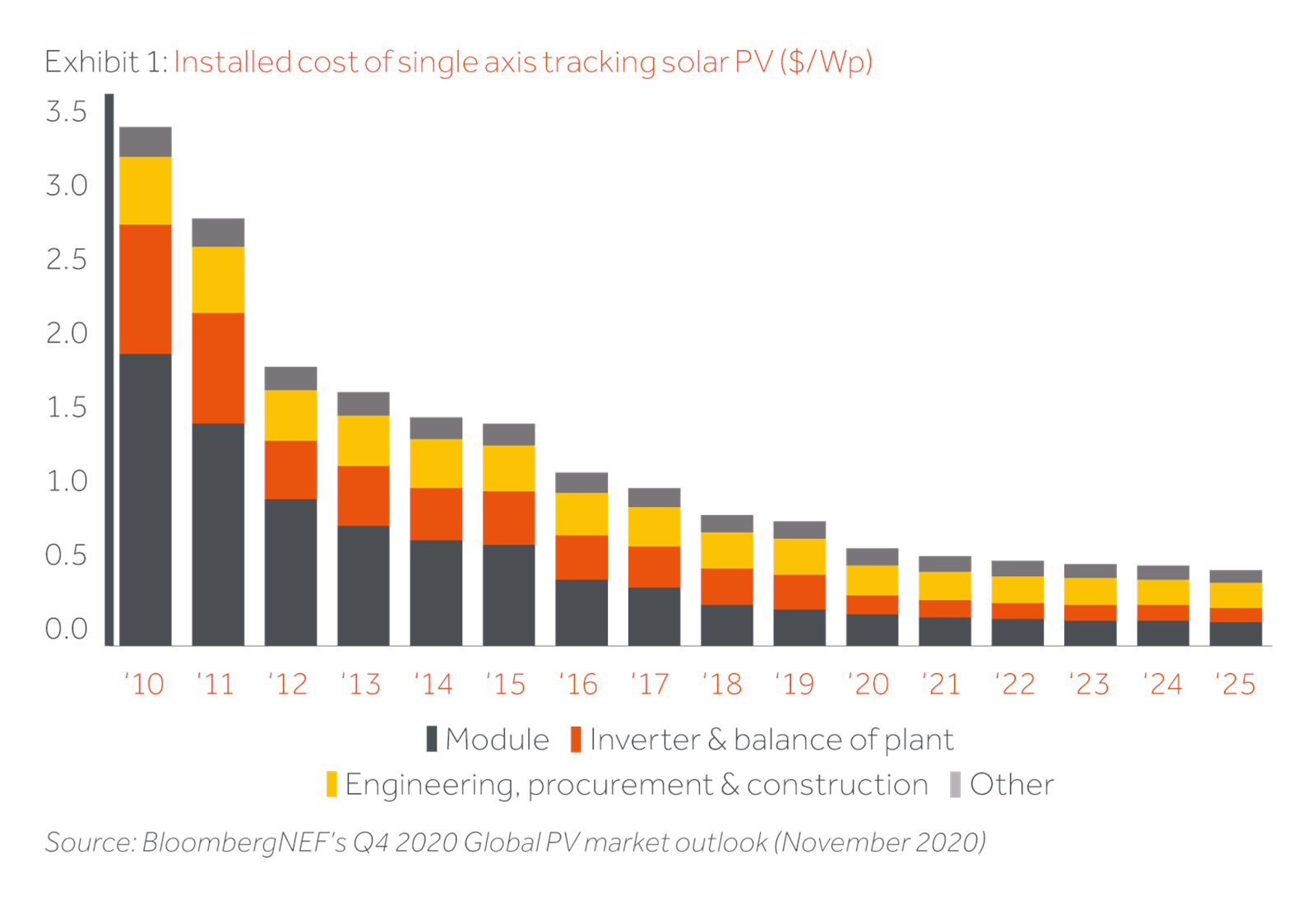

Solar PV is the fastest growing renewable energy technology and is expected to grow thirty-fold by 2050, from being just 2.4% of power generation in 2019, to supplying almost one third of global electricity by 2050¹. The advance of solar PV technology, resulting from cell efficiency, and ultimately the lowering cost of energy, has consistently exceeded expectation. This impressive evolution has been driven by a 90% reduction in price over the last decade.

Lower costs have been the result of:

- Increasing efficiencies across the value chain driven by competition and economies of scale, combined with;

- The continual improvement of the conversion efficiency of silicon based PV solar panels enabled by a multitude of incremental steps available to the industry

Value chain efficiencies

During 2019, an unexpected demand drop in China (which typically accounts for 40 – 50% of global demand), resulted in an over-supplied market and as such, considerable stress across the whole PV market supply chain. This resulted in a significant price drop, to below what was thought of as at-cost pricing at the time. This broke sticky pricing points and spurred the supply chain into furious competition, rapidly eliminating excessive margins and improving efficiencies. These value chain efficiencies continued in 2020 even under the COVID-19 impact, and were successfully adopted by Chinese suppliers as the solar PV production resumed in Q2 2020, with the Solar PV market again witnessing some of its lowest ever cost points. Although demand slowdown during the early COVID-19 period did contribute to a price reduction, ‘stock-clearance’ was clearly not the only factor at play. The value chain efficiencies are now well embedded.

Despite supply / demand largely rebalancing as at time of writing, these efficiency improvements have been maintained and margins have not recovered to their previous levels. As most of the constituent components are highly mature technologies (commodity production including silicon, glass, aluminium and silver) it is considered unlikely that any step changes in pricing or production efficiencies will materially move the overall cost of production and there is potentially more downside on pricing than upside as the world possibly enters another commodity super cycle. This pattern of lower costs and prices with demand growth making up for margin squeeze will be familiar to technology investors everywhere.

Conversion efficiency of photovoltaic (PV) cells

The real story behind PV costs is the unrelenting march of increasing conversion efficiencies of crystalline silicon based PV panels (i.e. the amount of solar radiation energy hitting the solar panel that is converted into electrical energy). Economists describe this as heuristic pricing-or more simply more bang for the buck. Over the last five years, crystalline silicon PV cells have improved their efficiency from 15% to 20%².

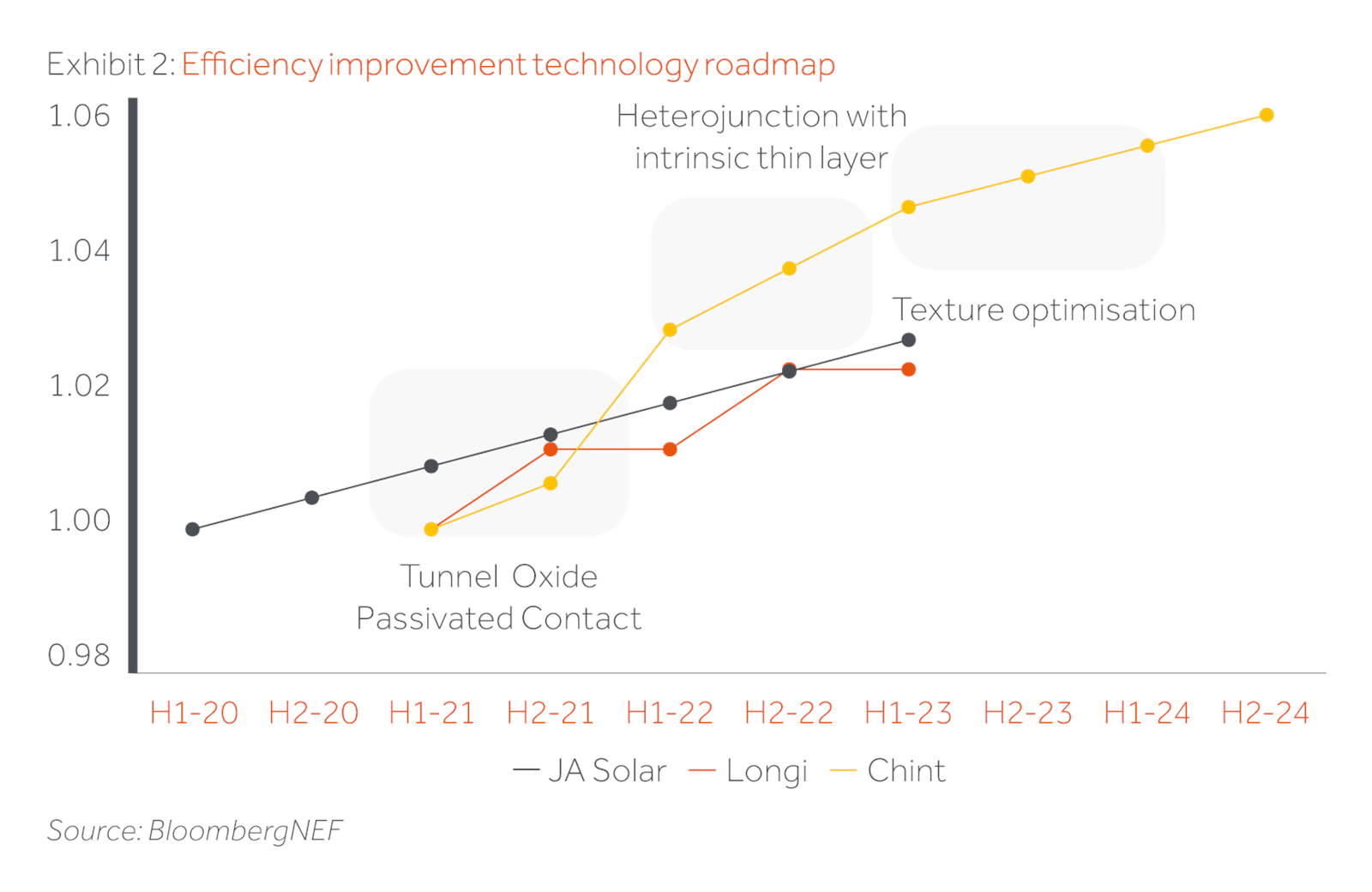

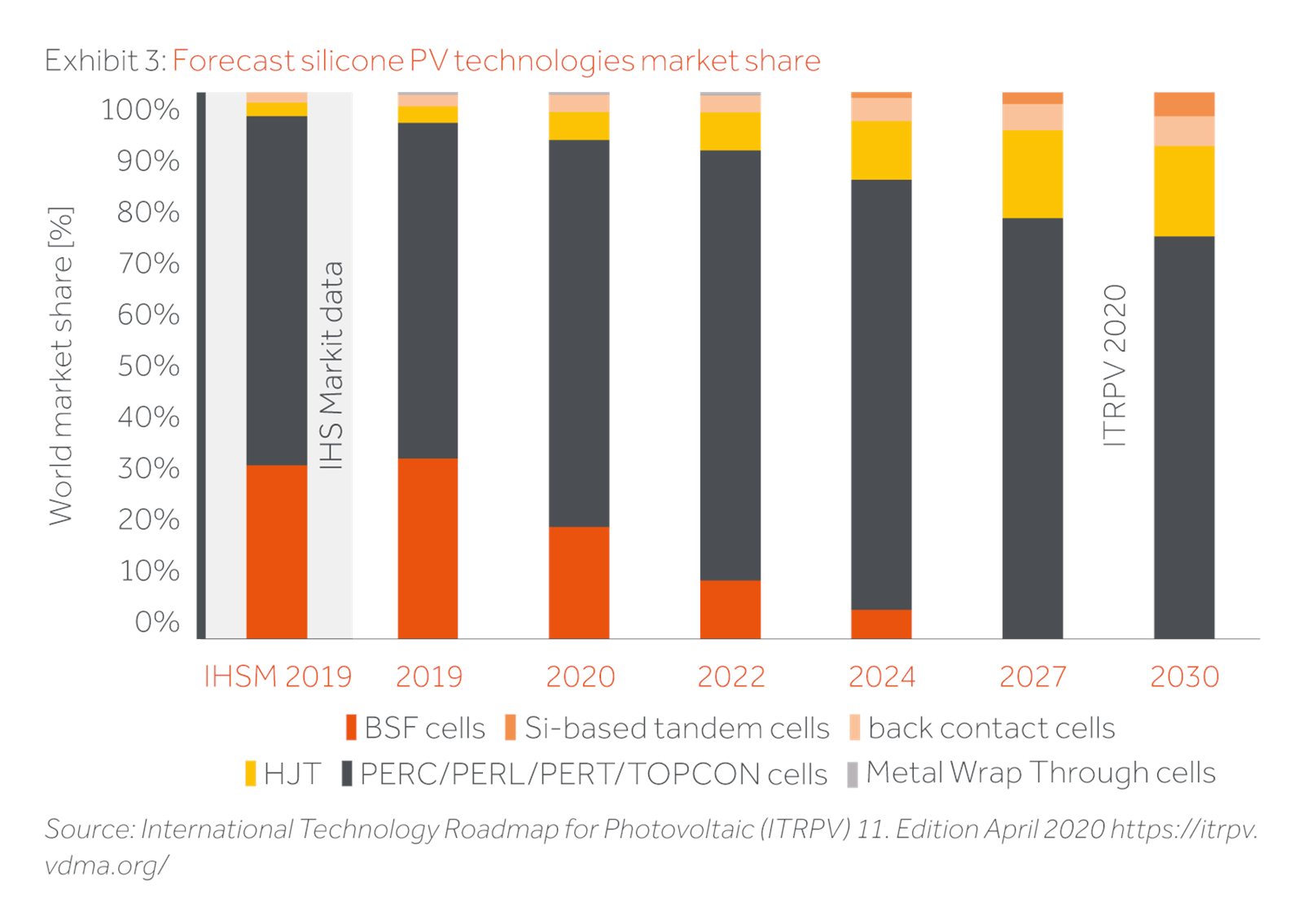

While there are a multitude of technological iterations, it has been the advances in poly and mono silicon PV panels which have driven the technology improvement and price declines leading to rapid growth in deployment of solar PV. R&D, commercialisation, followed by production line retooling, has delivered a classic roadmap of technology take up. While the multitude of technology paths are impossible to predict, the trend is clear and unlike the broader supply chain, the potential for cost reduction remains exponential over the next five to ten years.

A review from the major suppliers’ technology roadmaps (see Exhibit 2) clearly reveals both the trajectory but also the scale of anticipated efficiency improvement which is in turn likely to lead to further cost reductions in what is already the lowest cost of energy available in most of our markets.

Step changes

The breadth of technological change to-date and possibilities moving forward are endless and outside the scope of this article. To avoid swamping the reader with endless technical jargon, we have focused on meaningful trends as it relates to investment, however there are some step changes in technology which facilitate continual growth. To date this has been seen (Jargon warning alert!), with the move from Poly-silicon to mono-silicon, the adoption of Passivate Emitter and Rear Cell (PERC), and more recently the move to bi-facility. These were important steps which enabled not only larger steps in efficiency by also subsequent incremental improvements. The question arises as to whether such steps remain and the answer is an overarching yes! Reviewing, what many of the leading manufacturers are doing in terms of their re-tooling is a strong indicator of where we are heading and the indicators are positive with material steps likely. Some such options like heterojunction silicon, TOP-Con and N-type cells offer an exciting opportunity to a broad future of subsequent efficiency gains but also improvements to related factors (thermal related losses, broader spectrum response etc.) which would be more suitable for the climate conditions of many developing markets. Overall, silicon cell efficiency is expected to increase from 16-20% to c.25-30% by 2030 across the industry.

Thin film

First Solar, the only real credible alternative to the cheap China silicon PV, has failed to keep up with the march of PV and the large costs of re-tooling their existing factories limit their ability to expand. However, thin film solar panels will continue to occupy a niche where there is a distinct competitive advantage arising from other inherent benefits such as temperature coefficient and spectral response.

Developing technologies such as perovskite solar cells have already demonstrated efficiencies above 24% in labs, which is higher than that of cadmium telluride (CdTe) and copper indium gallium selenide (CIGS) thin films3. Hence, perovskites with steady improvements in stability could bring a step change in the solar PV cost trajectory, however this remains uncertain.

Larger panels, trackers and inverters

It’s not just the efficiency of solar PV cells that also offers room for improvement and lowering cost of energy. System improvements are also being realised through small but appreciable optimisations. Panel suppliers are now realising that the overall cost of energy is what sells not just $/Watt. This has resulted in increasing panel sizes, optimising cell layout and improving mounting and cable connections, ultimately translating to declining system pricing. Improved tracking systems, inverters with better analytics, and increasing life spans are also contributing to lower energy costs despite diminishing returns expected from future cost declines.

Floating solar

One of the key components to the Solar success story has been scalability. Floating solar offers another avenue to scalability through versatility. It is however unlikely to represent a step change in volume as ultimately solar becomes a story of “every penny counts.” Floating solar does however demonstrate the versatility and flexibility of solar PV, a technology unlikely to see any constraints with future land availability while also potentially complementing existing infrastructure (floating PV on hydro dam. Rooftop solar etc.).

Summary

Solar PV is expected to continue to have a cost of production logarithmic learning curve of in the range of 15 – 20% moving forward, and as a result continue to gain a larger share in the overall electricity mix. Solar PV capacity additions will roughly equal those of all other power-station types combined by 2050.

Driven by technological advances, solar PV cell efficiency will play a key role. Tandem photovoltaics are targeted as an opportunity to push module efficiency quickly towards 30% which would enhance energy yield and reduce system cost (mounting, trackers etc.). Perovskite tandems have already demonstrated a conversion efficiency of 29%⁴ and could enable upgrading the efficiency of existing and future silicon technologies (heterojunction silicon, TOP-Con and N-type cells) and leverage the existing infrastructure and supply chain of the crystalline silicon PV industry.

¹ DNV GL, Energy Transition Outlook 2020 (DNV estimate)

² Clean Energy Review – https://www.cleanenergyreviews.info/blog/most-efficient-solar-panels

³ DNV GL, Solar PV Powering through to 2030

⁴ Physics World – https://physicsworld.com/a/tandem-solar-cells-break-new-record/