We now explore these key metrics. We show the different fundamental market, macro and political risk characteristics using the above taxonomy. This allows us to map out our exposure to different types of risk and investment opportunity on a global basis.

We focus on market, macro, currency and governance risks. We decided to calculate simple unweighted averages for our metrics across the buckets.

We test our categories using the same set of country nominations as highlighted before. The resulting country universe is summarised in six buckets.

the six buckets

Global Influencers

Big Middles

Supply Chain Heroes

|

Stable but Small

Natural Resource Winners

Structurally Challenged

|

Source: Actis

We show the different fundamental market, macro and political risk characteristics, using the above taxonomy. This allows us to map out our exposure to different types of risk and investment opportunity on a global basis.

What Matters

1) Size Matters

A large economy, population or growth rates say nothing about investment returns. But market size parameters are useful to give a rough indication of investment opportunity.

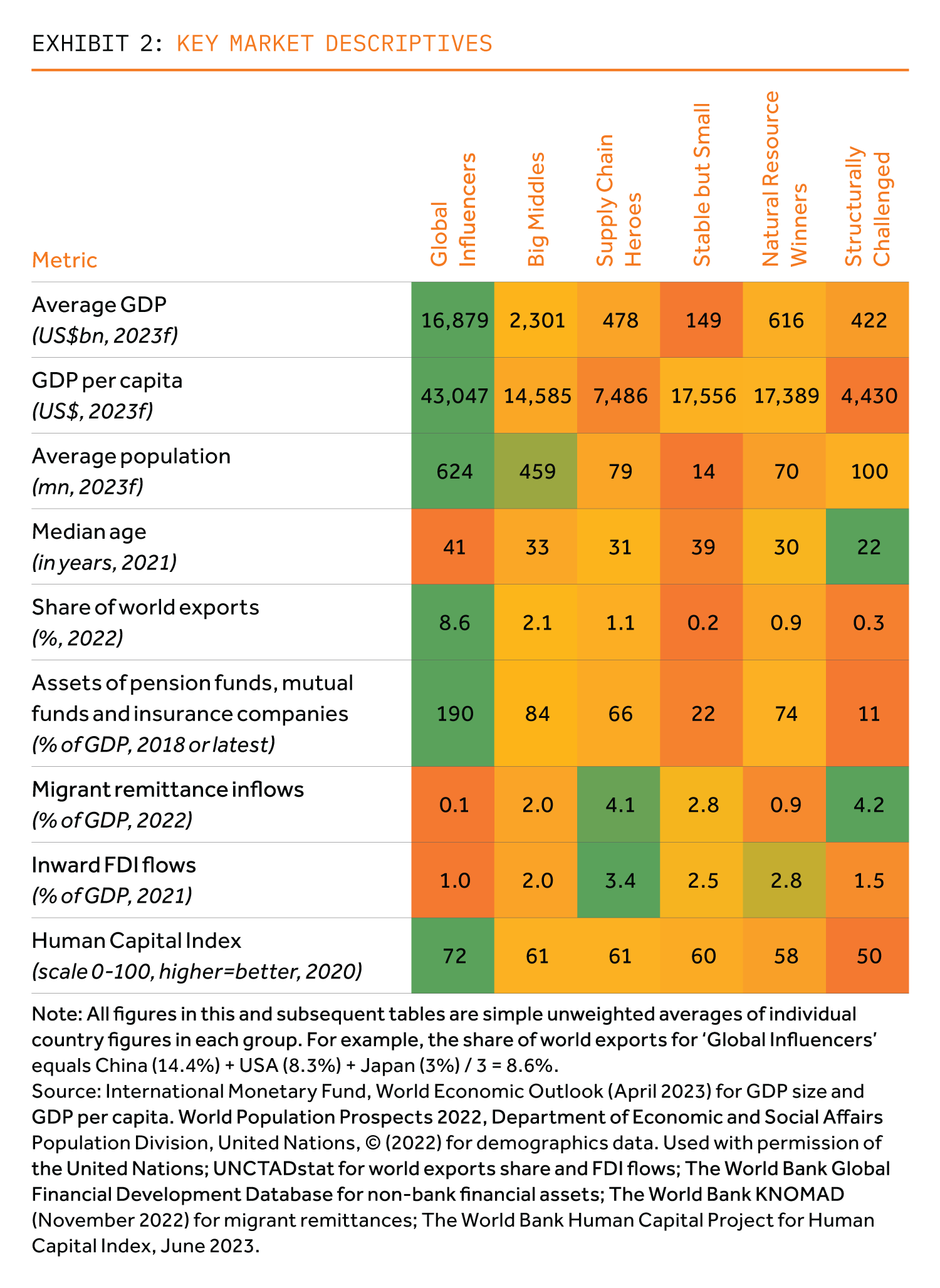

‘Global Influencers’ and ‘Big Middles’ clearly stand out (see Exhibit 2). As expected, ‘Stable but Small’ and ‘Structurally Challenged’ groups have smaller economies on average. However, the picture alters somewhat once we drill down into GDP per capita; here ‘Global Influencers’, Stable but Small, and ‘Natural Resource Winners’ stand out, followed by ‘Big Middles’.

2) Population Matters

In terms of demographics, ‘Global Influencers’ and ‘Big Middles’ are a class of their own. As the name indicates, our ‘Stable but Small’ bucket is clearly the least sizeable group. In terms of median age and population growth prospects, the picture is more nuanced. Here we have the emergence of ‘Structurally Challenged’, ‘Natural Resource Winners’ and ‘Supply Chain Heroes’ as the buckets with rapidly growing populations.

3) Trade Matters

Highlighting share of global exports shows whether countries are likely to be price takers or givers. ‘Global Influencers’ stand out on this metric as price givers and therefore less risky versus the rest.

4) Financial Resilience (really) Matters

Financial depth – think of this as shock absorption which should vary with per capita income. Deep domestic savings and natural incentives to hold assets onshore smooth volatility created by offshore investors selling local assets. Pension funds in Latin America and East Asia, sovereign wealth funds in MENA and insurance companies in South Africa all have local currency liabilities. As such, they are net buyers of local currency assets and so smooth economic and financial system volatility. A build-up in credit to GDP is frequently a precursor to financial crisis through reversal of funding. Battle scarred veterans, such as one of your authors, recall the 1980’s and 1990’s and think this factor is materially underappreciated. The nature of funding really matters.

Analysing assets of non-bank financial institutions to GDP shows that ‘Global Influencers’, ‘Big Middles’ and ‘Natural Resource Winners’ (including South Africa) have the deepest financial systems measured as the total assets of pensions funds, mutual funds and insurance companies as share of GDP.

5) Remittances Matter

Amongst the ‘Structurally Challenged’, ‘Supply Chain Heroes’ and ‘Stable but Small’, remittances act as an important source of additional flows, compensating for a limited domestic savings pool. They tend to be countercyclical and consistent, moving up during domestic downturns at a time when private capital tends to flee.

6) Foreign Direct Investment Matters

Foreign Direct Investment (FDI) brings in stable capital from abroad, increasing the overall investment and funding available within the country. FDI has many advantages. Long-term capital commitments are more stable and hence sustainable than short-term portfolio flows (‘hot money’). The latter leaves economies vulnerable to shifting investor sentiment and sudden outflows: Egypt is right now learning the hard way. FDI flows are also associated with technology transfer and increased export earnings.

Data shows ‘Supply Chain Heroes’ are clearly also FDI Heroes. In terms of annual FDI inflows as share of GDP, ’Supply Chain Heroes’ rank as the highest, with Vietnam leading the pack across all our economies covered (5.5% of GDP). This makes sense, as FDI typically stimulates trade activities by integrating the host country into global supply chains. Foreign investors often establish export-oriented industries. Other prominent performers on this metric include ‘Natural Resource Winners’ (where FDI is linked to commodity cycles, hence more volatile) and ‘Stable but Small’. For the rest, FDI represents a smaller share of GDP.

7) Institutional Maturity Matters

Mature institutions reduce uncertainty and foster economic stability by minimising the risks associated with volatile policy changes or political interference. Institutional maturity and operational independence of economic institutions helps untie investment cycles from electoral ones. This should lead to more rational policymaking.

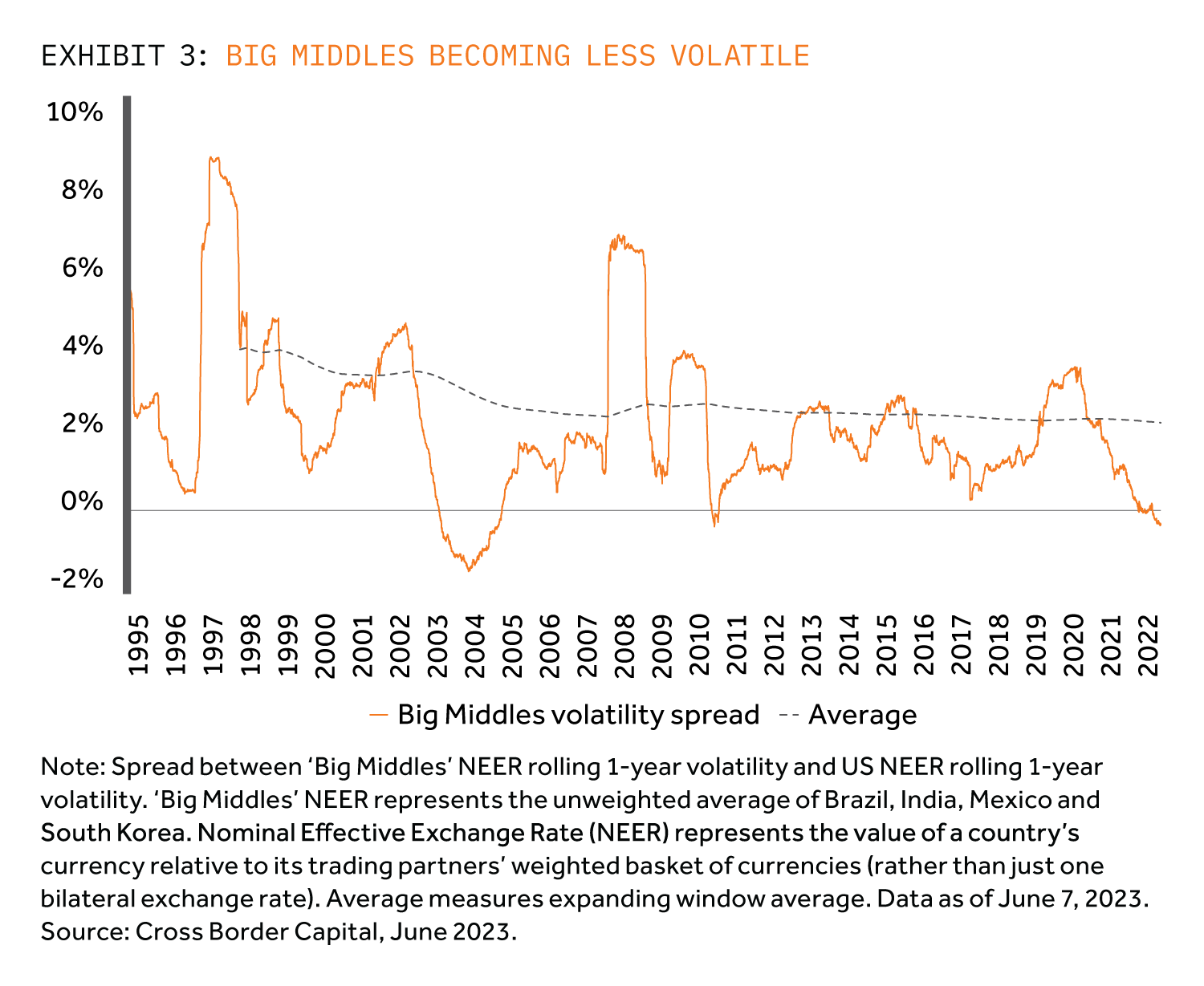

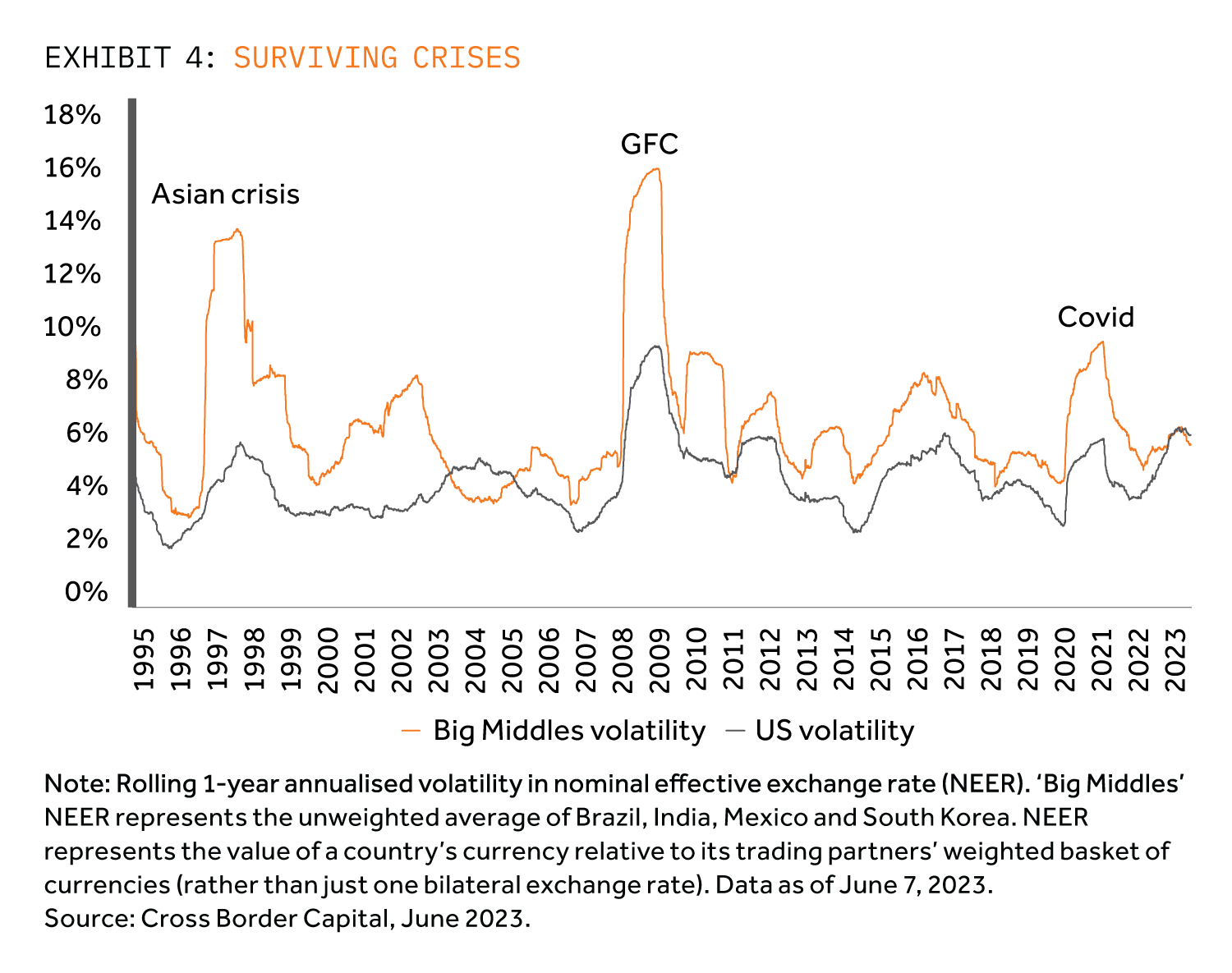

Here the ‘Big Middles’ and ‘Supply Chain Heroes’ stand out in terms of improvements. In both groups current account deficits, share of debt denominated in foreign currency and non-resident holdings of government debt are lower than a decade ago. Their central banks have become credible and independent. Countries, such as Brazil and Mexico, have been hiking prudently this cycle and getting ahead of the curve. Their economies have the largest ever FX reserves and no longer the type of currency mismatch or pegged exchange rates that have amplified past crisis (e.g. Asian Financial Crisis of 1997-98). Amongst both groups it has supported the reduction in currency volatility in the past decade and FX outperformance versus DM majors in the last years. The spread of volatility between the US dollar and ‘Big Middles’ currencies has dropped significantly in recent years (see Exhibit 3). Notably, the ‘Big Middles’ currencies have been less sensitive to extreme market events now than previously (see Exhibit 4).

To put these achievements in perspective: in the early-1990s hyperinflation plagued Brazil whilst the Bank of Thailand was a serious contender for the worst run central bank in the world (Bank Indonesia won that particular prize).

8) Human Capital Matters

The intuitive linkage between financial depth, educational attainment and productivity can be complex. We show that financial development is lowest for the ‘Structurally Challenged’ bucket, which is also characterised by lower levels of human capital development.

Looking at the World Bank’s Human Capital Index, which measures expected years of school, harmonized test scores and basic health, ‘Global Influencers’ perform the best, followed evenly by all other groups except ‘Structurally Challenged’. The relatively solid and even human capital picture across most of our investment universe is encouraging (although it masks some within group differences). It is one foundation of future economic sophistication and productivity growth.