Where We Stand Today

|

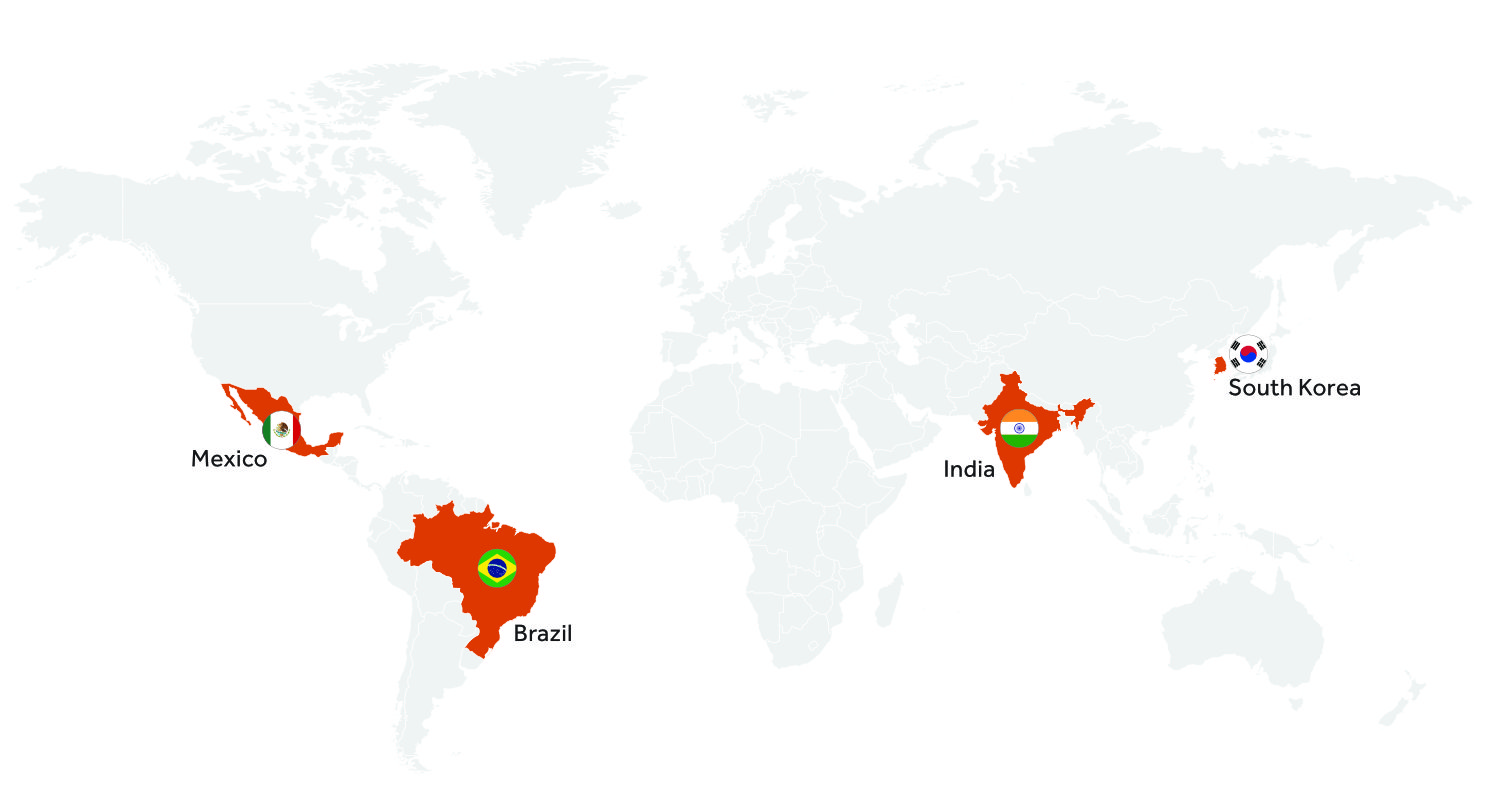

Brazil

|

|

- April 2023 inflation 4.2%, down from 12.1% in April 2022

- Interest rate 13.75%, up 450bps since January 2022

- GDP growth 2.9% in 2022

- Real trading at 4.96 per USD, flat compared to a year ago

- Despite political noise and volatility, stable economic fundamentals and growth backdrop

|

India

|

|

- April 2023 inflation 4.7%, down from 7.8% in April 2022

- Interest rate 6.5%, up 250bps since January 2022

- GDP growth 6.8% in 2022

- Rupee trading at 82.7 per USD, 6% weaker than a year ago

- Continuing stability from macro and political stand point

|

Mexico

|

|

- April 2023 inflation 6.3%, down from 8.7% in September 2022

- Interest rate 11.25%, up 575bps since January 2022

- GDP growth 3.1% in 2022

- Mexican peso trading at 17.6 per USD, 11% stronger than a year ago

- Material beneficiary of near shoring and FDI inflows

|

South korea

|

|

- April 2023 inflation 3.7%, down from 6.3% in July 2022

- Interest rate 3.5%, up 225bps since January 2022

- GDP growth 2.6% in 2022

- Won trading at 1327 per USD, 4% weaker than a year ago

- Macro generally sound with won slowly appreciating alongside yen

|

Source: Bloomberg LP for consumer prices, interest rates and exchange rates. International Monetary Fund World Economic Outlook database (April 2023) for real GDP growth figures in 2022. Exchange rates as of May 22, 2023 and interest rates as of June 7, 2023.