Where We Stand Today

|

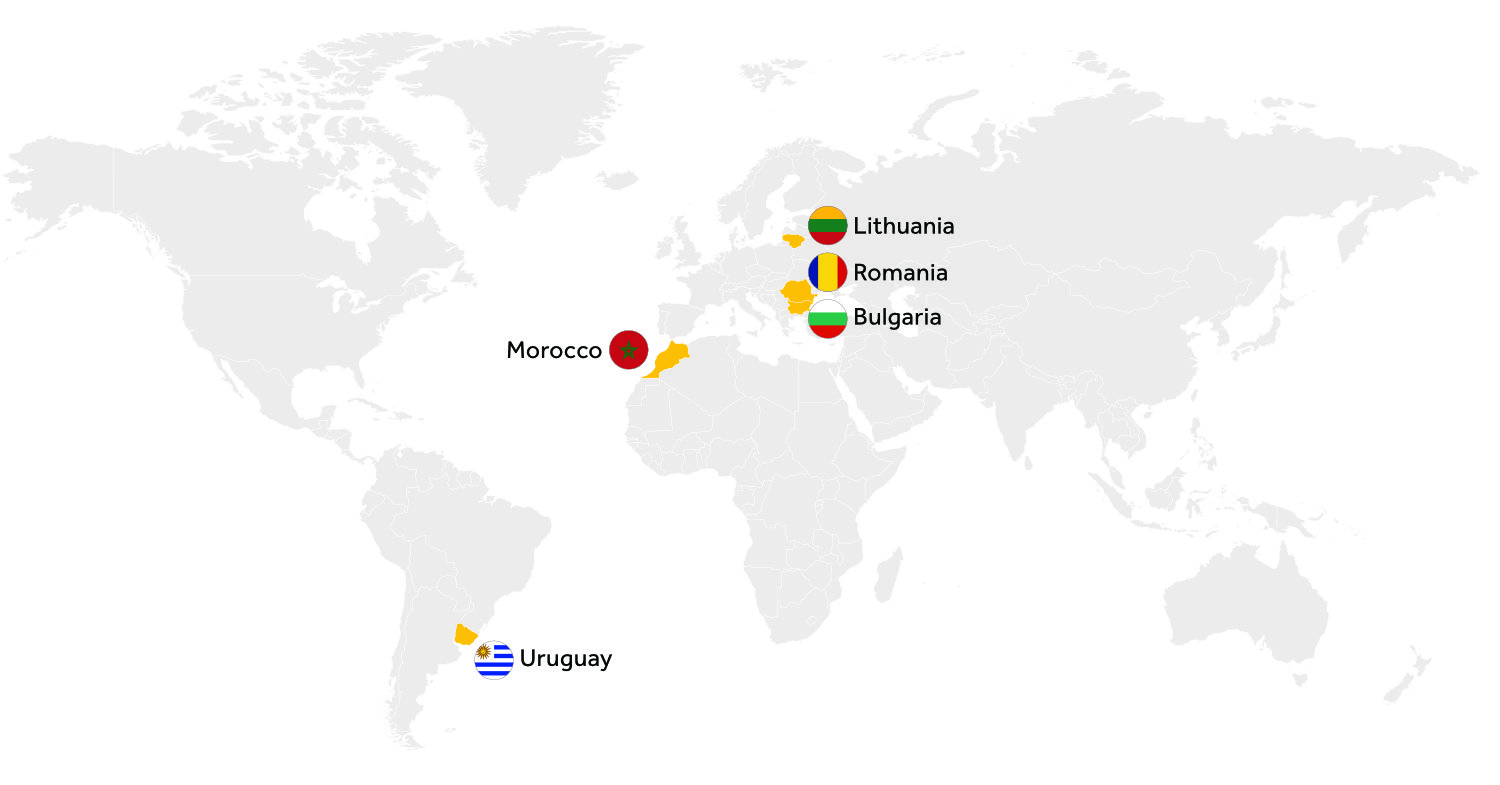

Bulgaria

|

|

- April 2023 inflation 11.6%, down from 18.7% in September 2022

- Interest rate 2.96%, up 296bps since January 2022

- GDP growth 3.4% in 2022

- Lev trading at 1.81 per USD, 2% stronger than a year ago

- Negative real rates support activity

|

Lithuania

|

|

- April 2023 inflation 14.5%, down from 24.1% in September 2022

- ECB interest rate 3.75%, up 375bps since January 2022

- GDP growth 1.9% in 2022

- Euro trading at 0.93 per USD, 2% stronger than a year ago

- Macroprudential policies, pro-business environment and openness to EU trade/risks

|

Morocco

|

|

- April 2023 inflation 7.8%, down from 10.1% in February 2023

- Interest rate 3%, up 150bps since January 2022

- GDP growth 1.1% in 2022, and accelerating this year

- Dirham trading at 10.22 per USD, 2% weaker than a year ago

- Flexible economy with currency tracking euro peg

|

Romania

|

|

- April 2023 inflation 11.2%, down from 16.8% in November 2022

- Interest rate 7%, up 500bps since January 2022

- GDP growth 4.8% in 2022

- Leu trading at 4.62 per USD, flat compared to a year ago

- Macro backdrop is improving as energy and headline inflation are easing. Activity holding up well, but twin deficits make it vulnerable to any rise in euro risk

|

Uruguay

|

|

- April 2023 inflation 7.6%, down from 10.0% in September 2022

- Interest rate 11.25%, up 550bps since January 2022

- GDP growth 4.9% in 2022

- Uruguayan peso trading at 39.0 per USD, 6% stronger than a year ago

- A track record of sound macroeconomic policies, with limited fiscal risks

|

Source: Bloomberg LP for consumer prices, interest rates and exchange rates. International Monetary Fund World Economic Outlook database (April 2023) for real GDP growth figures in 2022 and 2023f. Exchange rates as of May 22, 2023 and interest rates as of June 7, 2023.