiding curtailment loss, and many others as shown to the right. Battery storage could also improve system resiliency to deal with extreme weather events and support deferring investments in grid infrastructure.

2020 is expected to be a record year for energy storage as at least 4.5GW/9.2GWh of new installations are expected to come online globally, with approx. 98% of storage projects being Li-ion battery storage during H1 20206.

Battery cost trend and the future

Given the investment and scale benefit to Lithium-ion batteries due to rapid growth in electric vehicle sales, we expect that turnkey costs for Lithium-ion battery systems will reduce by c.60% between now until the end of the decade (see Exhibit 3), along with improvements in energy density (defined as amount of energy that could be stored per unit weight; the higher the energy density, the better it is).

Beyond 2025, there is an expectation that a host of new generation of battery cells and next-generation technology will begin to be commercially available and push the energy density of battery cells to increase

from the existing Li-ion battery 200Wh/kg by 2.5 times, to 500Wh/kg and drive battery prices down to $50-60/kWh by 2030.

There is a plethora of storage technologies in early-stage development. However, the large-scale investment already made in the supply chain and mass production facilities for Li-ion batteries will act as a barrier to entry. Alternative technologies will need to demonstrate significant technological and cost advantage over Li-ion batteries before large scale adaptation. This seems some way off.

Nevertheless, there are several exciting alternative battery storage technologies as discussed below that could become relevant and improve the sector over the next decade:

- Solid state batteries

- Redox flow batteries

- Zinc-air batteries

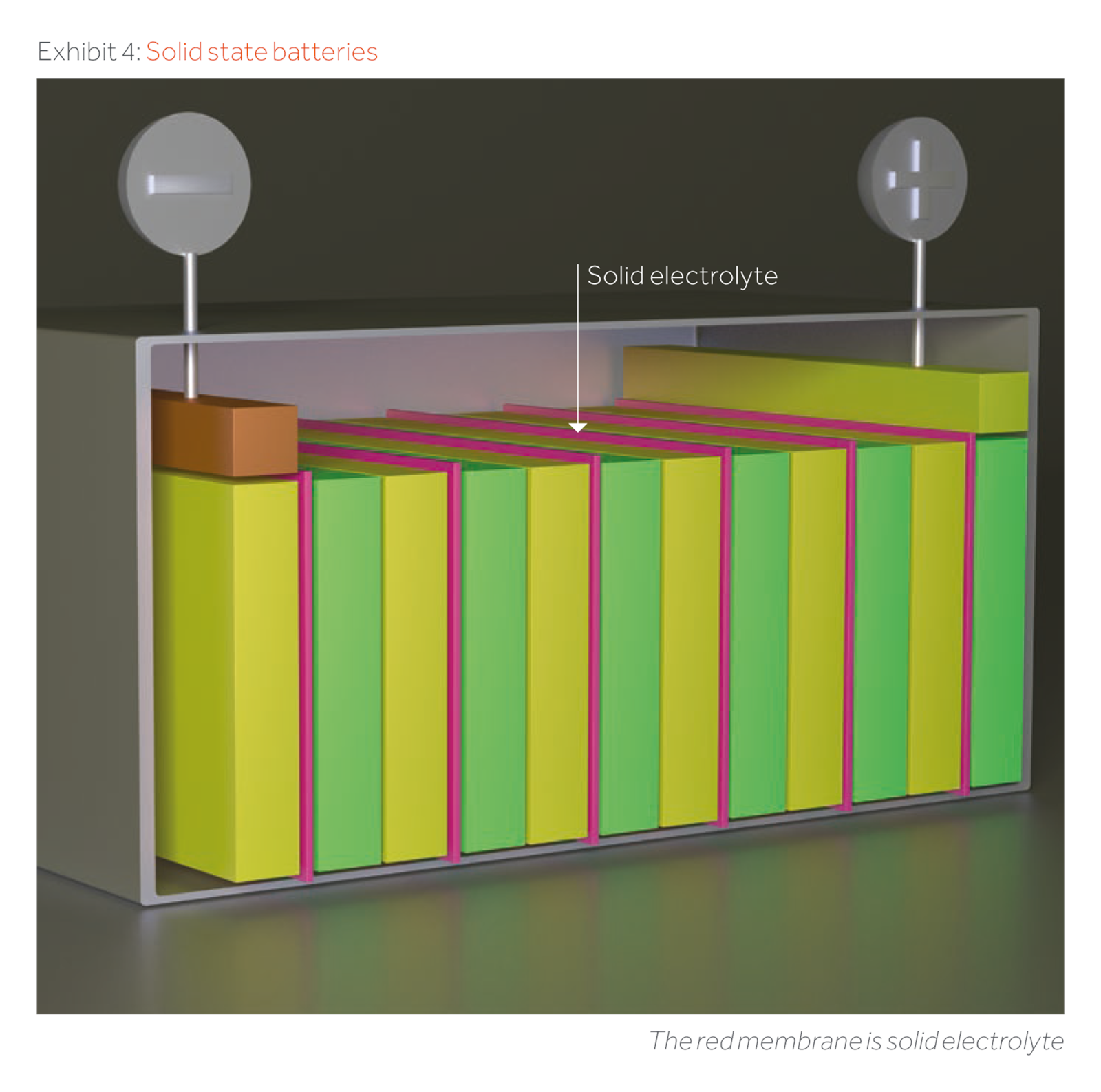

Solid state batteries

Most current lithium-ion batteries employ liquid electrolyte (Li-ion salts as organic solvents), which needs expensive membranes separating cathode and anode and impermeable casing to avoid leakage; the liquid electrolyte is also flammable causing safety concerns and restricting size/design freedom. Whereas, using a solid electrolyte will provide a smaller size battery with higher energy density, longer lifespan, increased safety and lower cost due to removal of certain components such as separator and casing. Solid-state batteries are expected to store up to twice as much energy as a Li-ion battery.

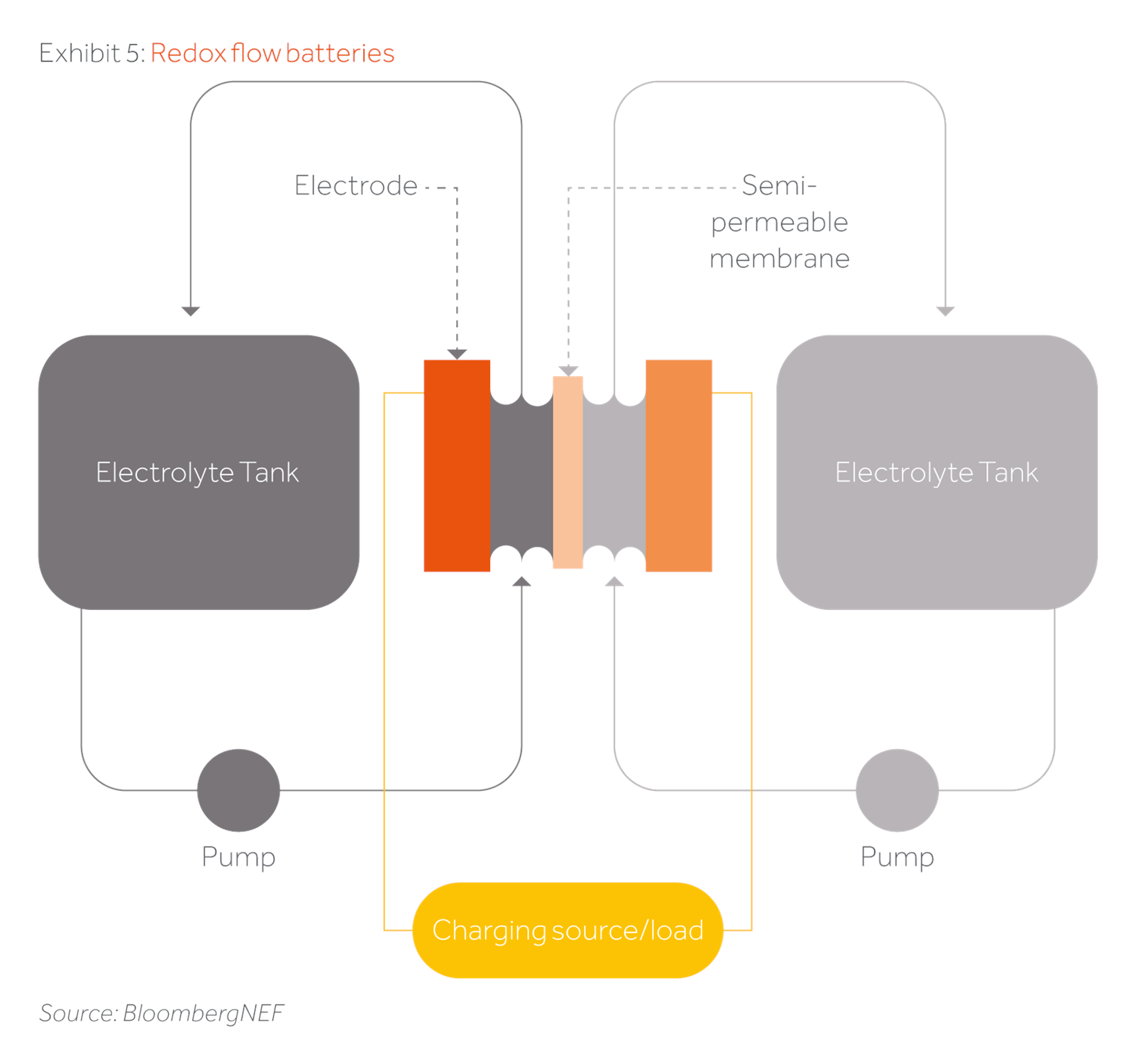

Redox flow batteries

Flow batteries store their energy in the electrolyte, which is in a flowable form of redox species such as Vanadium, Iron/Chromium, Zinc/Bromine. A redox flow battery has a distinguishable feature that the amount of power and energy can be scaled separately – whereby the amount of electrolyte could be increased to increase storage capacity, and the cell size and sequence determines the power capacity. With redox flow batteries, there is no phase conversion with solid active materials , which can significantly increase battery life and make it recyclable – key qualities suitable for utility scale battery storage applications.

Zinc-air batteries (ZAB)

The ZAB are from a wider family of batteries that use metal and air – in which the anode is a metal and cathode is carbon-based with a precious metal covering. As air passes freely through the battery, oxygen reacts with the metal and activates an electrolysis process and resultant flow of current. Until recently, ZAB suffered from poor cycle efficiencies (due to dendrite, needles, growing out of anode) and can have imbalanced charging and discharging times, but a substantial amount of R&D is being performed by universities and start-ups around the globe, and there are indications of a commercially viable technology being available by 2025.

There are several other interesting energy storage technologies such as Flywheel, Liquid or Compressed Air Energy Storage, Electrothermal and Gravity storage technologies, which could also evolve to outperform Li-ion battery technology but to date Li-ion enjoys a substantial lead.

Future of long-term/seasonal storage

The current battery storage technologies provide flexibility in the power system to accommodate the hourly or daily volatility but an economical solution for seasonal storage would be key to achieving the highest level of renewable energy penetration. The rationale of seasonal storage is to solve for two key issues:

- Shifting surplus green electricity from a season of high generation/low demand to a period of high demand/low generation, and

- Enable a complete decarbonisation of the electricity system in a sustainable manner.

A few viable options mainly differing in the way electricity is converted and stored – as hydrogen, methanol, methane, ammonia or methylcyclohexane are under development. As per DNV’s analysis, storing compressed hydrogen in a depleted gas field is the most cost effective seasonal solution7, and we expect the global policy movement towards Hydrogen to expedite economical and bankable solutions for seasonal storage earlier than thought.

What’s the opportunity for battery storage in emerging markets?

For emerging markets, the energy storage market is expected to grow to 20GW/60GWh with a US$25 billion revenue opportunity by 20258. Amongst our markets, India is emerging as one of the largest, immediate energy storage markets, with expected c.4GW (estimated 12-16GWh) of new storage capacity to be added to the energy mix (CAGR of 46%) until 2025, requiring approx. $6bn of investments in the next 5-7 years.

In Africa, Actis’ investee companies along with their partners are currently undertaking feasibility studies on two major grid-scale battery storage projects integrated with wind projects in Senegal (Lekela) and Kenya.

Sustainable and Responsible procurement of batteries is possible.

Actis’ Responsible Investment team continues to work with Tier-1 suppliers not only on responsible procurement of rare metals for batteries as well as evaluating recycling and second-life applications for batteries.

Battery storage is a key energy transition enabler

Continued deployment of energy storage will be key for energy transition. The dynamic application of battery storage on the generation and distribution side will help to integrate renewables into the energy mix but also manage grid flexibility and stability, making it an attractive, remunerative and unique solution.

With Actis aiming to supply clean, affordable and reliable electricity to billions of people, battery storage is no longer a potential technology but a competitive, mature and present-day enabler for the global energy transition towards a more sustainable and decarbonised future.

—

1 Bloomberg, 2020 Long Term Energy Storage Outlook

2 DNV GL, Energy Transition Outlook 2020

3 Bloomberg, 2020 Long Term Energy Storage Outlook

4 DNV GL, Solid State Battery Part 1: Technology Outlook

5 DNV GL, Energy Transition Outlook 2020

6 Bloomberg, 2020 Long Term Energy Storage Outlook

7 DNV GL, The Promise for Seasonal Storage 2020

8 IFC and Navigant